By HY Markets Forex Blog

The 18-nation euro was seen dropping as the Spanish economy weakened in the last quarter of 2013, reports from the National Institute of Statistics confirmed.

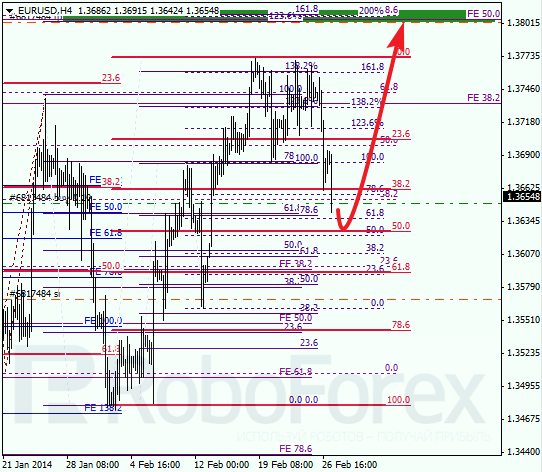

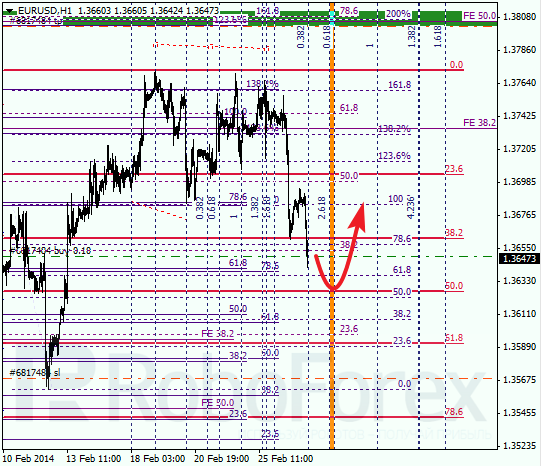

The euro declined by 0.23% at $1.3653, while Spain’s gross domestic product (GDP) report, lost approximately 30 pips.

The euro traded flat at £0.8207 against the British Pound, while against the Japanese yen, the euro eased 0.28% to ¥139.63.

Euro – Spain GDP

The Spanish economy expanded by 0.2% in the last quarter of 2013, compared to the rise of 0.5% seen in the previous three months and meeting in line with analysts’ forecasts, reports from the National Institute of Statistics confirmed on Thursday.

Spain’s gross domestic product (GDP) remained weak at an annual basis, dropping 0.2% in the fourth quarter.

However, the European Commission forecasted the Spanish economy would expand by 0.5% this year, while Spain’s Prime Minister Rajoy said the country’s economy is expected to rise more than the official estimates for this year.

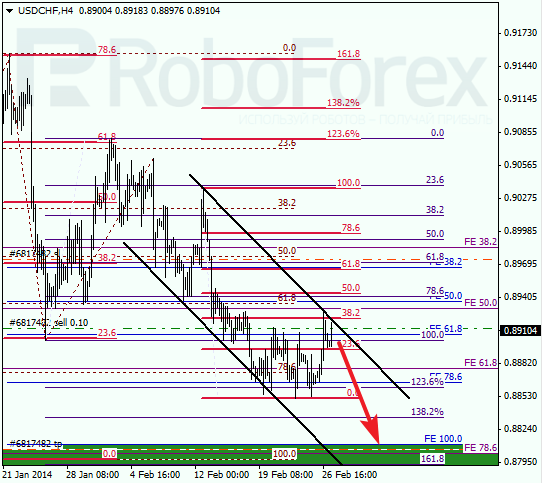

Germany’s Data

Meanwhile in Germany, the country’s labour figures outpaced analysts forecasts as the number of unemployed in Germany dropped by 14,000 on a seasonally adjusted basis, reports from Destatis confirmed. Germany’s unemployment rate came in unchanged at 6.8%.

Additional releases such as Germany’s inflation data are due later, which analysts are expecting to see a quickened pace of 0.6% month-on-month, compared to the slowdown seen in January.

“German CPI print will provide an indication of what to expect for tomorrow’s euro zone aggregate print. A weak inflation number today will no doubt raise market concerns of potential ECB action next week,” Lloyds Bank wrote in its research note.

Yellen Testimony in Focus

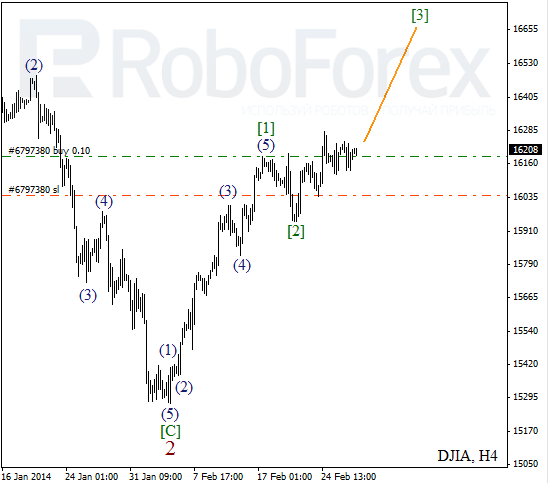

Meanwhile traders are focusing on the new Federal Reserve (Fed) Chair Janet Yellen to deliver her testimony on monetary policy before the Senate Banking Committee as part of the Fed’s semi-annual policy report known as Humphrey Hawkins. The testimony is due later in the day.

The US Federal Reserve reduced its monthly bond purchases by $10 billion at each of its two meetings, leaving its monthly stimulus at $65 billion. The yellow metal surged 70% from December 2008 to June 2011 as the central bank added over $4 trillion into the financial system to boost growth.

Visit www.hymarkets.com to find out more about our products and start trading today with only $50 using the latest trading technology today

The post Euro Trades Lower on Spain GDP appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog