By The Gold Report

Source: https://www.streetwisereports.com/pub/na/17496

Pershing Gold just released its prefeasibility study on the Relief Canyon Mine, and in this interview with The Gold Report, Pershing CEO Stephen Alfers discusses the economics of the Nevada project and his company’s plans to advance it.

The Gold Report: Steve, thanks for joining us today. Pershing Gold Corp. (PGLC:NASDAQ; PGLC:TSX) has just released a prefeasibility study for Relief Canyon. Would you tell us some of the highlights?

Steve Alfers: We’ve announced a major milestone for Pershing: the completion of a prefeasibility study and upgraded resource and reserve prepared by Mine Development Associates, a well-established engineering firm in Reno, Nev., a specialist in projects like ours. The prefeasibility study has been a catalyst that we’ve been working toward for some months now and is as a major development for the company.

First off, Mine Development Associates is recommending that the company advance the project to production. The company is now considering preconstruction programs leading up to construction and a restart of the mine in 2018.

Some of the highlights include an upgraded resource that includes Proven and Probable (2P) reserves of 634,000 ounces (634 Koz) of gold and 1.6 million ounces (1.6 Moz) of silver. We also announced a mine plan and financial model that contemplates annual production from this project of over 90 Koz/year and over the mine life of six years, at cash costs of $770 per ounce ($770/oz) and all-in sustaining costs of $802/oz. So the Relief Canyon project is a robust project. This prefeasibility study estimates a net present value (NPV) of $144 million ($144M) and an internal rate of return of 89%.

Where’s the upside that we’re looking forward to in this project? We provide upside in three different ways. One is the gold price. This economic analysis was done at $1,250/oz gold, and gold is currently at $1,279. The project itself has great leverage to the gold price. Every $50 increase in the price of gold adds $20M of NPV to the project itself.

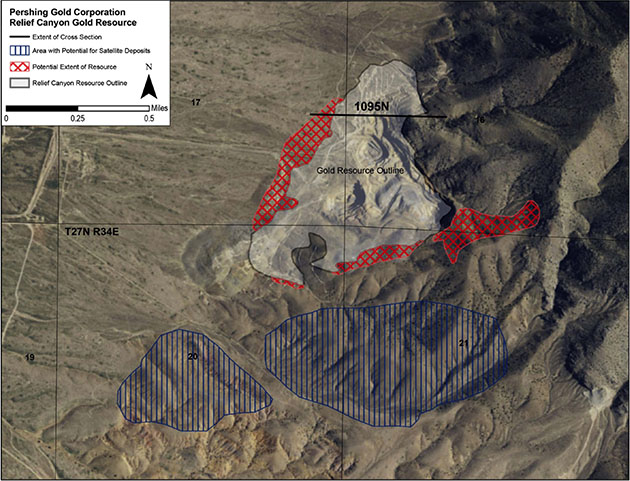

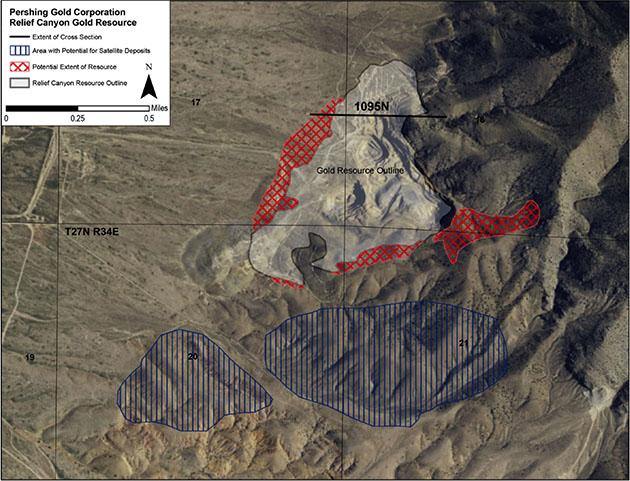

A second way we provide upside is that we can expand the project. Pershing controls more than 40 square miles (40 sq mi) of mineral rights adjacent to the Relief Canyon mine. We also know that the deposit is open in three directions. We’ve continued to explore and develop this land, and we’re actively exploring the greenfields exploration ground that comes along with the project.

The third way we provide upside is just plain operational efficiencies that happen as you begin a project. As you do so, you have opportunities to continue to revise and improve on the mine plans and improve the cost profile and improve the margins.

TGR: At this point, what infrastructure is needed to take the project to production?

SA: One of the unique aspects of Pershing Gold is that the Relief Canyon mine itself was mined successfully in the past, most recently in the 1980s and 1990s, and much of the infrastructure is in place there. We have a processing facility that is new and state of the art, so we don’t have to worry about the construction of those sorts of facilities.

Now, what we do have to do to accommodate the expansion that we plan for Relief Canyon is to add some additional pad space. We need to prepare the ground around a relocated waste dump that we want to locate next to the mine itself. We’re planning a relocation of our crushing capacity and the installation of a conveyor system to handle the crushed and agglomerated ore that we’ll move down to the pads and some other ancillary buildings involved that are really, in the scheme of things, relatively minor.

