By CountingPips.com | Weekly Large Trader COT Report: WTI Crude Oil

WTI Crude Oil Non-Commercial Positions:

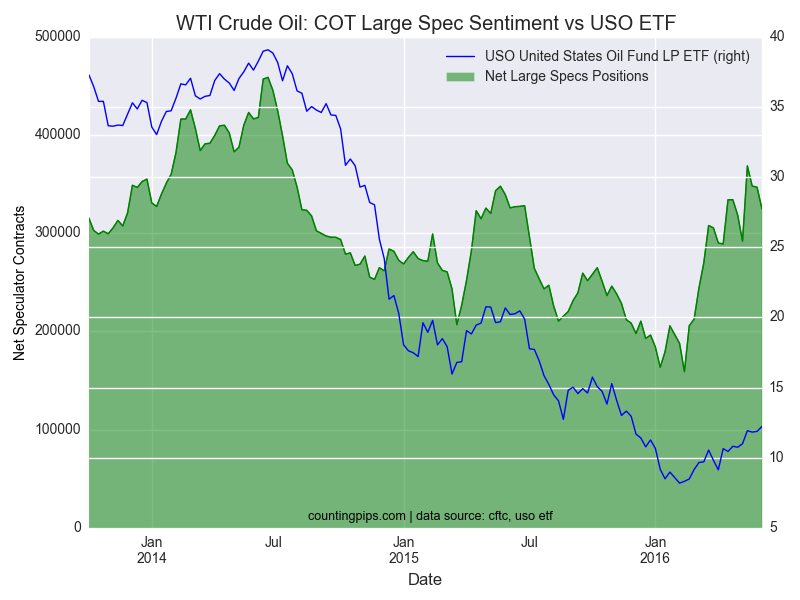

Futures market traders and large oil speculators reduced their overall bullish bets in WTI oil futures last week for a third consecutive week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial contracts of crude oil futures, traded by large speculators, traders and hedge funds, totaled a net position of +325,182 contracts in the data reported for June 7th. This was a change of -21,820 contracts from the previous week’s total of +347,002 net contracts for the data reported through May 31st.

For the week, the standing non-commercial long positions in oil futures advanced by 2,847 contracts but were overcome by the short positions that rose by 24,667 contracts to total the overall weekly net change of -21,820 contracts.

Net speculator positions are at their lowest level since May 10th after the three week fall but are still above the +300,000 contract threshold for a fifth straight week.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

WTI Crude Oil Commercial Positions:

In the commercial positions for oil on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) cut their existing bearish positions to a net total position of -320,162 contracts through June 7th. This is a weekly change of +19,200 contracts from the total net amount of -339,362 contracts on May 31st.

USO Crude Oil ETF:

Over the same weekly reporting time-frame, from Tuesday May 31st to Tuesday June 7th, the USO Oil ETF, which tracks the WTI crude oil price, increased from $11.87 to $12.22, according to ETF data for the USO United States Oil Fund LP ETF.

Last 6 Weeks of Large Trader Positions

| Date | Net Commercial Positions | Weekly Com Changes | Net Large Specs Positions | Weekly Spec Changes |

| 20160503 | -315207 | 9868 | 318544 | -15721 |

| 20160510 | -291621 | 23586 | 291960 | -26584 |

| 20160517 | -351429 | -59808 | 368769 | 76809 |

| 20160524 | -341742 | 9687 | 348142 | -20627 |

| 20160531 | -339362 | 2380 | 347002 | -1140 |

| 20160607 | -320162 | 19200 | 325182 | -21820 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators). Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

Article by CountingPips.com