By CentralBankNews.info

Israel’s central bank cut its benchmark interest rate by 25 basis points to 0.75 percent after a surprise fall in inflation in January, pessimism among consumers and continued strength of the shekel.

The Bank of Israel (BOI), which cut its rate by 75 basis points in 2013, said the decision to cut the rate was consistent with the bank’s aim of entrenching inflation within a 1-3 percent range and it would use its tools to achieve this objective along with encouraging growth and employment while it would continue to keep a close watch on asset markets, including the housing market.

Israeli consumer prices fell by 0.6 percent in January, higher than the 0.2 percent decline expected, pushing down the annual inflation rate to 1.4 percent from 1.8 percent in December. As a consequence, private forecasters reduced their inflation projections to an average of 1.6 percent over the next 12 months while capital market’s expectations were steady at 1.9 percent and inflation expectations derived from banks’ own rates were unchanged at 1.4 percent.

Private forecasters and market interest rates also indicated “some probability” of a cut in rates by the BOI over the next three months while expectations for a cut over the next year are lower and some forecasters even expect an interest rate increase, the central bank said.

The Senior Strategist: Chaos in Ukraine troubles investors

The political situation in Ukraine has reached dramatical heights. The country has a weak economy and will need help from the outside.

Senior Strategist Ib Fredslund Madsen evaluates, and looks at the other important economic and financial events of the week to come.

Video courtesy of en.jyskebank.tv

Learn to apply Moving Averages to your trading with this Free eBook

Special Trading Resource from Elliott Wave International

Greetings Trader,

Robert Prechter’s Elliott Wave International (EWI) has just released a free 10-page trading eBook: How You Can Find High-Confidence Trading Opportunities Using Moving Averages, by Senior Analyst Jeffrey Kennedy.

Moving averages are one of the most widely-used methods of technical analysis because they are simple to use, and they work. Now you can learn how to apply them to your trading and investing in this free eBook. Let EWI’s Jeffrey Kennedy teach you step-by-step how moving averages can help you find high-confidence trading opportunities. Jeffrey’s trading eBooks have been downloaded thousands of times because he knows how to take complex trading methods and teach them in a way you can immediately understand and apply. You’ll be amazed at how quickly you can benefit from Moving Averages with just this quick, 10-page lesson.

Improve your trading and investing with Moving Averages!

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world’s largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

Wave Analysis 24.02.2014 (DJIA Index, Crude Oil)

Article By RoboForex.com

Analysis for February 24th, 2014

DJIA Index

After completing bullish impulse inside wave [1], Index continued its correction. In the near term, price is expected to break local minimum and then start strong ascending movement inside the third wave.

More detailed wave structure is shown on H1 chart. Possibly, right now instrument is forming descending zigzag pattern inside wave [2]. Earlier, Index formed quite short wave (5) of [1]. Price may continue falling down inside wave (C) during the day.

Crude Oil

Oil is still controlled by bulls. Probably, right now price is forming ascending impulse inside wave C. Instrument is expected to reach new maximums during the week.

As we can see at the H1 chart, market finished the fourth wave inside wave C. On minor wave level, instrument completed initial ascending impulse. I’m keeping my buy order with target at the end of wave [5] of C.

RoboForex Analytical Department

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Weekend Update by the Practical Investor

Weekend Update

February 21, 2014

— VIX closed above its cluster of weekly Model supports after challenging weekly mid-Cycle resistance at 15.69. VIX held steady this week, a non-confirmation of the SPX rally attempts.

SPX closes above the Wedge formation a second week.

After piercing the lower trendline of its Orthodox Broadening Top (Megaphone formation) at 1748.00, SPX continued to consolidate above the Wedge trendline. Phase 7 of that patternHas lingered for another week without making a new high. The Phase 8 may be a potential crash, since this is a major reversal pattern. The Bearish Wedge implies a probable reversal to its origin. A new record high will not negate the effects of a Bearish Wedge or the Broadening Top. It only postpones it. Many bearish technicians are now bullish, not recognizing the bearish reversal pattern.

(ZeroHedge) “Of course, there are those who see these charts and through no self-referential cognitive-dissonance of their own (well in fact entirely for that status quo engendering reason) will proclaim… that proves it – US is cleanest dirty shirt and money is flooding back to ‘safety’ – however – that is entirely disingenuous…”

NDX stalls at a 13-year high.