TGR: The project is open pit?

SA: It is an open-pit mine and a heap-leach processing facility is in place there. Like many Nevada deposits, it is very amenable to open-pit mining. The Relief Canyon gold deposit itself is a stack of deposits. The main deposit or the deposit that outcrops at surface was partially exploited in the past, so we’ll open the project there. And as we continue to mine and expand this project, we’ll deepen the pits to get at the subparallel ore zones. It looks to be a very conventional open-pit project.

The ores themselves are predominantly oxide, and everything in our reserve is oxide. We’ll prepare those ores in a crushing system to reduce the size to optimize the recoveries. We’ll transport that material through a conveyor system. And then through stacking equipment, really quite light and useful equipment, we’ll stack that material on the pads in a way that improves and optimizes our ability to recover the gold from that heap-leaching operation.

TGR: One of the decisions facing Pershing was whether the company would truck the ore versus using a conveyor system. Does this mean you decided to use the conveyor belt system instead of trucking?

SA: Yes. One of the main objectives of this economic analysis was to evaluate a number of mining options and processing options. One of those was whether or not we would move the ores, the stacking on these pads, by trucks, which are rather heavy, multi-ton vehicles, or whether we would use a lightweight conveyor system. The efficiencies involved with the way we intend to prepare these ores lend themselves to the conveyor system. It involves a little bit more capital, and we needed to have a very thorough engineering study done to establish the feasibility of going that route. And we achieved that. So we have made the decision we’re going to pursue the conveyor stacking.

In addition to that, we expected Mine Development Associates to compare and contrast the economics with going ahead and acquiring the mining equipment, mainly the trucks themselves, or to contract with a contractor who supplies that equipment and provides the haul from the mine itself to the crushing facility.

Those economics showed that because of the way we were able to negotiate some of these bids for the contract mining available to us, we were able to get something of a combination of those. So we’re pursuing a contract mining scenario that helps us suppress the operating cost over the life of that mine.

But we also carry with it an option to purchase the equipment. As we later get into the project and as we continue what we expect to be future expansions, we can always change our minds and acquire that equipment and cross over to self-mining and get even better breaks on the mining cost and increase the margins of the project even further.

TGR: Could you tell us about the permitting situation at Relief Canyon? Do you need to get any additional permits?

SA: We have in hand the permits we need to start the mine. This is a project that is partially on government lands and partially on private mineral rights that we’ve acquired over the last few years. The permitting process has been somewhat easier because having that kind of land position gives us some options on where we would site some of the facilities. We’ve had good working relationships that have expedited the permitting.

I do want to remind everybody that this is the U.S. and this is Nevada. In a place like Nevada, you’re never really through with permitting. We have the permits we need to start and get into the first expansion of the project. We’re already looking ahead to our next expansion. Having completed the prefeasibility study and the engineering work that goes along with that, we’re now in a position that provides that last piece of baseline data that we need to file for our next expansion that we would look forward to some years down the road. Ongoing relationship with regulators and continuing modifications of permits is just a reality of life in mining in the United States. We’ve all done it in our careers in the past, and it’s been working very well for us.

TGR: How soon do you think you would be able to start production?

SA: We’ve just had in front of our board of directors this study with the economics and details around that engineering. We’re considering right now the program for the pre-production work plans that will lead up to and through the construction decision itself and then the start-up. I won’t speak for my board of directors until they’ve had every opportunity to make the decisions on the timing. But what we’re expecting is that we’ll commence with that pre-production work soon, and then we would look to start up into 2018.

TGR: How much capex is needed to start production?

SA: We’re anticipating initial capital of around $23.6M, and that’s for conveyor systems, a crusher upgrade, construction of pads and waste dump facilities, and those sort of things. I would suggest that readers compare that with more typical operations where that initial capital could be much higher than that, something more like $60M or $70M, sometimes $100M, for projects that lack infrastructure. But we have a lot of the infrastructure there, and that gives us the latitude to spend a bit more capital in ways where we can optimize the handling of the materials, like that conveyor system, for example.

TGR: Do you anticipate having to do a financing for this capital?

SA: We have cash in hand right now for what we need. As we go forward, we’ll have to look at the whole range of alternatives to cover initial capital and some other capital costs. As those who have followed the company closely know, we’ve worked out a non-binding letter of intent for a debt facility. Alongside that, we’re considering other opportunities to finance the project that could be commodity-based transactions and even royalty or streaming deals. We’re looking at all sorts of alternatives and recognize that this is not such a large number to raise where we have such robust economics on this project.

TGR: You mentioned that Relief Canyon remains open in three directions. Do you anticipate conducting additional exploration quickly? Or is this something that you will look at further down the line?

SA: We are looking at two different alternatives. Much of what we have done over the last four years has been to define the existing Relief Canyon deposit. Because we had so much of the infrastructure in place, the processing facility in particular, we really focused on the immediately available open pit that was there. We did extensive drilling in 2015 and 2016 on that deposit itself. We more or less threw a corral around that and did our economics on that, and that’s what’s represented in this prefeasibility study.

