By IFCMarkets

US Dollar strengthened a lot on Friday on Fed members speeches. The first speaker was the Fed chair Janet Yellen who said the rake hike is possible as more and more strong economic data on labour market, economic activity and inflation are coming out in US lately. The initial reaction of the markets was quite lukewarm. Later the Fed’s Stanley Fisher spoke having precised the words of the Fed Chair saying that the rates may be hiked more than once this year and the first hike is possible already in September. Three more Fed meetings are scheduled till the end of this year. Thanks to Stanly Fisher’s words the chances for the Fed September rate hike rose to 36% and for December rake hike to 63.7%, according to FedWatch data. US stock market indices fell significantly as the US dollar strengthened and the rate hike became more probable. All this reduces the competitiveness of US companies. Today at 14-30 СЕSТ the personal income data for July came out positive in line with the forecast.

European stock indices are falling for the second straight day today following the US ones. The trading activity is low today due to the Bank holidays in UK. No economic data are expected today.

Nikkei slightly rose today on weaker yen. Lower national currency busts the exporters’ earnings. The decline in yen against the dollar on Friday was the steepest in 6 weeks. Tomorrow morning at 1-30 СЕТ the significant data on Japan’s economy will come out: unemployment and retail sales for July.

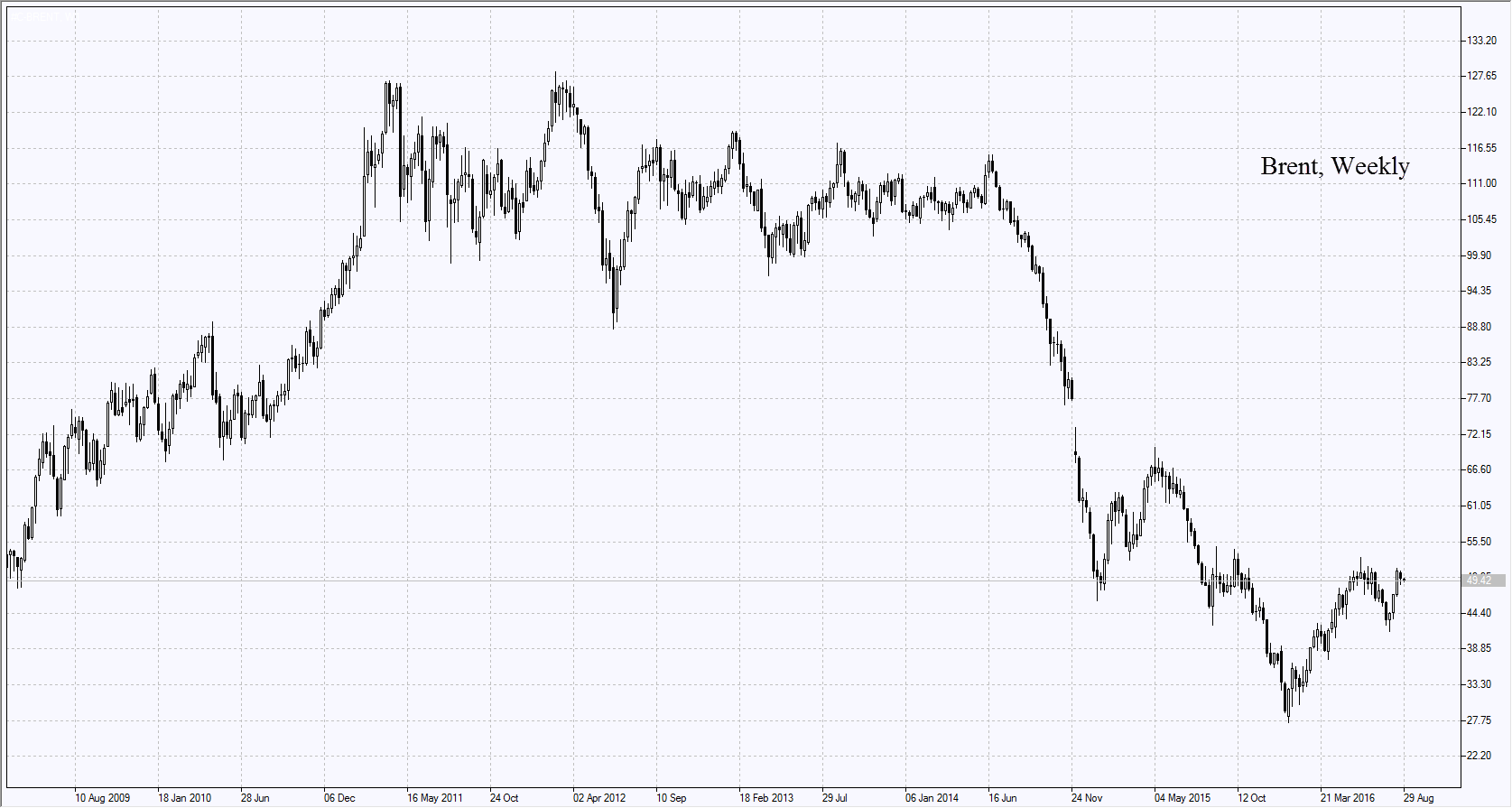