NDX made a new high this week, testing its Broadening Top trendline, but closed at a small loss for the week. This type of rally is a bull trap, keeping investors reassured that all is well. Monday may be a key reversal day for all the indices, according to the Cycles Model.

(ZeroHedge) In the spring of 2012, we predicted that not only would corporate excess cash not go toward such core economic recovery “uses of funds” as CapEx, not only for the simple reason that there was, and is, no actual recovery, but that in order to create the artificial impression of improving conditions, as well as the satisfy activist investors seeking a quick ROI, companies would spend the bulk of their cash on stock buybacks and dividends. Gradually, this cash use is shifting to M&A – a classic ‘top of the cycle’ indicator – although courtesy of the unprecedented bubble in various sectors, tech most notably, corporations are opting to chiefly use overvalued stock as the currency of acquisition (see the recent purchase of Whatsapp by Facebook, funded mostly through FB stock) instead of cash.

The Euro’s head fake may be over.

The Euro broke out of its consolidation, but has heavy Cycle Top resistance overhead. The inability to make a new high indicates this may be a bearish head fake.

(Bloomberg) Ukrainian parliament Speaker Oleksandr Turchynov, handed presidential powers as lawmakers prepare to form a coalition government, warned that the economy was in a “pre-default situation.”

Lawmakers in Kiev worked on reshaping government after ousting Viktor Yanukovych from the presidency for a role in the violence that killed at least 82 people last week. The U.S. and the European Union pledged aid for a new cabinet. Border guards stopped Yanukovych at an airport in the eastern city of Donetsk two days ago. He wasn’t detained.

The Yen closed beneath Intermediate-term resistance.

The Yen slipped beneath weekly Intermediate-term resistance at 97.67, closing beneath it for the first time in two weeks. Further decline is anticipated by the Cycles Model. The next break of the Head & Shoulders neckline may bring the Yen beneath its 2008 lows.

(Bloomberg) The yen — which weakened last week against eight of 16 major counterparts tracked by Bloomberg — was little changed at 102.49 per dollar following a 0.7 percent decline last week, the steepest weekly drop in 2014. Ending deflation in Japan will benefit the global economy, central bank Governor Haruhiko Kuroda said at the G-20 in Sydney.

U.S. Dollar is edging up to the Triangle trendline.

The dollar declined even more this week before edging up to its Triangle trendline at 80.40 by Friday. The expected Master Cycle low arrived on Tuesday. A reversal above the trendline reinstates the bullish view on the Dollar. The dollar shorts may have to deal with the reversal in the coming week.

(Reuters) – Asian stocks wobbled and the dollar firmed in early trade on Monday, as investors appeared to give no more than a passing nod to the Group of 20’s latest commitment to spur faster global growth.

The dollar edged up against a basket of currencies after posting its first weekly gain in three weeks. The dollar index rose to 80.254, moving away from last week’s low of 79.927 touched on Wednesday, which was its lowest since late last year

Treasuries stall above the Broadening Wedge.

Treasuries stalled above Broadening Wedge trendline and weekly Intermediate-term support at 130.79. The Cycles Model suggests a renewed decline into the end of February or early March.

(WSJ) Treasury prices fell Thursday for a second-straight session as investors brushed off another round of disappointing U.S. economic data and focused on the Federal Reserve’s push to reduce monetary stimulus.

Benchmark 10-year notes fell 4/32 in price to yield 2.75%, according to Tradeweb. The 30-year bond lost 9/32 to yield 3.723%. Two-year notes edged down a fraction to yield 0.322%. Bond yields rise when prices fall.

Gold holds above Long-term resistance.

Gold stayed above Long-Term resistance at 1310.19 but began to falter after making a 58.4% retracement of the prior decline on Tuesday. The Cycles Model calls for a month-long decline that may break through the Lip of a Cup with Handle formation. The potential consequences appear to be severe. See the article below to gauge the sentiment of the press.

(ZeroHedge) As China News reports, in a gold shop in Taiyuan, Shanxi Province, a “tyrant female” (Google Translate must have loved that one) bought more than 880 grams of gold jewelry. Lunch boxes were used to weigh the gold and it left other shoppers speechless with admiration.

Crude completes a 56% retracement.

Crude peaked on Wednesday, closing lower, but with a gain for the week. It had managed to complete a 56% retracement of its decline from 112.24 and now may be ready for a swift decline. There is a Head & Shoulders formation at the base of this rally, which, if pierced, may lead to a much deeper decline.

