By The Gold Report

Source: Clive Maund for The Streetwise Reports 12/09/2016

View Original Article: https://www.streetwisereports.com/pub/na/what-will-happen-to-cannabis-investments-with-jeff-sessions-as-u-s-attorney-general

Technical analyst Clive Maund charts movements in the cannabis sector after the Nov. 8 legalization votes and the appointment of anti-cannabis firebrand Jeff Sessions as U.S. Attorney General.

For those of you who have spent the past 6 months living in a cave, you are probably not aware of the fantastic gains that have been made in cannabis stocks. At clivemaund.com we had already figured out that the sector was set for huge gains ahead of the November 8th legalization vote as far back as April, and subscribers were directed to various stocks which went on to make spectacular gains. If you want to review what we achieved click here for a free download.

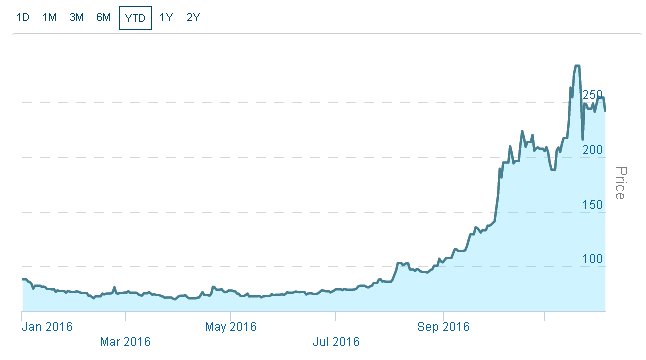

The cannabis sector has done pretty much as expected in recent weeks. After the huge gains into the multi-state vote on legalization on November 8th, this heavily overbought sector has started reacting back and may be forming a top. The votes on legalization went well (only Arizona voted no), which certainly augurs well for the sector over the longer-term, but this outcome was expected so the vote became a “sell on the news” event that triggered heavy profit taking, which even started to kick in several days before the vote.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The following charts, courtesy of marijuanaindex.com, are most interesting and make clear how the sector has topped out, at least for now, and the big question is whether the sideways pattern now forming is a top or a consolidation. Here it should be pointed out that we were long many stocks across the sector months ago, and sold out for massive profits around the time of the vote on November 8th.

The North American marijuana index shows a large top or consolidation pattern, which looks like a flat-topped broadening formation, which is normally bearish…

The U.S. marijuana index has fared somewhat worse, because of the effect of the Republican victory (the Republicans are not as well disposed toward marijuana as the Democrats) and latterly, the appointment of anti-cannabis firebrand Jeff Sessions as Attorney General…

The Canadian marijuana index, meanwhile, looks a lot better, because it is not blighted by U.S. Federal law, or the likes of Jeff Sessions…

Charts above courtesy of the THE MARIJUANA INDEX.

Although the multi-state vote had a largely positive outcome, it’s not necessarily plain sailing for the sector from here on in the U.S. This is because the Republicans won the general election, not the Democrats, and they are not so favorably disposed toward the marijuana industry as the Republicans, and here we should remember that at the Federal level, the industry remains illegal, even if approved at state level. A particular setback was the nomination of anti-cannabis firebrand Jeff Sessions as Attorney General, who may have the power to impede the industry and even roll back some recent gains.

The criminalization of cannabis actually has strong parallels with the era of “prohibition” when alcohol was banned in the US, a big difference being that unlike alcohol, marijuana has a wide range of important medicinal uses. Just as, in modern times, the abuse of alcohol by many young people, and some older people, is no longer seen as grounds to ban it, the abuse of cannabis by some young people, which is inevitable, should not and probably will not be seen as grounds to ban it. Up until recently, an underlying reason for the criminalization of cannabis has been the threat that medical marijuana poses to the profits of Big Pharma as an alternative to their expensive pills and potions, but they are now yielding to public pressure to permit it, aided by the knowledge that they can proceed to buy up much of the industry using their massive war chest and then administer it on their own terms. This is a big reason why resistance to the decriminalization of cannabis by the likes of Jeff Sessions, although potentially a significant problem over the medium-term, is likely to ease with the passage of time.

This Ride with Larry video, assuming it was not in some way faked, shows the dramatic effect of marijuana on a man suffering from Parkinson’s.

Translating all these fundamental considerations into their impact on the marijuana sector as a whole, and individual stocks, is the challenge facing analysts trying to assess the potential of the sector for investors going forward. Our assessment that the sector was likely to react back or at the least go into a period of lengthy consolidation after the vote, even if it was favorable, was based on the fact that it had risen so sharply ahead of it, and attracted rampant speculative interest. Thus far, this assessment has proven to be correct, but what now?

Given the potential of people like the new Attorney General to invoke Federal law to create problems for the industry over the medium-term, which might lead to the still-overbought sector reacting back further, a cautious and selective approach to the sector appears to be in order for now. There are still stocks within the sector that look well placed to advance further even if the sector as a whole corrects back, and these are the stocks that we will be focusing on at clivemaund.com going forward.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by Clive Maund