Article by Investazor.com

The monetary policy meeting of the European Central Bank for November is going to take place. In this context, the whole economic world’s focus is directed through the possible major changes that can be announced with this occasion and their possible major effects. In order to present to you an overview of this important monthly event of the EURO zone, we drew up a synthesis article.

The monetary policy meeting of the European Central Bank for November is going to take place. In this context, the whole economic world’s focus is directed through the possible major changes that can be announced with this occasion and their possible major effects. In order to present to you an overview of this important monthly event of the EURO zone, we drew up a synthesis article.

Short retrospective of the recent ECB monetary policy evolution

If it were to analyze the European Central Bank’s monetary policy in the second part of this year, we can observe – as a general statement – the affirmation consisting of keeping low the interest rates for “an extended period of time.” Accordingly, if we consider the value of the interest rate, we can observe that it has been kept at 0.50% since May 2013.

Since the first months of the year, Mario Draghi, the ECB president, kept admitting the fact that the European economy is evolving at a slow pace, requiring stimulus. Price stability remained the focus of the ECB during the last months while struggling to maintain the inflation at the target of 2%.

In July, some of the main concerns were Greece and Cyprus, which caused destabilization in the European economy. The officials expectations of seeing these countries on a stable track are postpone for 2014. Whereas August didn’t bring any changes, September’s surprised by the vote of the European Parliament to create a single supervisory mechanism and to start the process of composing a banking union which is aimed to help the ECB achieving its targets. In October, positive signals in the real economy gave momentum while advanced steps were taken concerning the banks which will be mainly involved in the single supervisory mechanism as well as a broad assessment in this matter.

These retrospective lines, followed by a deep macro-economic analysis of the last direction in the EURO area’s economy, create a frame that permits us to identify possible scenarios for the ECB meeting.

Is Euro zone recovery going according to plan?

Not quite, and this is why it gets very interesting. Just when the European economy started to gain some momentum and finally was driving on the recovery highway (Spain being able to pull out of the recession after two years!!!), the last day of October kind of ruined the “Euro zone economic party” after two indicators of major importance gave a warning signal.

We are talking about the inflation rate, which unexpectedly fell to 0.7% from a 1.1% anticipated value and the unemployment rate which also disappointed the investors climbing to 12.2% from a 12% estimated value. This unpleasant surprise was rapidly discounted in the market price leading to a 1.1% Euro diving to 1.3581$.

Besides that, these two dark horses (unemployment and inflation) immediately fuelled the speculations that ECB is likely to cut the interest rate at the next monetary policy meeting on 7th of November in order to avoid a deflation and to have a better shot at the 2% inflation rate target.

Leading to the ECB monetary policy meeting, Wednesday brought us stronger-than-expected German industry orders, an actual 3.3% from a expected 0.6%, increasing the expectations that ECB would keep rates unchanged on Thursday despite a steep fall in inflation and helping push the Euro up 0.3% to $1.3518.

To cut the story short, we are going to give you a few scenarios for possible outcomes of the ECB monetary policy meeting:

1. After the significant drop in the inflation rate and the fears of a potential deflation, ECB decides to cut the rates and has a more-than-expected dovish tone. In this scenario, taking into account that markets are expecting a hold in the interest rates, we see a significant drop of EURUSD and the European capital markets indices.

2. In the second possible outcome, we expect an “I wouldn’t be so worried” speech from Mario Draghi in which he states that the European economic recovery is evolving, but at a slow pace and the markets should not panic because ECB has the situation under control. In this case, we could see a slight gain of EURUSD and the European capital markets indices because investors already discounted in the market price that ECB will maintain the rate unchanged. Besides that, the upward push would also come from the fact that investors would see this kind of speech as a vote of confidence in the European economy from Mario Draghi.

3. In the last scenario, we still expect that ECB would maintain the interest rates at the same level, but Mario Draghi will hint at a potential cut in December if the macro indicators show a declining state of the European economy. In this situation, markets will rush to discount in the prices a potential December rate cut, pushing EURUSD and the European capital markets indices downward at a moderate pace.