(WSJ) Crude oil from North Dakota’s Bakken Shale formation contains several times the combustible gases as oil from elsewhere, a Wall Street Journal analysis found, raising new questions about the safety of shipping such crude by rail across the U.S.

Federal investigators are trying to determine whether such vapors are responsible for recent extraordinary explosions of oil-filled railcars, including one that killed several dozen people in Canada last summer.

China stocks challenge mid-Cycle resistance.

The bounce from the January 20 low made a final probe to weekly mid-Cycle resistance on Thursday, but couldn’t hold above weekly Long-term resistance at 2126.83 by the close of the week. The secular decline may now resume with the next significant low in mid-March. There is no support beneath its Cycle Bottom at 1949.25.

(ZeroHedge) As we warned last week, stockpiles of iron-ore have reached record levels in China as end-demand slumps but, as Bloomberg notes, this is potentially creating massive dislocations in other markets. Record imports of iron ore and copper, driven by traders who use them as loan collateral, risk repeating the vicious cycle of repayment difficulties and falling prices already seen in the steel-trading market. A stunning 40 percent of the iron ore at China’s ports are part of finance deals(having replaced copper after China’s last shadow-banking crackdown) and with the glut, prices drop (driving down the value of collateral on loans) and “borrowers, forced by their bankers to repay loans or to top up collateral, will have to sell the metals, sinking market prices even further and begetting a vicious cycle.”

The India Nifty bounces to Intermediate-term resistance.

The CNX Nifty bounced from its Long-term support to challenge Intermediate-term resistance at 6174.09. The challenge may not be over, but once the reversal occurs, the potential loss of Long-term support could be deadly for India stocks. The Cycles Model calls for a decline through mid-May. Could there be some economic disappointments ahead?

(TimesofIndia) Categorically denying the possibility of a military coup in India, defence minister A K Antony said on Sunday he had full faith in the armed forces and assured they would follow instructions given by the civilian government in policy matters.

“I have been in constant touch not only with top officials in the army, navy and air force but also with the jawans and those guarding our borders,” Antony said after presenting awards to coast guard personnel at a ceremony. “I have full faith in the military forces. There isn’t even the remotest chance of a military coup in the country.”

Trouble brewing?

The Banking Index is struggling beneath its trendline.

BKX attempted a challenge of weekly Short-term resistance and trading channel trendline at 68.87, but failed to close above it for a third week. The uptrend line is broken and, more importantly, stands as a resistance to any further rally. The Cycles Model suggests a new low may be seen in the next two weeks. Might there be a flash crash?

(TheEconomist) The economics of international banking are straightforward enough: raise funds in countries where they are cheap, lend where they are dear. Done right, this is both lucrative for bankers and good for the world, by channelling savings to their most productive use. Those economics have begun to come apart over the past five years, battered first by the excesses of profit-seeking bankers and now by regulators. On February 18th the Federal Reserve Board voted to “ring-fence” foreign banks’ American operations, forcing them to meet the same standards for capital and liquidity as American banks, rather than allowing them to rely on their parents’ buffers.

(Bloomberg) Royal Bank of Scotland Group Plc Chief Executive Officer Ross McEwan moved to reassure employees that there will be “no big announcement” on job cuts when the lender publishes the results of its strategic review next week. “This type of thing is frustrating and unsettling,” McEwan, 56, wrote in a memo to employees today. “This has been building over recent weeks and months and was always to be expected ahead of our strategy update.”

(ZeroHedge) Six months ago a “glitch” halted all ATM withdrawals, and Credit and Debit card transactions for Russia’s largest bank but today, the CEO of the huge bank has no such “glitch” to blame:

*SBERBANK SEES RUN ON ITS BANK MACHINES IN UKRAINE, GREF SAYS

*UKRAINE SITUATION IS PRESSURING RUBLE: SBERBANK CEO GREF

*SBERBANK HALTS LENDING IN UKRAINE, GREF SAYS

We suspect that whether an agreement is in place or not, this will continue.

(ZeroHedge) While, for now, depositors at Austria’s Hypo-Alde-Adria-Bank (nationalized in 2009) have not had assets confiscated, Austrian authorities are shifting in an unusual (scary precedent-setting) direction. Amid the resignation of the bank’s CEO, the government is taking aim at ‘speculators’ who dared to buy the bank’s bonds below par – and made money therefore on the back of the taxpayer. “What financial markets expect is not always what you want politically,” Austria’s finance minister warned, “if someone buys today at a lower price, saying ‘shortly, I’ll get 100 back,’ that’s what’s agitating the people. “It seems Europe has a new template.

