By IFCMarkets

Trend or retracement?

Today at 10:30 CET we expect the release of CPI/Consumer price index in the UK. The index is published monthly by the Office for National Statistics, and represents performance of the previous year. This form of representation allows avoiding the influence of seasonal factors on inflation rate. CPI is calculated on the basis of various goods and services. It is considered to be the main inflation indicator of the UK economy and is taken into account when the Bank of England is changing the base lending rate. The index increase amid favourable economic conditions usually leads to the British pound strengthening. Moderate inflation is also welcomed by investors as an indicator of natural economic growth. As deflation hit the EU, the risen UK CPI could attract additional investment and strengthen the national currency. We deem the news released today would result in volatility momentum of the British pound.

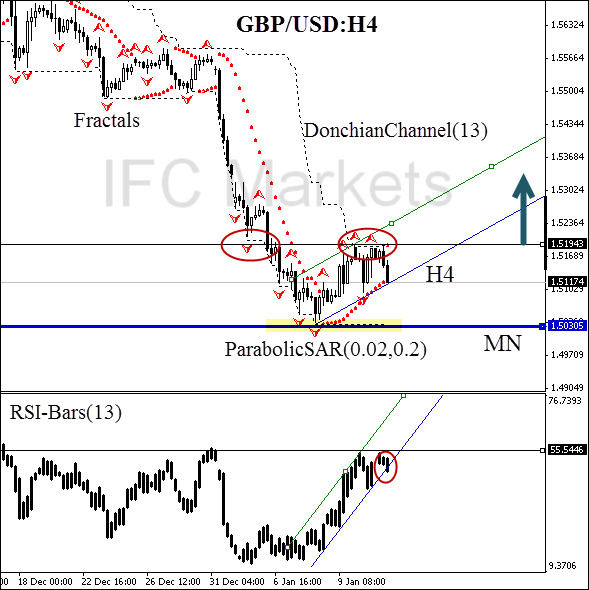

Here we consider GBP/USD currency pair on the H4 chart. The price is centered between the resistance of bearish pattern “double top” (marked in red ellipse) and the strong MN support line at 1.50305. The resistance line is located at the previous support level 1.51943, which provides extra significance. However, a bullish trend channel has begun its formation, and Parabolic values are moving along the uptrend support line. We believe bulls determine the price direction now. RSI-Bars oscillator confirms the trend. The only alarming sign is its trend line breakout. Conservative traders are recommended to wait for the RSI-Bars oscillator confirmation: the breakout at 55.5446%. We believe that it will happen after the price overcomes the double top level, which can be used for placing a pending buy order. Stop Loss can be placed at the MN support line, which is confirmed by the lower Donchian Channel boundary and the Bill Williams fractal. After order execution, Stop Loss is to be moved near the next fractal low. Thus, we are changing the probable profit/loss ratio to the breakeven point.

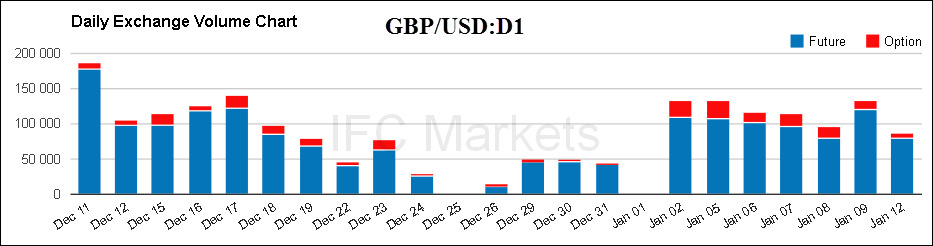

We have every reason to believe the uptrend to persist. The futures volume traded on the Chicago Mercantile Exchange dropped significantly. The current daily GBP retracement is not the formation of a new trend, so we expect the British pound to increase. The most cautious investors should wait for the level of 125000 contracts to be outperformed.

| Position | Buy |

| Buy stop | above 1.51943 |

| Stop loss | below 1.50305 |

Dear traders. For the detailed report of the strategy based on analytical issues of technical analysis click here.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Market Analysis provided by IFCMarkets