Article by Investazor.com

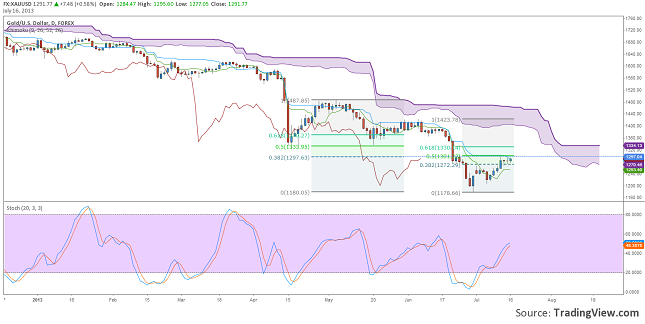

Chart: XAUUSD, Daily

After hitting a low under 1180$ per ounce the price of Gold bounced back to 1290$ per ounce. The most interesting thing about this throwback is that the commercials are still net short on this instrument, but the open interest is on the up move. This might mean that the precious metal is being bought by private investors more, and less by Central Banks and Hedge Funds.

Tomorrow Ben Bernanke is expected to have another speech. Investors will look for signals regarding the Quantitative Easing. If the Fed will start tapering it later than September, we might see another rally in the price of gold, while if this date will be maintained there is a possibility for the price to drop suddenly.

Looking at the technical analysis of gold’s price chart using a system based on Ichimoku Kinko Hyo, we observed that the price is now in the layer between the Tenkan-sen and Kijun-sen averages. Adding a Fibonacci retrace we can conclude that 1300$ per ounce is a very good resistance level. If the price will break and close above this level we can expect for it to rally to 1350$ per ounce, where it will find itself in the Kumo.

Even though the signals are bullish, keep an eye on the 1270$ support. A break under this level could mean another drop for the price of gold. The target levels for a down move are 1210$ and 1180$ per ounce.

The post Gold (XAUUSD) might Bottom around Current Levels appeared first on investazor.com.