Have a great week!

Anthony M. Cherniawski

The Practical Investor, LLC

P.O. Box 129, Holt, MI 48842

www.thepracticalinvestor.com

Office: (517) 699.1554

Fax: (517) 699.1558

Disclaimer: Nothing in this email should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of certain indexes or their proxies using a proprietary model. At no time shall a reader be justified in inferring that personal investment advice is intended. Investing carries certain risks of losses and leveraged products and futures may be especially volatile. Information provided by TPI is expressed in good faith, but is not guaranteed. A perfect market service does not exist. Long-term success in the market demands recognition that error and uncertainty are a part of any effort to assess the probable outcome of any given investment. Please consult your financial advisor to explain all risks before making any investment decision. It is not possible to invest in any index.

The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Japanese Candlesticks Analysis 24.02.2014 (EUR/USD, USD/JPY)

Article By RoboForex.com

Analysis for February 24th, 2014

EUR USD, “Euro vs US Dollar”

H4 chart of EUR USD shows bullish tendency within ascending trend. Upper Window is resistance level. Three Line Break chart indicates descending correction; Heiken Ashi candlesticks confirm ascending trend.

H1 chart of EUR USD also shows bullish tendency. Lower Window is support level, upper Window is resistance one. Three Line Break chart and Heiken Ashi candlesticks confirm ascending movement.

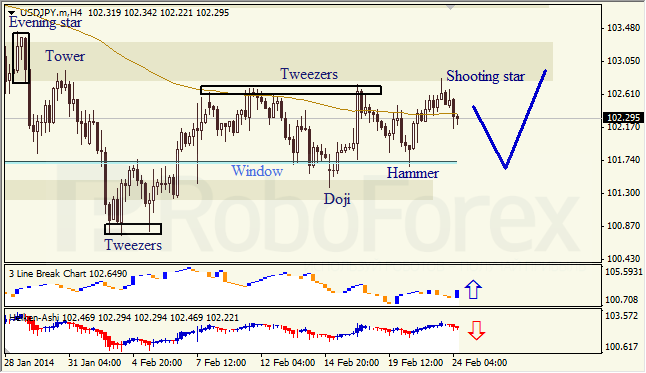

USD JPY, “US Dollar vs Japanese Yen”

H4 chart of USD JPY shows sideways correction. Closest Window is support level. Three Line Break chart indicates correction; Shooting Star pattern and Heiken Ashi candlesticks confirm descending movement.

H1 chart of USD JPY shows bearish tendency. Upper Window is resistance level. Hammer pattern indicates bullish pullback; Three Line Break chart and Heiken Ashi candlesticks confirm descending movement.

RoboForex Analytical Department

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

The End of the Middle Class

The news that Toyota would quit making cars in Australia by 2017 sparked a big debate in the Port Phillip Publishing office. The subject? Can you have a middle class without a manufacturing sector?

On the surface, Australia’s economy is already dominated by services, with 75% of jobs being in service related industries. The era of lifelong employment in skilled manufacturing has been over for many years. But will that lead to lower standards of living for Australians? Or will the country be better off moving into lower-volume but higher-knowledge manufacturing jobs?

How you answer this question may come down to whether you believe countries have, or should have, such a thing as ‘national interest’ these days. From a consumer perspective, it certainly doesn’t matter if cars are made here. People can get what they want from just about anywhere.

But the current global system – a diversified global supply chain, ‘just in time’ logistics, cheap energy and large shipping containers – is still fairly new, and perhaps not all that robust when disagreements between countries escalate.

Put another way, do you want to be dependent for key technologies or items on open and free markets? After all, very few governments really believe in or practice free trade. Everyone protects their own, whether it’s for employment reasons or because they view key technologies as something that should not be trusted to foreigners.

Economically, once Toyota goes, Australia will be the only G-20 country without a domestic auto making sector. But so what? In the 21st century, do you need an industrial base to have a healthy economy? Maybe not.

However, history shows that the manufacturing sector played a big role in getting a lot of people into the middle class. It was skilled labour that employed millions of people in Britain and the United States. Per capita incomes grew. GDP grew. Wages grew in real terms. The tax base grew too. That was the golden age and the peak for the US in the 1950s and 1960s, when General Motors ruled the world.

