By IFCMarkets

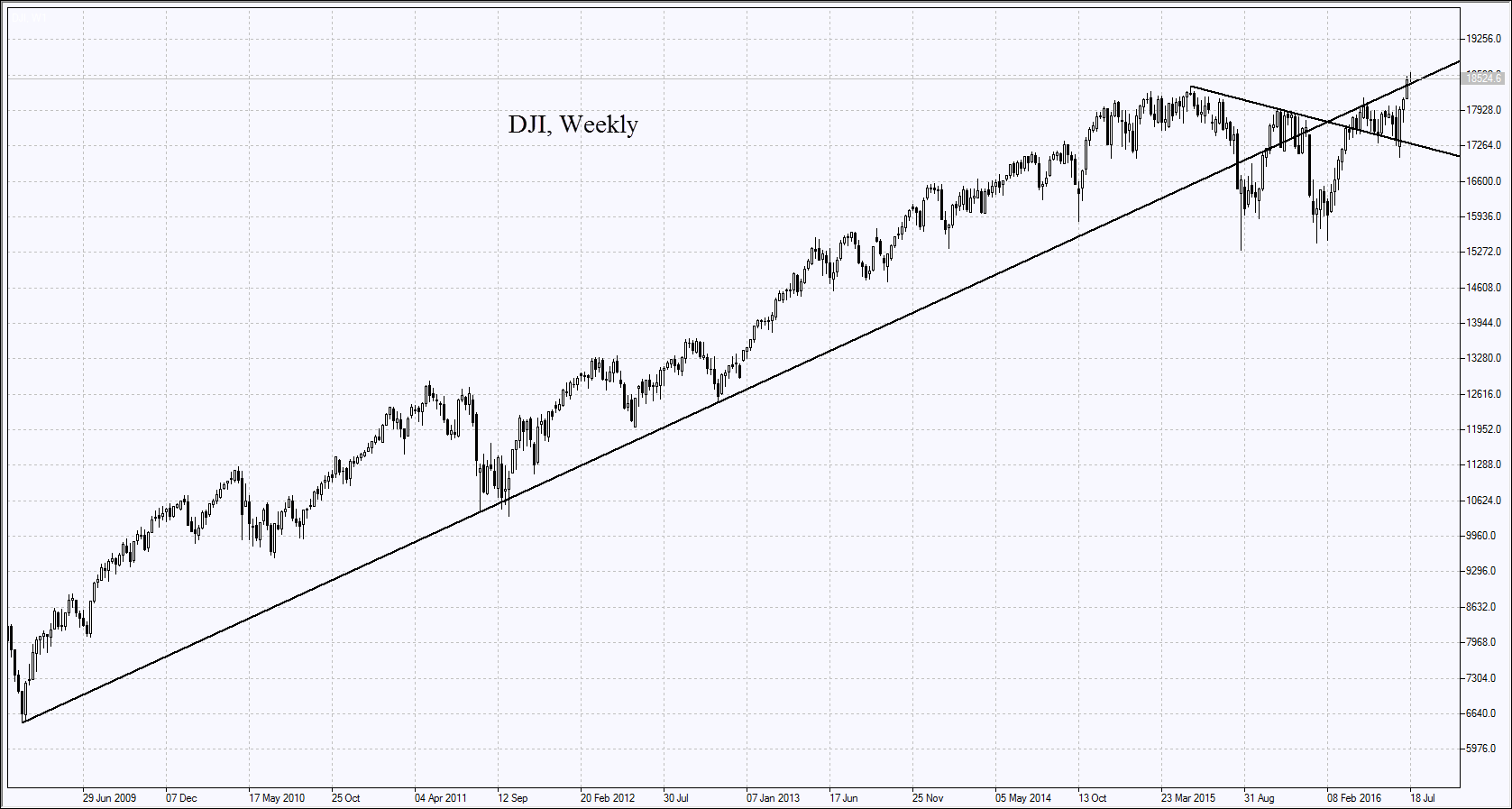

US stock prices and the US dollar index fell on Thursday. This happened because of various market news. Macroeconomic data in the United States were positive, but not enough important for markets. In particular, the weekly unemployment rate decreased slightly and the existing home sales rose in June. Yesterday’s drop in the US stock market indexes was the result of weak quarterly report and forecasts of Southwest Airlines (its stock prices dropped by 11,2%), Union Pacific (-3,4%) and Intel (-4%) companies. This week, the S&P 500 has once again renewed its historical high. Investors think that the quarterly decline in total earnings of the companies included in it will be minus 3,3% compared with the 2nd quarter of 2015. In early June, the estimate was worse and reached minus 4,5%, and even earlier – minus 5%.Today, futures on the US market stock indexes rose despite of Starbuck’s weak report published on Thursday after the completion of trades.Yesterday, the US dollar showed weakening against the major currencies after the Bank of Japan and the ECB announced that they are not planning an immediate mitigation of monetary policy. Today, the American currency strengthened and won back almost all its losses as the British pound declined. The June PMI in Britain fell below 50 pips, and the composite index has been minimal since 2009. This will increase the probability of rate cuts of the Bank of England at the next meeting on August 4. Today, at 15:45 CET, similar to British, the July industrial PMI will be released in the United States.

