Demand For The EURUSD Remaining

The EURUSD decreased to 1.3823 yesterday, where it was bough out and increased to 1.3879. It did not continue to rise, as having tested the level, the EURUSD retreated to 1.3839. Nevertheless, declines continue to attract steady interest to sales, and now the euro is approaching yesterday’s highs. The pair can continue rising, however it should overcome quite a few obstacles on the way to the psychological level of 1.4000. Falling to 1.3800 will increase a probability of a breakout through support with a further decline to 1.3720.

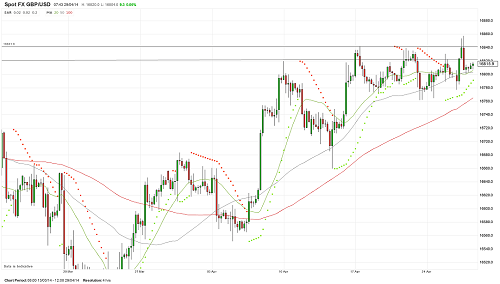

The GBPUSD Continuing to Be Bought

The British pound in pair with the U.S. dollar traded quite positively yesterday. On wane to 1.6777 the pair was bought out, and then it rose to 1.6857, having overcome the levels of 1.6822 and 1.6841. However, the pound failed to consolidate higher that led to a decline to 1.6800. Demand for the pair remains here, but its immediate inability to consolidate above the broken highs is a negative factor, increasing the risks of the development of a descending correction. Today, data on the GDP in Great Britain will be published, which can either support a rise in the pound or contribute to its decline below 1.6762.

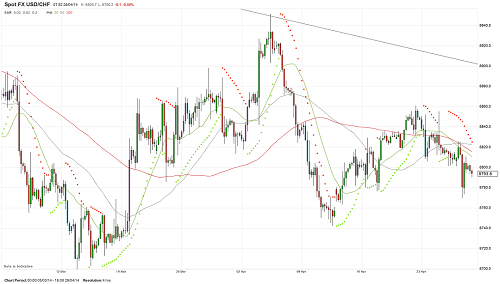

The USDCHF Can Test 0.8700

The USDCHF continued falling and tested the level of 0.8770, after that retreated to 0.8810. Nevertheless, the dollar remains under pressure along with the downside risks towards the 87th figure. A breakout of which will strengthen its falling. The dollar should rise and consolidate above 0.8951 to weaken a bearish impulse. A steady breakout through the resistance around 0.9118 will give a reason to imply a base formation with the development of a large ascending correction.

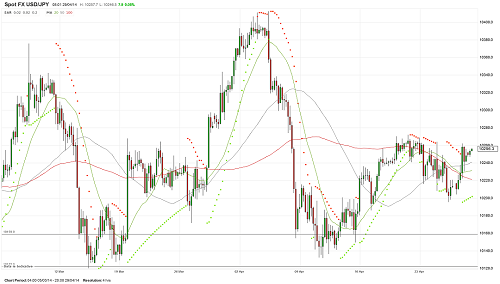

The USDJPY Increasing Again

The support around the 102nd figure held out and from which the USDJPY went steady upward. As a result of a rise, the dollar tested the resistance around 102.62, after that retreated to 102.30. Nevertheless, demand for it remains, and it approached to yesterday’s highs again. Thus, ability to consolidate above the 102nd figure increases the risks of a breakout through current resistance and further development of an upward momentum. In this case a rise to 103.40-104.00 should be expected. In turn, a breakout of the 102nd figure will lead to testing the support around 101.59.