The EURUSD Is In A Narrow Range Again

The EURUSD continues trading in a tight range where it has already been for a week except falling to 1.3648. Yesterday, it rose above 1.3720 and tested 1.3734 and after that it returned to 1.3706. Thus, a forecast is the same – growth attempts encounter interest to sale that keeps the risks of testing the support around 1.3618. Breaking through current resistance will lead to a rise in the direction of the 38th figure, however the pair is trading below, a bearish sentiment will be kept.

The GBPUSD Running A Risk To Recover A Decline

The GBPUSD is also consolidating in a tight range. Resistance is around 1.6842, and support is around 1.6805. Inability to rise and to consolidate above 1.6842 is a negative factor for the pair. In theory, bears are trying to test 1.6730 in a short time again. However, today data on consumer inflation in the UK will be published that can influence significantly on the dynamics of the GBPUSD.

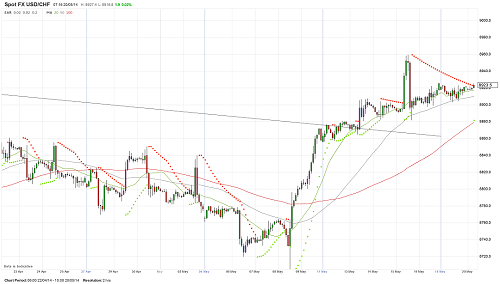

The USDCHF Can Test 0.8959

Yesterday, fluctuations in the EURUSD were not marked. It stuck in a tight range this time between the levels of 0.8903 and 0.8923. The franc remains under pressure along with the risks of testing the USDCHF bulls by the current high at the level of 0.8959. Breaking through this level will open the way to the 91st figure. A fall below 0.8840-0.8800 will weaken a bullish impulse and put the 87th figure at risk.