The shift to a ‘service based’ economy is widely touted as both inevitable and beneficial. But is it? If you don’t have the accumulated knowledge and capital to manufacture things – and how can you make them competitively, in mass quantities, with globalised labour? – then there’s no doubt it changes the nature of your domestic job market.

In the US, the withering of manufacturing has meant more part time work, at lower real wages, for more people. And arguably, it’s also meant less satisfying work for people, less meaningful work they could be proud of and raise a family on. After all, no one ever grew up wanting to stock women’s underwear at Wal-Mart. You’ve also seen a structural decline in the labour force participation rate, with fewer people looking for work and more people dropping out of the workplace altogether and going on the dole.

With fake free trade, prices are lower for manufactured goods, but wages have to go down too. What do you think that means for quality of life? You have access to credit to buy cheaper goods and services. But your real wages decline and so too does the satisfaction you take from the work you do. Does that sound like a good deal? A fair trade?

Smaller city states (like Singapore) and nation states (like Switzerland) are in a much better position to de-industrialise or specialise in what they make (desalination technology in Singapore, watches in Switzerland, for example). But it doesn’t always work out for the best.

Look at how finance and the City dominates the economy of the UK. The middle class gets wiped out. Property prices in the big cities soar. You have very, very rich people…and then pretty much everyone else.

The same thing is going on in America, although it’s been somewhat tempered by the shale gas boom, where cheap energy has lured some kinds of manufacturing back to American shores. But as the economy shifts to services for the masses and finance for the elites, how many people can become bond traders and real estate agents in a country of 300 million people?

And what kind of economy is it when everyone makes money selling houses to each other that they purchase with increasingly large amounts of borrowed money?

This is why the micro-manufacturing or ‘makers’ revolution in 3D printing that Sam and Kris have researched is such an important idea. It’s a massive change in scale for the economy, from large and centralised to individual and decentralised. Yet it’s still based on the idea that you have to produce something that someone else values to generate an income (whether it matters to you is only half the battle…if you can’t exchange it, there’s no transaction).

In the 20th century, mass-market manufacturing went hand-in-hand with the creation of a healthy middle class. In the Western world, the middle class is under pressure from lower labour costs in the emerging markets and financial repression from Wall Street and Washington elites. The technology revolution can’t come soon enough because the war is already here…and it’s on you.

Dan Denning+,

Editor, The Denning Report

Ed note: The above article is an edited extract from Scoops Lane, the free twice a week email sent to all subscribers of any paid Port Phillip Publishing product.

Where the Aussie Stock Market Could be in 2018

The market never rises or falls in a straight line.

The first seven weeks of this year have shown that.

From the start of the year until today the S&P/ASX 200 is up 1.6%. The supposedly terrible resource sector, as measured by the S&P/ASX 300 Metals & Mining index, is up 5%.

In fact, since 6 February, both indices are up 7.3% and 10.8% respectively.

That makes a mockery of those who say it’s impossible to make money in this market. That’s rubbish.

Proof of that is the 33% price rise over the past two weeks of a stock most of the mainstream had given up for dead. And yet the Australian Small-Cap Investigator readers who followed our advice 15 months ago should now be sitting on 109% gains…

Over the past eight months we’ve made a lot of noise about our view that the Aussie market is heading higher.

You may remember that last July we put our neck on the line to say the Aussie market could reach 7,000 points by the end of 2013.

It was a big call. It was also the wrong call. The main Aussie index didn’t hit 7,000 points by the end of the year. In fact, it got nowhere near it. The S&P/ASX 200 finished the year at 5,352. That’s almost a whopping 1,700 points short of our target.

And yet in a way, missing the target by such a wide margin didn’t matter. What was more important was that we got the direction right, and for the most part we got the investments right.

But as we’ve explained before, investing is all about looking ahead. The past means nothing. Now, everything we see in the market tells us to forget about the idea of the market hitting 7,000 points.

There’s a much bigger target to aim for…

When a Bearish Investor Bought Stocks

Our favourite example of making a big call, getting the timing wrong, but still making a bucket load of cash for his clients is Paul Tudor Jones.

You may not have heard of him. He was a big figure on Wall Street in the 1980s.

In 1985 he made a big call saying that the stock market would hit a top and then crash…in 1988. He was sure it would happen. But Paul Tudor Jones wasn’t like most bearish analysts who planned to wait for the crash and then buy stocks cheap.

