- Don’t get suckered into an expensive stock.

- My ingenious ratio keeps the market honest.

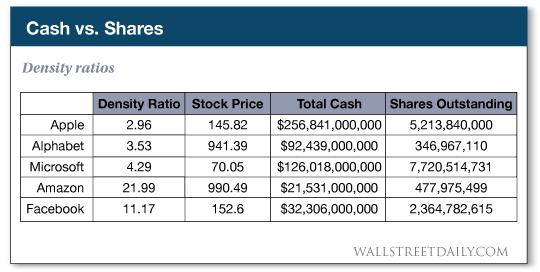

- Silicon Valley’s “fab five” are not dirt-cheap.

- Also recommended: The culmination of my life’s work…

I don’t care what investing legend you idolize and try to emulate — Buffett, Graham, Lynch — they all share a common recommendation.

They favor buying undervalued stocks and selling them when they’re overvalued.

Or more commonly: “Buy low, sell high.”

Of course, if you’ve invested for more than a week, you know this is easier said than done.

Undervalued (cheap) and overvalued (expensive) are such subjective measures when it comes to investing.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Most times we end up guessing — and most times we end up overpaying.

But today, I’ll show you one amazingly simple way to always buy stocks that are truly cheap.

It’s especially sage advice given the recent heights of the benchmark indexes.

Hunting for “Low-Density” Stocks

All you have to do in order to invest like Warren Buffett or any of America’s most successful investors — and rack up easy double-digit gains — is to buy what I call “low-density” stocks.

I define density like this: the value the market assigns to the cash that a company has in the bank.

A high density ratio means the market overvalues the cash.

A low density ratio means the market undervalues the cash.

The reason I focus on cash is straightforward: It’s the most tangible, liquid asset — and the easiest to value.

After all, $1 is worth $1. So it’s easy to tell when you’re overpaying or getting a discount.

Here, I’ll illustrate this concept with a simple example…

To calculate the density ratio, we simply divide the price per share by the cash per share (total cash divided by shares outstanding).

So say Company XYZ trades for $1 per share and has $1 per share in cash.

In this case, the result is 1.

Take note, though…

Such a 1-to-1 ratio (share price to cash) is extremely uncommon.

Most companies have density ratios well above 1. (Yawn.)

But if you find a stock with a density ratio below 1 — well, that, my friend, warrants immediate attention.

Let me explain…

Say a stock is trading for $7.50… but it’s worth $10 in cash per share. That’s a density ratio of 0.75.

Or it’s the same as purchasing $1 worth of stock for 75 cents.

Rest assured, whenever America’s best investors can scoop up shares at a major discount — they do!

And you should too.

That’s because these discounts, understandably, don’t last for long.

So Who’s Flush With Cash?

These days, any worthwhile hunt for cash will lead directly to Silicon Valley.

“Apple, Alphabet, Microsoft, Amazon and Facebook have recently become the five most valuable listed companies in the world, in that order. With a total market value of $2.9 trillion, they are worth more than any five firms in history,” according to The Economist.

Their mountain of cash is so epic it might lead you to believe that they boast favorable density ratios.

Well, I went ahead and did all the heavy lifting for you.

And armed with the data below, don’t let anyone tell you that these five companies are dirt-cheap.

The density ratios suggest that they’re actually overvalued.

So if you’re building a retirement portfolio, I’d argue against anchoring it with the fabulous five “kings of cash.”

See for yourself…

Instead, I recommend buying the microcap stocks on the receiving end of all of the spending.

Whether it’s via direct business relationships with these mega-caps with billions in cash — or via an outright takeover.

Apple, Alphabet, Microsoft, Amazon and Facebook together spent $100 billion last year.

Their collective riches are flowing into emerging industries like autonomous vehicles, artificial intelligence, smart dust, drones… even immortality drugs.

I know the benchmark indexes are all near historic highs.

Nonetheless, it remains a really good time to be strategically buying.

Ahead of the tape,

Louis Basenese

Chief Investment Strategist, Wall Street Daily

The post Checkmate Silicon Valley in One Move appeared first on Wall Street Daily.