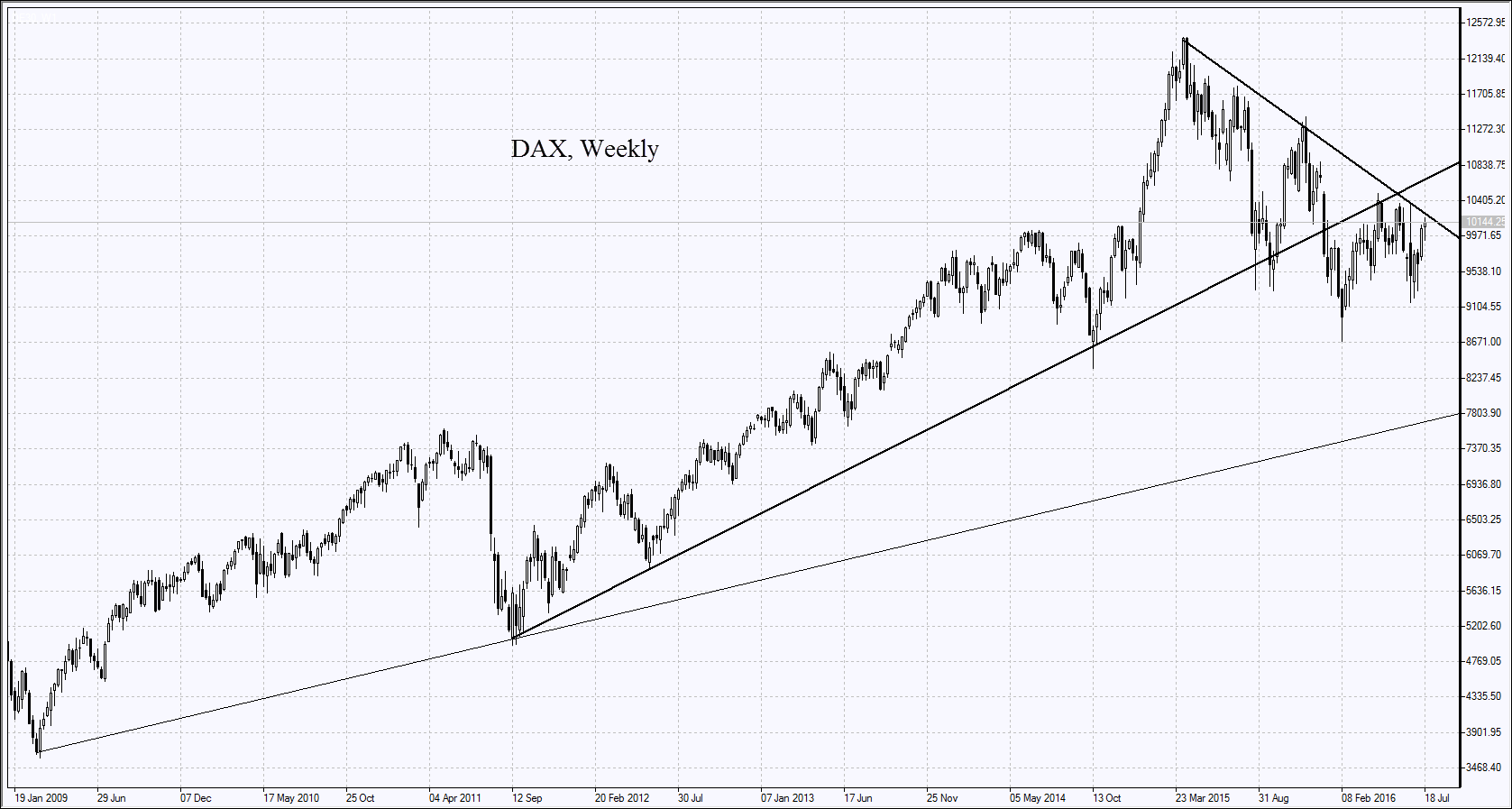

The European stocks, yesterday and today, fluctuate in a narrow range. Today, the common stock indexes of STOXX 600 and FTSEurofirst 300 fell by 0,4%. Macroeconomic data come out relatively positive, but the yesterday’s ECB statement that it will not hurry with the start of the additional incentive of the European economy, does not contribute to the activity of stock buyers. In particular, today were published positive indicators of the industrial PMI of Germany and France in June. The German turned out to be the maximum from the beginning of 2014.However, there was a week quarterly report of Skanska and a number of companies, which outweighed the macroeconomic positive. Today, there will not be any significant statistics in the Eurozone.

Nikkei, yesterday and today, fell as Yen strengthened after the announcement of Haruhiko Kuroda, the head of the Bank of Japan , that additional measures are not expected in the near future for the stimulation of the economy. Earlier, USD/JPY rate reached the maximum for 6 weeks, therefore some investors began to make profit actively. Now, however, the weakening of Yen stopped. Most market participants do not exclude that the Bank of Japan will take measures to mitigate the monetary policy at the next meeting on July 28-29. Today, in the morning was published the PMI of Japan for June, which was positive. On Monday, at 1:50 CET will be released foreign data for June. They may have positive impact on the values of Japanese assets.

