By The Gold Report

http://www.theaureport.com/pub/na/16952

Of all the people in the tech world, Steve Jobs perhaps understood the potential of the Internet better than any of his peers. Bob Moriarty of 321Gold discusses how Jobs’ insight can provide lessons on gold manipulation and what moves markets.

Of all the people in the tech world, Steve Jobs perhaps understood the potential of the Internet better than any of his peers. Bob Moriarty of 321Gold discusses how Jobs’ insight can provide lessons on gold manipulation and what moves markets.

Many years ago Steve Jobs said that the most wonderful thing about the Internet was that it gives everyone a voice. He also stated that the worst thing about the Internet is that it gives everyone a voice.

We have more access to information at our fingertips than any society has had in history. But as a guy running a financial information website for the last 15 years, I have found that while we have access to far more information, much of it is little more than noise. My experience is that all unsuccessful investors focus on noise and ignore signal. . .to their financial peril.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

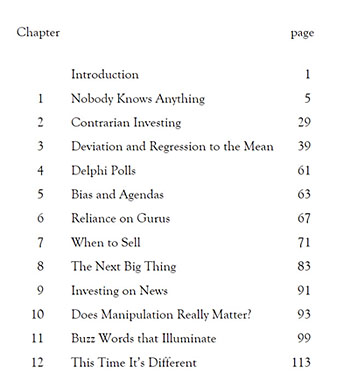

So recently I wrote a book about the basics I think every investor needs to understand to be a successful investor. The book, “Nobody Knows Anything,” may not make you rich but it might keep you from becoming poor. I cover subjects that most writers are afraid to mention, such as manipulation and why it’s meaningless, how news has nothing to do with price action and what four words mark the end of every single bubble.

The conspiracy crowd who believe that every blip in the price of gold and silver is controlled by a “Cartel” located somewhere went into a frenzy in mid-April when Deutsche Bank agreed that, yes, it had manipulated the gold and silver fixes at the expense of investors. Not only that, the bank was quite willing to snitch on its partners in crime.

My reaction was similar to that of Captain Renault in “Casablanca,” “I’m shocked, shocked to find out that gambling is going on in here!”

Every serious investor over the age of 13 should understand that all financial markets are manipulated. We understand that governments not only think they have a right to manipulate currencies and interest rates; they believe they have an obligation. Any serious investor knows that when he buys or sells shares, the high-frequency traders are front running their orders and clipping them for cents per share. It’s manipulation. The SEC could end it in a day. It’s illegal, yet it goes on.

What was interesting to me was to see the speed at which those shrieking about manipulation immediately made the irrational leap to price suppression in gold and silver. That’s a theory long past its sell-by date. By the end of April 2011, as silver tried to nudge $50 an ounce ($50/oz), up from $4/oz at the end of November 2001, the idea of silver being suppressed should have died a death. You can’t have an 1,140% rise in any commodity that is being actively suppressed. If the price of gold and silver were being actively held down, it was the most ineffective manipulation in history.

In “Nobody Knows Anything,” I discuss investors having a plan. What should you do if you have an investment that has gone up 1140%?

In November 2001, I was telling my readers that silver was at a low. In April 2011, I was telling investors that silver was at a top. In April 2011, the “manipulation” crowd was telling the choir to not only own gold and silver but to buy more because it was being suppressed. Yea, right.

If you have an investment and refuse to take a profit, the only other alternative is that you take a loss.

Your choice as an investor is to listen to those writers and sites that cater to your fantasies or to learn the basics of investing. I highly suggest learning to ignore the experts, the gurus and the other fools.

Deutsche Bank admitting it was front running gold and silver in the fix has about as much to do with price suppression as butterflies doing a tap dance in the moonlight. I cover this in the book.

I also chat about how news has nothing at all to do with price movement. That’s something I rarely hear others talk about, but investors need to know that prices move independently of news and often make countermoves to what might seem logical.

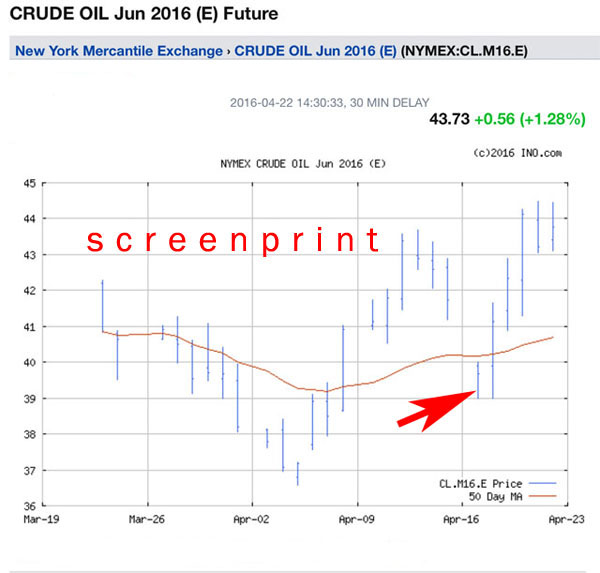

A great example took place on April 17 when 18 oil producing countries got together in Doha for what was expected to be a rubber stamp of an agreement to freeze oil production at January levels. The “News” on Monday, April 18 was that since Iran refused to attend the meeting and wouldn’t be part of any such agreement, Saudi Arabia would not support production stability. Prices were expected to plummet to new lows. In Sunday night trading, the price of oil dropped 5% from the close on Friday.

Markets don’t care about news. On Monday after the announcement oil recovered most of the losses. By mid-week oil was back at levels not seen since January. While we have all been conditioned by the talking heads on CNBC and Fox to believe that “gold went down today because of XXX,” it’s just not so. Nobody is waiting by the phone to place an order while they watch the news. Markets are made up of thousands of independent traders each buying and selling for reasons of their own. Markets go up, markets go down, and the actions of thousands of different investors all move price to the correct point independent of either manipulation or news.

Going back to the action in silver in April 2011 at the top, the ratio of the number of ounces of silver you needed to pay to get an ounce of gold had gone from 85:1 to 31:1. Compared to gold, silver was expensive. You can use that as a very valuable and important signal that tells you when to get into a trade and when to get out at a profit. Best of all, you don’t need to predict the direction of price movement; you can make a profit no matter which direction prices move.

The simple way to do it would be to use silver-gold ratios of 80:1 as a signal to sell gold and buy silver and 45:1 as a signal to sell silver and buy gold. This is a trade that only requires action every 2.5 years or so but has been profitable every time it has taken place since 1975. It’s called deviation and regression to the mean and I cover it. You need to understand it.

While it’s perfectly true that investors have more access to information than at any point in history, it’s also important to remember that they have access to more disinformation than at any point in history. Investing isn’t rocket science as long as you understand the basics and what moves markets and other investors.

“Nobody Knows Anything” is available on Amazon in either Kindle or paperback format.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Bob Moriarty and not of Streetwise Reports or its officers. Bob Moriarty is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. Bob Moriarty was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Charts courtesy of Bob Moriarty

Streetwise – The Gold Report is Copyright © 2016 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 773-5020

Email: [email protected]