PCI : Forex Technical Analysis December 04, 2014

By IFCMarkets

Crude oil hedge

Under conditions when budget revenues depend on energy prices the national currency is subordinated to market volatility. For example, the correlation between the Russian ruble and BRENT futures for the last month was 80%, virtually eliminating the influence of other factors. Among the “commodity currencies” a national currency of Russia showed the minimal resistance to the uncertainty of oil market. From the beginning of this year BRENT has lost 30% while Russian ruble – about 43%. The values are comparable. Additional 13% can be attributed to the sanctions and economic blockade of Russia. Until the last moment there was no certainty about the reaction of the OPEC to oil supply growth. There is still no certainty about the level of shale projects profitability that can stop the decline of the oil market. How to eliminate the effect of energy uncertainty for the national currency and how to hedge risks?

Lets consider a spread instrument [CAD+MXN+NOK+RUB]/BRENT, composed on the basis of PCI technology. This instrument is based on the quotation of commodity currencies (Canadian dollar, Mexican peso, Norwegian krone and the Russian ruble) against BRENT futures – we use the FX cross-rate. Weights of the basic portfolio are selected based on the vulnerability of the exporter trade balance to the energy market conditions. The table below presents the share of budget revenues; based on revenue from oil export for BRENT value of $ 71 per barrel (the price does not affect the relative weights). We used data from the International Energy Agency.

| Currency | The share of oil exports in budget revenues,% |

| RUB | 43 |

| NOK | 15 |

| MXN | 13 |

| CAD | 6 |

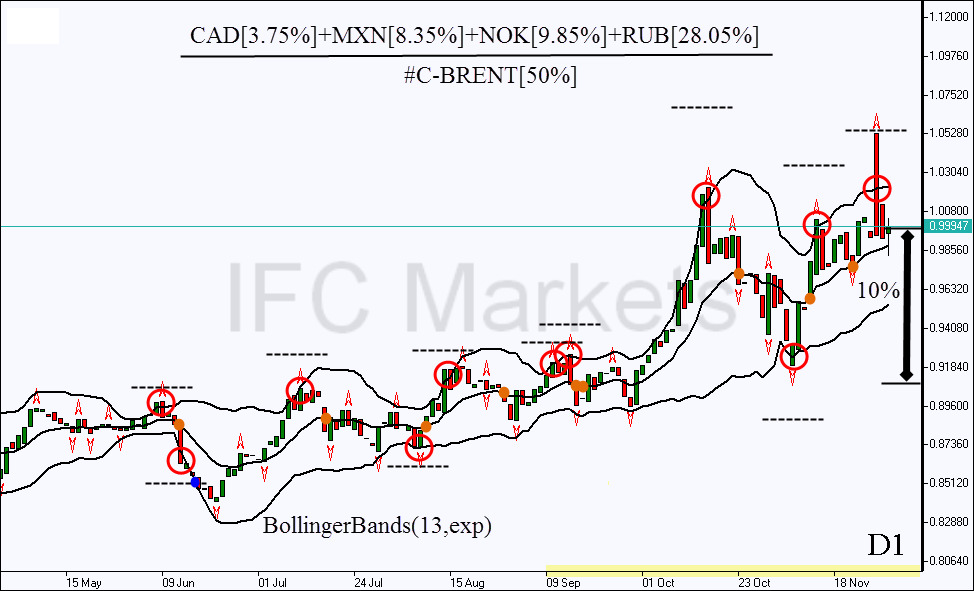

The weights of basic portfolio are chosen in proportion to the underlying listed shares: CAD – 3.75%, MXN – 8.35%, NOK – 9.85%, RUB – 28.05%. The remaining 50% of the capital account for BRENT futures. Operation of spread purchase corresponds to the opening of a long position of the portfolio [CAD + MXN + NOK + RUB] and a short position of BRENT. The daily chart of the instrument, based on the open/close prices is composed in NetTradeX platform and presented in the figure below.

The instrument is ideal for working within the channel as part of a mean reversion strategy. A range of 13 days and the exponential moving average within the BollingerBands channel are used. Position is opened at the intersection of the candle body with a channel border (red oval) and closed at the touch of a moving average (solid circle). Restriction risk dotted line is defined based on the distance between the current border of the channel and the moving average value at the moment of opening. Of the ten featured deals only one is unprofitable, and the loss is limited by a stop. The ratio of profit /loss is greater than one, depending on market volatility.

Free Reports:

This strategy allows avoiding the risk of falling liquidity that exists when following the trend in “thin” market of commodity currencies. The second advantage is that the results of trade are determined only by the fundamental relationship between the trade balance and oil exports. The structure of budget has a high inertia and weights of the basic portfolio may stay constant for many years. Uncertainty of crude oil market is much less important in this approach: the chart shows the absence of numerous dangerous gaps, and only a weak ten percent increase in the period of high volatility (since September 9).

For more information about the mechanism of portfolio transactions, you can read in the section of our website “Quick Guide: PCI” .

Market Analysis provided by IFCMarkets