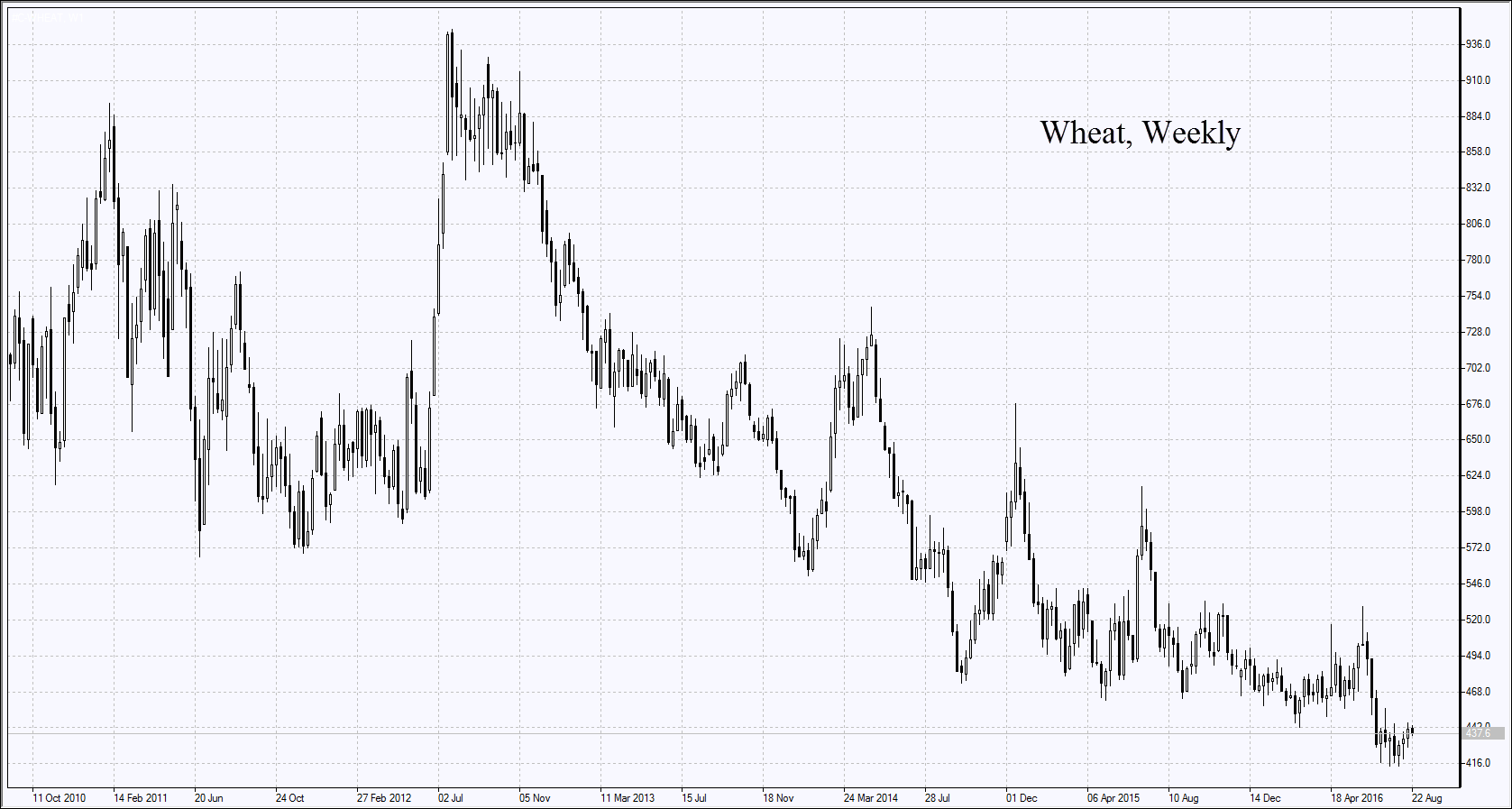

This week, the grain futures prices markedly declined. The Ministry of Agriculture of Argentina has raised its forecast for maize harvest in the country in 2015/16 to 39,8 million tons. The previous estimate was lower: 37,9 million tons. Soybean harvest forecast was increased from 58 million tons to 58,8 million tons. It should be noted that in 2014/15, Argentina produced 33, 8 million tons of maize and 61, 4 million tons of soybeans. They have declined 5th week in a row. An additional negative factor for grain futures was the improvement of weather conditions in the US. In the main grain regions of the country it became not so hot, which can contribute to the increase of yield. Good news for wheat, which can theoretically support its quotes: ODA Groupe agency has lowered the forecast of wheat harvest in the European Union to 30 million tons to 35 million tons expected earlier. In addition, the crop in France may be the lowest since 2003. The reduction of forecasts is due to heavy rains.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.