World oil prices slightly fell on Monday as US dollar strengthened. Moreover, the energy minister of Saudi Arabia said that «global oil prices are moving in the right direction». Market participants decided such a claim reduces the chances for oil production “freeze” by OPEC members on the International Energy Forum on September 28-29. In July oil production in Saudi Arabia hit a historical high of 10.67mln barrels a day. The previous attempt to limit production was made in this January and failed due to the rigid stance of Iran. The active rigs count was unchanged in US last week and is still 406 according to Baker Hughes. The same week last year the count was 675 units.

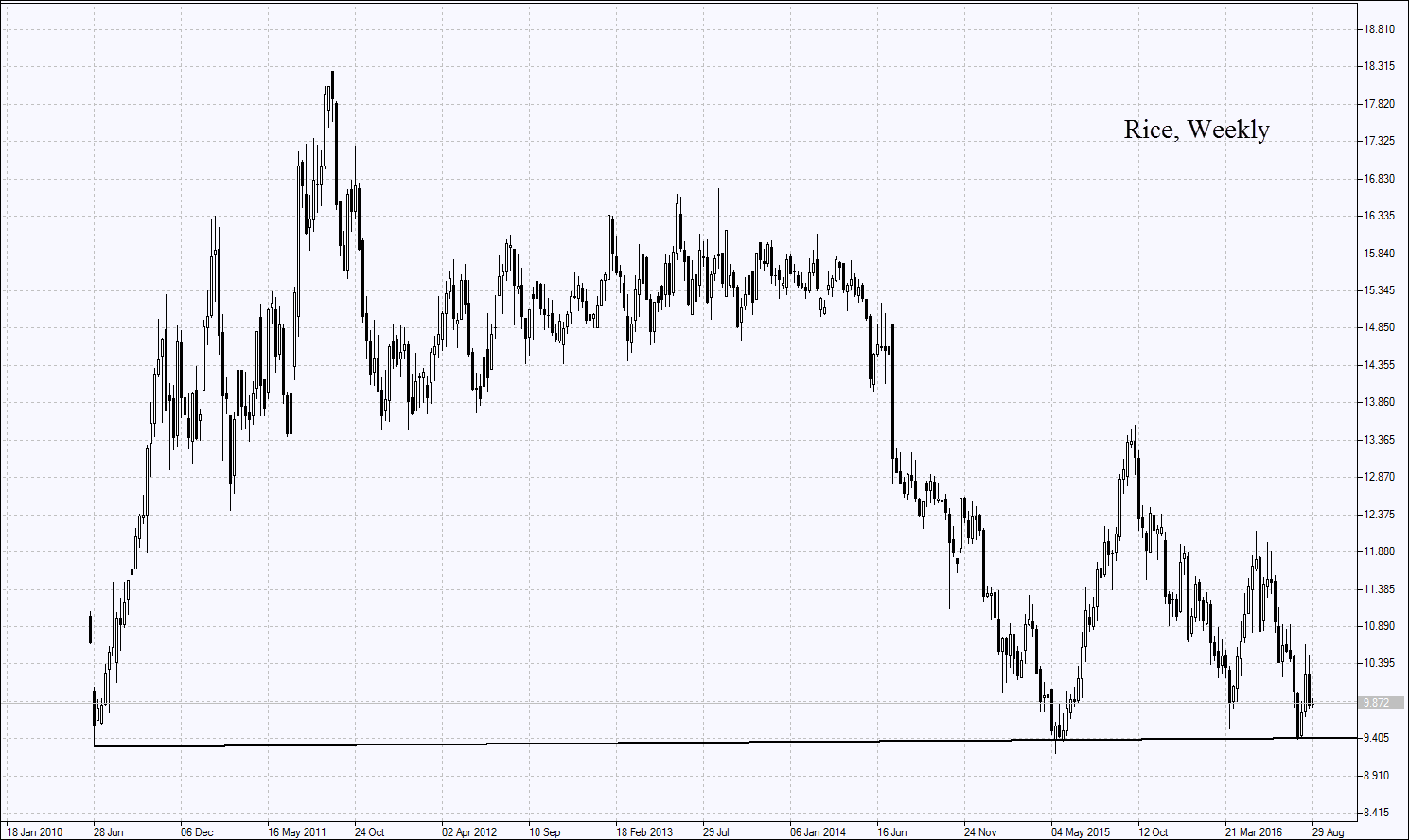

Wheat prices fell on Monday for the 6th straight day as the world major wheat importer, Egypt, decided to prolong embargo on wheat imports with signs of spurred rye. The prospects of record high crops also push the wheat prices lower. Previously International Grains Council raised the outlook for the global corn production in 2016/17 agricultural season to 1.03bn tonnes from 1.017bn. In previous season the corn crops were 969bn tonnes. This season the outlook for global wheat production was raised from 735 to 743mln tonnes. The soybeans crops may amount to 325mln tonnes which is just 2.8% above the last year’s 317mln tonnes. The global rice production may total 484mln tonnes which is 2.3% above the last year’s 473mln tonnes.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

