Article by ForexTime

USD/JPY suffered from heavy selling pressure since the beginning of this year, and lost 18% of its value before to find a low at 99.02 level during Brexit vote day.

This sell-off was fueled mainly by the ineffective monetary policy adopted by the Bank of Japan. Since late 2012, BOJ has implemented a massive stimulus program in order to boost the economic growth and to help inflation in Japan to recover from lowest level in two decade.

Despite that, Bank of Japan failed to reach its inflation target of 2% after testing many stimulus measures (several rate cuts, the introduction of negative rates, bond-buying programs, Quantitative and Qualitative easing…)

It is clear that investors have agreed that the BOJ has begun to lose its power as a price stability regulator, and this was apparent after the recent purchase expansion of ETF (Exchange-traded funds) initiated on July 29, that underwhelmed expectations.

Immediately, the Japanese currency plunged 3% to reach 102 level against the U.S Dollar, sending a clear deception signal to BOJ policy makers. In the meantime, Governor Kuroda kept the door open for further easing in the upcoming meetings after he said that the central bank would assess the effects of negative interest rates later this year. Moreover, he told reporters after the policy meeting that he do not think that BOJ has reached the limits yet, both in the terms of more rate cuts and increased asset purchases.

In the same context, the U.S Federal Reserve has adopted a conservative approach since its last rate increase in December 2015 and took a step back regarding the date of the next rate increase many times throughout this year, which put the U.S Dollar under pressure as the central bank lost credibility. For all those reasons mentioned above, USD/JPY has found the ideal environment to extend its decline in 2016.

Nonetheless, after the recent Yellen speech in Jackson Hole, the sentiment towards the U.S Dollar has completely changed as the FED’s chair, said that the case for interest rate hike has strengthened in recent months with the U.S economy approaching the pre-defined goals by the central bank. The probability of rate hike by December surged to 60% by that time, reinforcing the demand for U.S Dollar.

Meanwhile, the FED came out with another disappointment yesterday for market participants.

“Near-term risks to the economic outlook appear roughly balanced,” the Federal Open Market Committee said in its statement Wednesday .FED officials judged that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of continued progress toward its objectives.

As of now, the probabilities of a rate hike in November fell to 19.3% only while market is expecting the FED to be ready to take action before the end of the year as December probabilities stabilized at 58.6%.

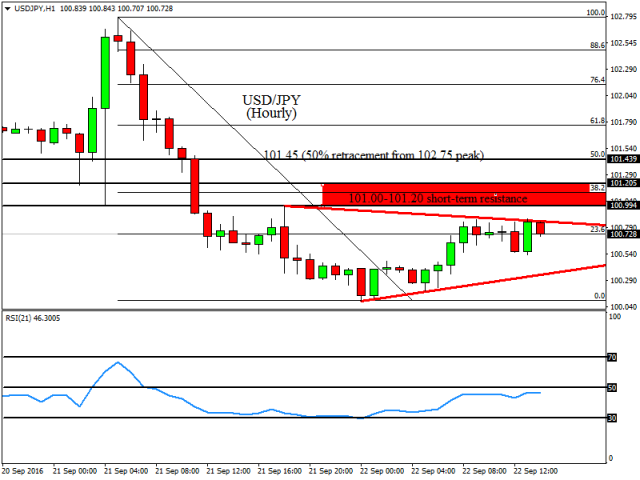

From a technical standpoint, the pair remain clearly oversold in the short-term; in the meantime, we continue to see strong reaction each time the pair is trying to break below 100.00 psychological support. This level is important to Bank of Japan officials, and we may still see some interventions from time to time around this level.

Looking at the recent price action, the pair failed near 102.80 resistance level and extended its decline below the 101.00 daily support, which cleared the path for a big sell-off that reached as low as 100.10 overnight.

In the near-term, momentum indicators started to show some positive signs; however, the current jump can be defined as a dead cat bounce as the pair remain strongly bearish below 102.80 peak. Therefore, this recovery can be short-lived and we expect strong sellers to appear between 101.00-101.20 resistance zone, before to see a downside reaction again.

In extension, a break above this zone should open the way to a re-test of 101.45 area.

Finally, the picture remain negative in the daily chart as prices keep printing lower highs since early 2016 peak and consequently, the selling pressure is likely to resume when the fundamental dynamics converge again.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com