Because he was so confident about his analysis, he played the expected crash a different way. Instead of sitting on the sidelines in cash, he also believed that the market would keep climbing from 1985 until 1988. So, what do you think he did?

That’s right, he took huge positions in the market, betting that until the crash happened he could clean up as the market continued to rise.

And that’s exactly what happened.

Of course, the market didn’t crash in 1988. The market crashed in 1987. But by then Paul Tudor Jones had reassessed his outlook along the way. So that by the time ‘Black Monday’ hit in October 1987, Jones had set his funds to benefit as the market took one heck of a beating.

Can you afford NOT to be in Stocks?

Now, don’t get us wrong. Your humble newsletter writer and stock market analyst isn’t about to claim we deserve to rub shoulders with the likes of Paul Tudor Jones, George Soros or Jim Rogers.

But what we are saying is that we take the same view of today’s market that Jones took of the market in 1985.

We get it that there’s a whole bunch of trouble brewing. We get it that the actions taken after the 2008 market crash have simply sowed the seeds of the next crash.

We get that. You probably get that too.

The thing is, do you want to just keep all your money in cash waiting for a crash that may not happen for another two years? What if it takes even longer for a crash to happen? What if it doesn’t happen for five, 10 or 15 years?

Can you afford to be out of the market for that long?

If we’re right about where the market is heading over the next four or five years then the answer will be a resounding ‘No’.

Because based on the scenario we believe will play out, the Aussie stock market is heading in a direction that could see it hit 15,000 points by 2018.

‘Dead’ Stock More Than Doubles

Of course, you could rightly wonder why you should believe us. After all, we’ve just told you that our 2013 year-end target for the Aussie market fell woefully short – nearly 1,700 points short to be precise.

But that’s actually our point. In a way the target number is arbitrary. But it’s symbolic of where the market could go if the global economy heads where we expect.

That means a continuation of outstanding growth in China’s economy, at least the appearance of a recovery in the US and Europe, an Australian economy that recovers after perhaps going into a recession for the first time in 22 years, and ongoing demand for Australia’s natural resources.

Remember what we said to you just three weeks ago:

‘When we read everywhere about the death of resource stocks, it tells us one thing – you better get ready for one heck of a resource stock rally…‘

Since then the resource stock index has climbed 10.8%. And that could be just the beginning. Not just for the resource sector, but for the entire Aussie market. An ‘old media’ stock we tipped in November 2012, when most other investors had given it up for dead, is now up 121.7%. 33% of that gain has come in the past month.

If this all plays out as we expect there are big rewards ahead, especially for the type of stock that tends to perform best when stock markets rally.

Bottom line: whatever your circumstance, no investor can afford to miss out on this rally.

Cheers,

Kris+

PS: You can quiz me on my bullish stock market views in person at the upcoming World War D conference in Melbourne at the end of next month. I’ll be on the stage with global finance gurus Dr Marc Faber, Jim Rickards, and Satyajit Das. You can find out more here about what I consider to be the best money and finance conference in Australia this year. Click here for the revealing trailer…

Special Report: Retirement Security Ladder

EURUSD remains in uptrend from 1.3477

EURUSD remains in uptrend from 1.3477, the fall from 1.3773 could be treated as consolidation of the uptrend. Initial support is at the bottom of the price channel on 4-hour chart, and the key support is at 1.3686, as long at this level holds, the uptrend could be expected to continue, and next target would be at 1.3850 area. On the downside, a breakdown below 1.3686 support will indicate that the uptrend from 1.3477 had completed at 1.3773 already, then the following downward movement could bring price back to 1.3400 zone.

Provided by ForexCycle.com

NZD/USD Forecast February 24 – 28

Article by Investazor.com

The kiwi had a rough week after the macroeconomic data from New Zeeland was pretty weak with all three publications being below expectations. The highlights of the week were the retail sales, which fall short of the forecasted value with an increase of just 1.2% in comparison with 1.7%, which was the expected value. The downside of NZDUSD was magnified by the data from the American economy that even was kind of weak, the Flash Manufacturing PMI came way better than the expectations. Overall, NZDUSD declined on a weekly basis and retreated below 0.8300.

Economic Calendar

Inflation Expectations q/q (9:00 GTM)-Monday. A medium impact indicator which measures the percentage that business managers expect the price of goods and services to change annually during the next 2 years. It is important because expectations of future inflation can manifest into real inflation and workers tend to push for higher wages when they think prices will rise.

The post NZD/USD Forecast February 24 – 28 appeared first on investazor.com.