Article by Investment U

You probably agree that nothing gets the blood pumping like making a lot of money in a relatively short time. But to do this you need to think differently than the herd and see a crisis as an opportunity.

While you’ll find the best values in the midst of, or following, a crisis, you need to approach the crisis in the right way.

Let me share with you my three crisis investing rules as applied to Argentina.

- Avoid the temptation to invest in the vortex of the crisis; wait for the dust to settle and the story to fade from the front page.

- Identify and monitor a target company (or group of companies) and confirm value and prospects going forward.

- Put in place a sell stop just in case you’re wrong.

Argentine Gambit #1

This brings me to Argentina, where pessimism is in the water and a crisis is usually just around the corner.

In late May of 2010, I noticed that an avalanche of bad news had beaten down the Argentine market and that the market was getting zero attention from financial media and gurus.

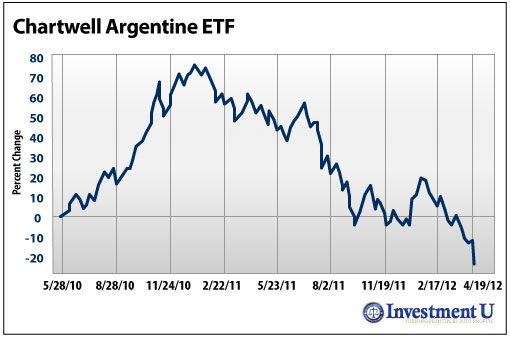

So I put together and recommended to members a diversified basket of seven Argentine stocks trading on the NYSE. You might call this a custom Argentine ETF.

This strategy was based on a belief that that most of the downside risk had been wrung out of the market and that the probabilities of a rebound were in my favor.

The results were well beyond my expectations.

By October 2010, this basket had rocketed almost 70% and then fell through my 15% sell stop for a neat 55% gain in less than five months.

You can also see that since late 2010, this market has been through a disappointing and choppy decline. This dismal performance has tracked a sad series of anti-market policy blunders by the Argentine government.

The latest crushing blow to investor confidence was nationalizing Repsol’s equity stake in Argentina’s YPF. This sent my Argentina ETF to a level 25% below where it was in May 2010.

It seems that everyone hit the panic button, selling all of their Argentine stocks.

As Spain’s prime minister put it last month, “You would have to be crazy to invest in Argentina right now.”

Argentine Gambit #2

Call me crazy, but I see an opportunity.

This story faded from the front pages and nobody is pitching Argentine stocks that have been, drip by drip, driven to bargain-basement prices.

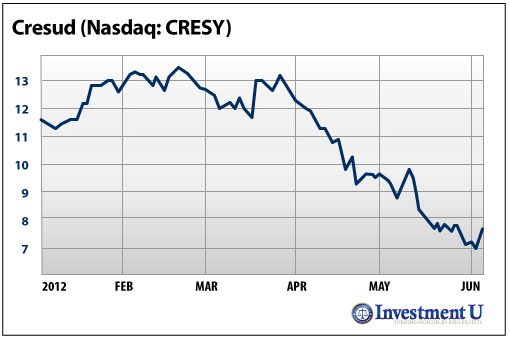

Next, I selected and have been watching my value target, Argentina farming giant Cresud (Nasdaq: CRESY). Cresud is one of the largest farming companies in Latin America.

The company produces agricultural commodities like corn, wheat, soybeans, sunflower, sorghum, milk and beef cattle on about half a million hectares of land. In addition to Argentina, Cresud owns significant farmland in Brazil as well as other South American countries.

Cresud, which has a great balance sheet, is largely an asset play as quality farmland is becoming more and more difficult to find in the world.

The stock is trading at about 20% below book value, but represents an even bigger value since land bought many years ago by the company is carried on the balance sheet at cost rather than current market value. As a bonus, Cresud owns 55% of Argentinean real estate developer IRSA (NYSE:IRS).

Some of you may wish to track CRESY for a while to get more comfortable with the situation. Others may wish to take action, but don’t confuse crisis investing with reckless investing. This is truly an aggressive value pick in the midst of max pessimism.

So always take a small position before rushing in. If it’s truly great bargain, there’s no need to hurry.

Put in place a 15% trailing stop loss in case the market moves against us and to lock in profits if we get it right.

Good Investing,

Carl Delfeld

Article by Investment U