By IFCMarkets

Data support British Pound

UK economy is improving ahead of June UK parliament election. Will the British Pound continue strengthening?

The British Pound is rising amid improved economic data and corporate earnings in euro-zone, UK’s top trading partner. Two third of European companies out of 76% that have reported first-quarter results as of May 16 have beaten analysts’ expectations, indicating earnings growth of around 20%. Recent UK inflation data showed consumer prices rose 2.7% on year in April from 2.3% in the previous month, more than the 2.5% expected. The core inflation also accelerated, rising 2.4% on year after 1.8% gain in March. Expectations of a conservative victory in UK parliament elections on June 8 also support Pound: a larger Tory majority is deemed more favorable for Prime Minister May allowing her more flexibility to avoid more extreme outcomes in hard Brexit scenario and accept a long transition period after the formal withdrawal. Today Retail Sales for April will be reported, no change is expected. On May 25 second estimate of Q1 GDP will be published, an improvement is expected.

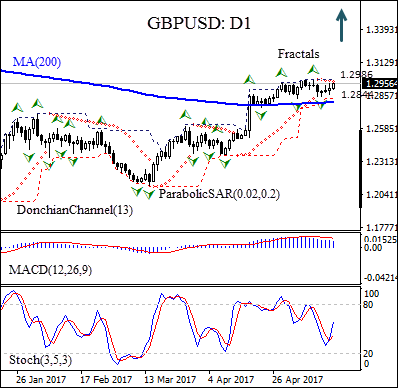

On the daily chart the GBPUSD: D1 is above the 200-day moving average MA(200) which is edging higher after leveling off in the beginning of April.

- The Parabolic indicator gives a sell signal.

- The Donchian channel is flat, indicating no trend yet.

- The MACD indicator gives a bearish signal.

- The stochastic oscillator is rising but has not reached the overbought zone, this is a bullish signal.

We believe the bullish movement will continue after the price breaches above the upper Donchian bound at 1.2986, confirmed also by fractal high. It can be used as an entry point for a pending order to buy. The stop loss can be placed below the last fractal low at 1.2844. After placing the pending order the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop-loss level (1.2844) without reaching the order (1.2896) we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Technical Analysis Summary

| Position | Buy |

| Buy stop | Above 1.2986 |

| Stop loss | Below 1.2844 |

Market Analysis provided by IFCMarkets