The Energy Report

Source: The Energy Report 09/13/2016

View Original Article: https://www.streetwisereports.com/pub/na/nemaska-lithium-discovers-new-lithium-bearing-zone-at-whabouchi

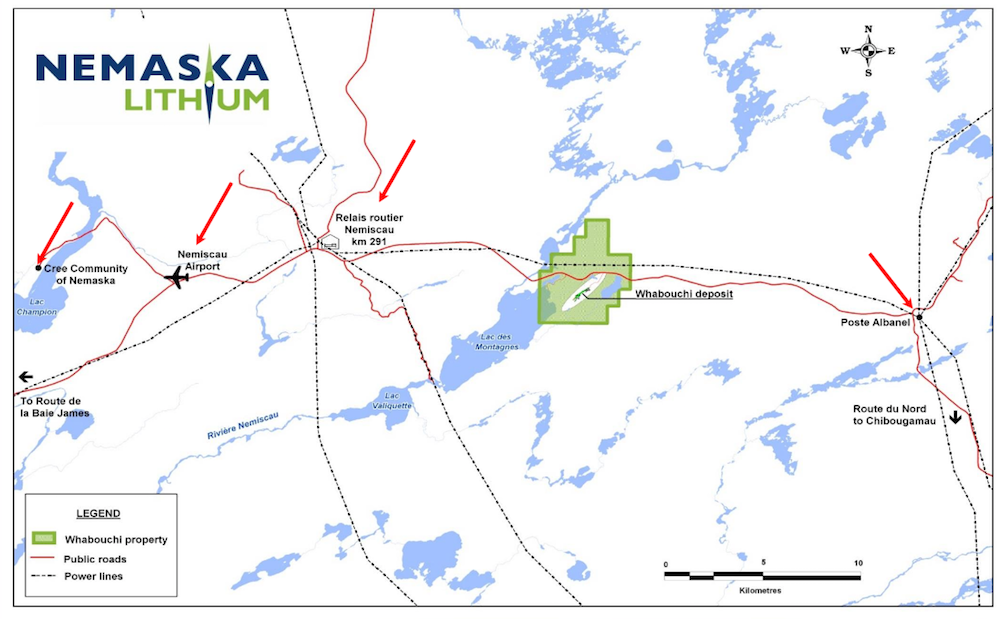

Nemaska Lithium has expanded the drill program at its Whabouchi lithium project following discovery of a new lithium-bearing zone, leading analyst David Talbot of Dundee Capital Markets to reiterate the investment thesis for Dundee’s top lithium pick.

In its Sept. 6 press release, Nemaska Lithium Inc. (NMX:TSX; NMKEF:OTCQX) announced it had expanded its drill program “from 44 drill holes over 13,700 m to 50 holes over 17,000 m after [encountering] a new lithium bearing zone in the southwestern end of the planned pit area.” The new mineralized zone has been dubbed Doris.

In a Sept. 6 research report, David Talbot of Dundee Capital Markets wrote, “With this new discovery a bonus, Nemaska appears to be well on its way to achieving its three drilling objectives for this fall: 1) upgrade 4.79 MM t of in-pit inferred resources; 2) increase resource confidence between surface and 200m vertical depth; and 3) confirm continuity and potentially extend mineralization down to 500m vertical depth.”

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Addressing his assertion that Doris could improve the economics of Nemaska’s project, Talbot wrote, “New shallow lithium mineralization potentially could positively impact the existing Feasibility Study (assays pending).”

In addition, the Doris Zone’s proximity to the existing Whabouchi pit means “it may be close enough to consider incorporating into early open pit production schedules,” according to Talbot.

In addition, the company stated that, thus far, the drill program at Whabouchi has “generally encountered mineralization where expected, further increasing the confidence in the existing block model, which has fundamentally held intact since its initial inception.”

Talbot reiterated Dundee’s Buy rating for Nemaska, with price target of CA$2.30.

Read what other experts are saying about:

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Tracy Salcedo compiled this article for Streetwise Reports LLC. Tracy Salcedo provides services to Streetwise Reports as an independent contractor. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Nemaska Lithium Inc. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional Disclosures for this Content

Dundee Capital Markets, Nemaska Lithium Inc., Sept. 6, 2016

Research Analyst Certification: Each Research Analyst involved in the preparation of this research report hereby certifies that: (1) the views and recommendations expressed herein accurately reflect his/her personal views about any and all of the securities or issuers that are the subject matter of this research report; and (2) his/her compensation is not and will not be directly related to the specific recommendations or views expressed by the Research Analyst in this research report. The Research Analyst involved in the preparation of this research report does not have authority whatsoever (actual, implied or apparent) to act on behalf of any issuer mentioned in this research report.

Dundee Capital Markets has written procedures designed to identify and manage potential conflicts of interest that arise in connection with its research and other businesses. The compensation of each Research Analyst/Associate involved in the preparation of this research report is based competitively upon several criteria, including performance assessment criteria based on quality of research. The Research Analyst compensation pool includes revenues from several sources, including sales, trading and investment banking. Research analysts do not receive compensation based upon revenues from specific investment banking transactions. Dundee Capital Markets generally restricts any research analyst and any member of his or her household from executing trades in the securities of a company that such research analyst covers.

Dundee Capital Markets may have had, and may in the future have, long or short positions in the securities discussed in this research report and, from time to time, may have executed or may execute transactions on behalf of the issuer of such securities or its clients.

Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this research report. The price of the securities mentioned in this research report and the income they produce may fluctuate and/or be adversely affected by market factors or exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal. Furthermore, the securities discussed in this research report may not be liquid investments, may have a high level of volatility or may be subject to additional and special risks associated with securities and investments in emerging markets and/or foreign countries that may give rise to substantial risk and are not suitable for all investors. Dundee Capital Markets accepts no liability whatsoever for any loss arising from any use or reliance on this research report or the information contained herein.