Technical overview of the market before the ECB’s monetary policy

After clearing out our economic scenarios for the next ECB monetary policy, let us take you now through the technical scenarios that could follow on medium term time frame for some of the most important instruments.

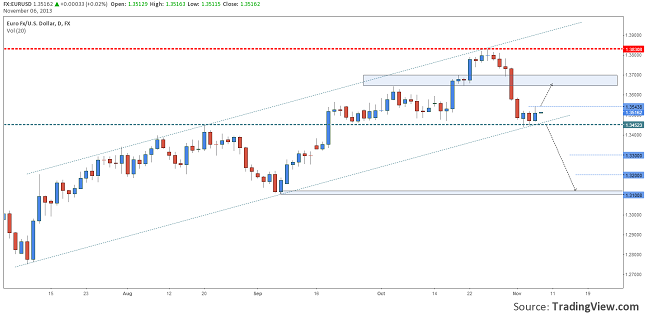

Mario Draghi could keep its optimistic tone and strengthen investors’ confidence in the Euro Area economy triggering this way new buying momentum for the Euro. EUR/USD has fallen to the support area created by the uptrend line and the 1.3450 support level. Here we can see that it is hesitating, meaning that the market is waiting also for fundamental reasons to head into a certain direction.

From the technical point of view EURUSD is still in an uptrend as long as the trend line will not be broken. A bounce from this current area could bring the Euro back to 1.3650/1.3700. Stronger confidence in the direction of the economy could mean also aggressive buying that could move this currency pair above 1.3700.

On the other hand a more dovish approach, of the ECB, could trigger aggressive selling of the Euro. The current fall of the EURUSD, fueled by good economic data from the United States, could accentuate tomorrow if the ECB will surprisingly cut the interest rate, or announce a possible cut in the near future. A daily close under the trend line could only mean that the US dollar could strengthen all the way to 1.3300/3200 or even 1.3100 if the Non-Farm Employment from Friday will be above expectations.

Chart: EURUSD, Daily

If EURUSD still has some bullish potential, EURJPY doesn’t look that good. On this currency pair’s price chart a Rising Wedge has emerged during the last months. This price pattern is accompanied also by negative divergences on the 56 days RSI; both signals could announce a reversal in the current uptrend.

A dovish approach could push the price of this pair under the current low, 132.40, and open the way for a down trend that could target the level 125.00. A 6% drop of this pair is also the full target of the Rising Wedge.

On the other side, if Euro will recover after the ECB monetary policy of this month, we might witness a rally of the EURJPY back to 135.00.

Chart: EURJPY, Daily

Another interesting instrument to follow would be, from our opinion, DAX30. The German stock index gives some bearish signals when applying technical analysis. The price has hit the rejection line of the uptrend channel and the 14 days RSI which has crossed above 70 level and drew a small negative divergence while falling back under the overbought limit level.

Bad news from the ECB could be the argument for the markets to sell sell sell! A drop under 8960 would also be the technical confirmation for a deeper correction of the current trend. The target level for a drop could be 8760, but the price might end up even lower if the economic data will continue to disappoint the markets in the near future.

A positive scenario would move the price above 9100 and this could mean free hand for another rally with limits at 9200 and 9300.

Chart: DAX30, Daily

As you can see the markets are barely waiting for the ECB monetary policy from tomorrow. In the past this meetings followed by the press conference have triggered high volatility in the Forex and Equity markets. We recommend traders to be attentive to details and manage their positions with high responsibility, because the market emotions could end up hitting their stop losses.

After the conference has ended and the market sided with a direction, don’t think that the party it’s over. Friday will be published some very important indicators from the US labor market that could strengthen the direction or turn it around.

Research Team Investazor

The post The most likely Scenarios of the ECB Monetary Policy Meeting Aftermath appeared first on investazor.com.