At the same time, we have begun to step out from this existing pit that we have defined in this feasibility study with wide-spaced drilling out to the west. The deposits themselves are tabular deposits. They are at their shallowest up in the range front and into the Humboldt Mountain range itself. And they dip down to the south and southwest at some distance. But the mineralization continues there. In 2016, we completed a stepout drilling program out west to chase those deposits and to try to determine the continuity of this mineralization out west. With that wide-spaced drilling, we continued to encounter good mineralization with good grades southwest of the deposit. And we recognize that these deposits still remain open out in that direction.

Among the things that we will do is to consider a near-term drilling program that would drill on closer drill hole spacing the mineralization that we’ve already identified with the objective of bringing that into the pit fairly soon, early 2018 or so. In addition, we would continue these wide stepouts several hundred feet to continue to test the extent of the western continuity of the ore body itself. The deposit is also open to the south and to the southeast.

I would not consider this drilling to be anything like early-stage exploration. It’s simply chasing known mineralization to determine the extent outside this pit.

In addition, we also have 40 sq mi of ground along the range front of the Pershing Gold and Silver District there, and it’s highly prospective. We’ve been preparing really early-stage exploration targets now for a few years. We’re drilling some now. We’ll continue to do that. We’ll pursue both of those routes in order to improve this project.

TGR: The Blackjack project is located about six miles away from Relief Canyon. Could you tell us a little bit about your recent agreement with Newmont Mining Corp. (NEM:NYSE) and your drilling there and what upside it offers investors?

SA: Blackjack is one of those projects that I think of as earlier-stage exploration. It is almost due south of Relief Canyon. It’s situated similarly in that these are old mining districts, really much older than Relief Canyon, that were mined in the turn of the last century and, most recently, around the 1950s for mercury and antimony, known to be frequently associated with gold deposits. So we have begun to prepare those targets for drilling.

The Newmont ground was really important to us there because it provided a contiguous ownership pattern of some 4,000 or 5,000 acres of the mineralization that included seven old abandoned mercury and antimony mines in that area. We’ve begun to do drilling down there. It’s close enough to Relief Canyon that depending upon what we find there, there are all sorts of possible scenarios where the synergies that are created between successful discovery of satellite deposits in and around Blackjack will produce ores or loaded carbon that we could haul up to our processing facilities and refinery at Relief Canyon and process them there. That provides the opportunity of continuing the Relief Canyon as a long-lived project in the future, being able to serve satellite deposits that we think are likely to be discovered down in and around that Blackjack area. Blackjack is highly prospective. It’s not the only target area that we have in that 40 sq mi of exploration in, around and adjacent to Relief Canyon.

TGR: Would you talk about the experience of your management team?

SA: One of the philosophies of the company has been to attract senior people with considerable hands-on experience in Nevada and in deposits of this sort.

From early on, when we started the company, our main objective was to explore and discover new gold zones, which we did. When we started with this project, we had virtually no NI-43-101-compliant ounces there. We turned that into more than 800 Koz of resource. And inside that, for the first time, we’ve been able to establish the quality of that ore body, and we now point to 634 Koz of 2P reserves. So the record has been impressive.

I give the credit for all of that to the quality of the personnel that we were able to attract there. We started with a geology team. What they did was make those discoveries that turned that into a very significant gold-silver deposit.

About two years or so, we began to add operating people. Our new senior engineering officer in the company is Tim Arnold. He comes to us with well over 20 years of experience in operations, many of those in Nevada. Several of those years of experience were spent right in Pershing County itself. He’s very familiar with the terrain and the challenges that you face in putting together an operation there. He’s also been a magnet for talent.

TGR: Anything last words for our readers?

SA: Our investors and those interested in the company who have been following us for quite a while I expect have been waiting for this prefeasibility study to hit the Street. Well, here it is. I’d direct your attention to it. What you will see is a project with enough infrastructure already in place that production is near term. Economics are robust. As you see this coming, it’s a good time to consider increasing your investment or making your investment in Pershing Gold Corp. I would welcome everybody as new shareholders.

TGR: Thanks for your time, Steve.

Stephen Alfers, executive chairman, president and CEO of Pershing Gold Corp., has a distinguished, thirty-year career in the domestic and international natural resources industry. He has a proven success record in building value and maximizing growth. He has extensive experience in private and public corporate finance, mergers and acquisitions, complex international business transactions and governmental affairs. He is nationally and internationally recognized for his expertise in natural resource development, privatization of state-owned enterprises and foreign investment.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) Pershing Gold Corp. is a billboard sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclaimers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Pershing Gold Corp. had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Stephen Alfers and not of Streetwise Reports or its officers.

4) Stephen Alfers: I was not paid by Streetwise Reports to participate in this interview. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview. I or my family own shares of the following companies mentioned in this interview: Pershing Gold Corp.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

6) This interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.