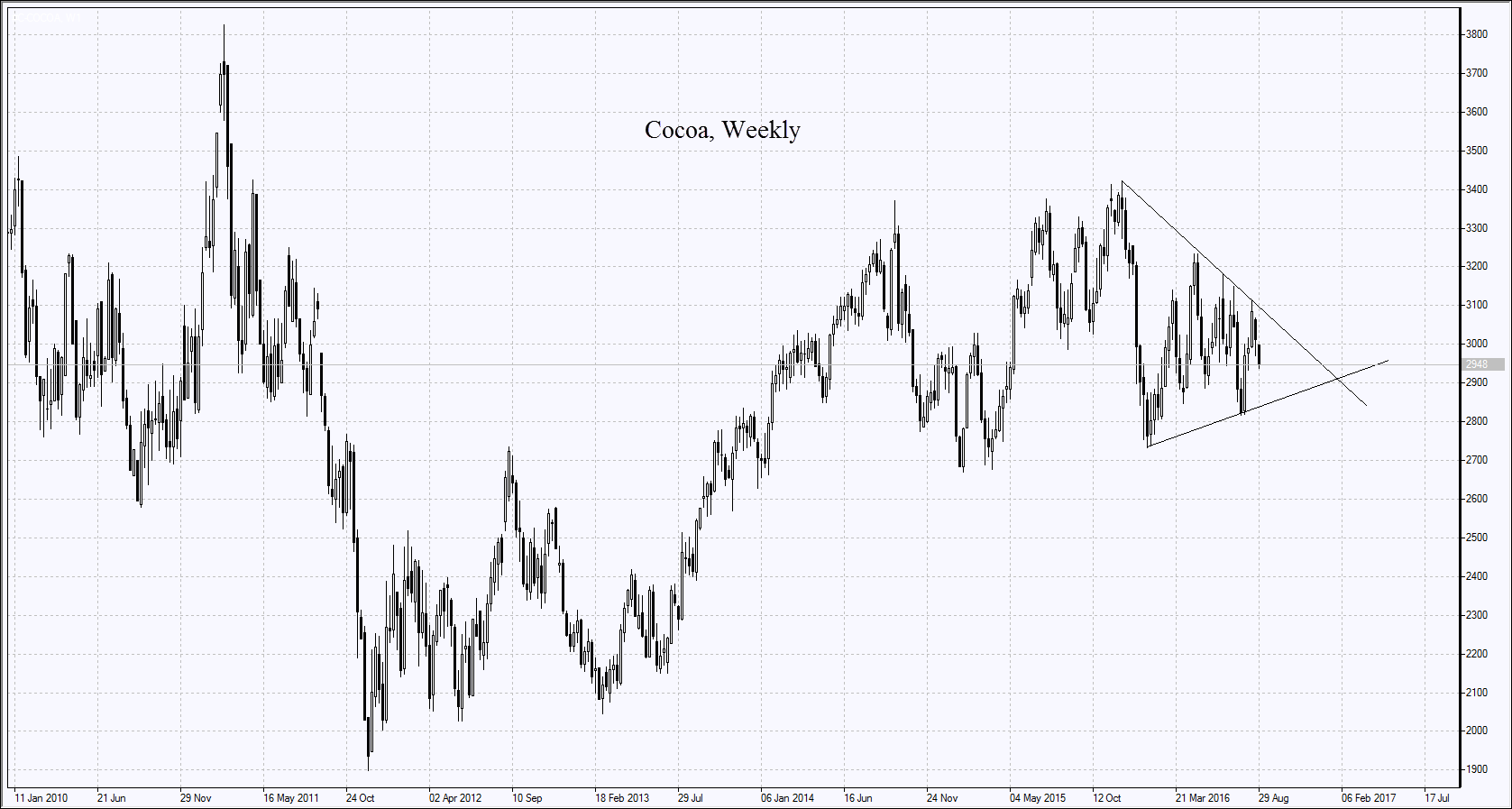

Cocoa shipments to the of the world production leader Cote-d’Ivoire fell 15% to 1.453mln tonnes since the start of the year up to August 28 down from 1.71mln tonnes in the same period of previous year. Exports from sea harbors of Abidjan and San-Pedro amounted to 4 thousand tonnes in a week of August 22-28 against 14 thousand tonnes in the same week last year.

Market Analysis provided by IFCMarkets

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.