By IFCMarkets

Retracement completion

Let us consider the daily price chart of XAUUSD(GOLD) instrument. The price is moving in the limits of W1 and D1 bearish trend, containing the falling Donchian Channel. At the moment, we can observe the price retracement completion: the last bar peak of RSI-Bars oscillator is located on the border of the overbought zone, and that confirms a price reversal is about to happen when the oscillator signal breaks the support level at 16.5854%. The corresponding Parabolic confirmation will be obtained after the support level breakout at 1128.95, located below next to the last Bill Williams fractal and the Donchian Channel border. This mark can be used for opening a pending sell order with Stop Loss placed above 1258.35. This level is confirmed by the upper Donchian Channel boundary and the D1 trend line.

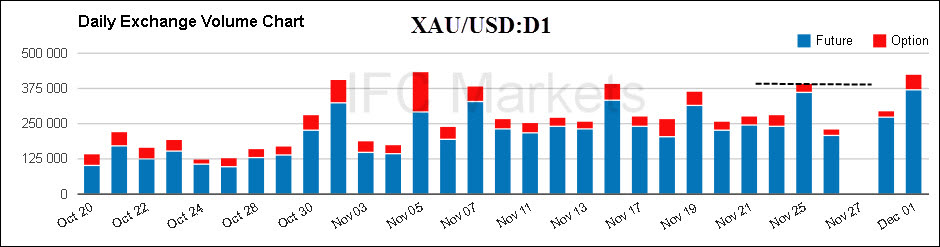

Currently, we have a confirmatory bearish signal looking at the volume of gold futures and options traded on Chicago Mercantile Exchange. The number of contracts outperformed the last level of 375000, and it is still advancing. For the trading volume data please click here.

After position opening, Stop Loss is to be moved after the ParabolicSAR values, near the next fractal high. Thus, we are changing the probable profit/loss ratio to the breakeven point.

| Position | Sell |

| Sell stop | below 1128.95 |

| Stop loss | above 1258.35 |

Dear traders. For the detailed report of the strategy based on analytical issues of technical analysis click here.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Market Analysis provided by IFCMarkets