By CentralBankNews.info

Following is an updated version of Central Bank News’ calendar of meetings by central bank committees that decide monetary policy. In the event that committee meetings take place over several days, the date listed below is for the final day when decisions are normally announced. The calendar is updated when new information becomes available.

The latest version of the calendar can always be accessed by clicking on this link.

Gold Prices Advances before US Labour Data

Futures for gold were seen climbing on the last day of the trading week before data for US job data including non-farm payrolls and unemployment rate figures. The data is expected to be released later in the day. The yellow metal is rising towards its sixth weekly gain.

Bullion for March delivery rose 0.37% trading at $1,261.80 an ounce as of the time of writing, while silver futures fell 0.19% lower to $19.89 an ounce at the same time.

Meanwhile in China, the HSBC services Purchasing Managers’ Index (PMI) dropped to 50.7 in January, compared to the previous reading of 50.9 in December. China probably overtook India as the world’s largest consumer of gold in 2013.

On Thursday, holdings in the world’s largest exchange trade fund, SPDR; came in at 797.05 tones. The dollar index which measures the strength of the greenback against a basket of six of its major peers fell by 0.01% to 80.897 points at the time of writing.

Gold – US Employment Data

The jobless claims in the US dropped by 20,000 to 331,000 in the week ending February, compared to the revised figures of 351,000 seen in the previous week, reports from the Labour Department confirmed.

The nonfarm payrolls data which is expected to be released later during the day is forecasted to show 180,000 new jobs added in the US in January according to analysts, after a 74,000 gain was seen in the previous month.

The US unemployment rate is forecasted to remain unchanged at 6.7% in January.

The US trade balance came in at a deficit of $38.7 billion for December, compared to the previous figures of $34.6 billion deficit in the previous month, data from the US Census Bureau confirmed.

Visit www.hymarkets.com to find out more about our products and start trading today with only $50 using the latest trading technology today.

The post Gold Prices Advances before US Labour Data appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog

Crude Oil Seen Trading Mixed Ahead of US Employment Data

Crude Prices were seen trading slightly mixed on Friday as analysts awaits US jobs reports later in the day.

WTI for March delivery came in 0.15% lower trading at $97.70 per barrel on the New York Mercantile Exchange at the time of writing, at the same time Brent for March settlement gained 0.18% to $107.39 a barrel on the London-based ICE Futures Europe exchange. Brent crude was at a premium of $9.69 to the North American crude.

Crude – US Employment Data

The jobless claims in the US dropped by 20,000 to 331,000 in the week ending February, compared to the revised figures of 351,000 seen in the previous week, reports from the Labour Department confirmed.

The nonfarm payrolls data which is expected to be released later during the day is forecasted to show 180,000 new jobs added in the US in January according to analysts, after a 74,000 gain was seen in the previous month.

Crude – Libya

Libya’s production has ranged from 450,000 to 500,000 barrels per day; however the production is still below the previous figures of 600,000 barrels seen last week, according to Nuri Berruien, chairman of National Oil Corp.

Libya is a member of the Organization of Petroleum Exporting Countries and holds the largest crude reserves in Africa.

Other News

Meanwhile in China, the HSBC services Purchasing Managers’ Index (PMI) dropped to 50.7 in January, compared to the previous reading of 50.9 in December.

In Australia, the Reserve Bank of Australia (RBA) released its quarterly statement on Monetary Policy. The bank revised its gross domestic product (GDP) forecast for the year till June 2014 from 2.5% to 2.75% in the last monetary policy statement. While forecasts for the year ending December 2014, the gross domestic product (GDP) is forecasted to rise between 2.25% and 3.25%.

According to the EIA, refineries operated at 86.1% of their capacity in the week ending January 31, the lowest since October.

Distillate inventories, including heating oil and diesel declined for a fourth week in the week ended January 31, data from the Energy Information Administration (EIA).

Visit www.hymarkets.com to find out more about our products and start trading today with only $50 using the latest trading technology today.

The post Crude Oil Seen Trading Mixed Ahead of US Employment Data appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog

Debt: The Last Social Taboo?

Guest Post By Dennis Miller – Debt: The Last Social Taboo?

Social taboos have dropped left and right since I was a young man raising a family, but one is unlikely to disappear any time soon: holding too much personal debt. But debt need not be a personal tragedy nor a badge of shame. For some, it is simply a practical problem with practical solutions. For others, however, it isn’t even the real problem.

In the last few year I’ve watched two friends handle debt quite differently, and those differences illustrate the real taboo about debt that we seem to ignore. I’ve changed names and tweaked a few details to keep peace in the world, but what follows are essentially two true stories: those of Joe Able and Tom Baker.

Both Joe and Tom are early baby boomers. During their careers, both had the external trappings of success: nice homes, luxury cars, and a good amount of other cool stuff. They earned good incomes and paid a lot in taxes along the way. They moved into their peak earning years during the Internet boom, and both of their companies flourished.

Nevertheless, neither Joe nor Tom amassed much wealth. Instead, they financed signs of wealth. Their justification: they made enough money to easily afford the payments. Neither Joe nor Tom had a problem with this approach.

In short, both enjoyed playing the role of big shot.

Well, the economy turned and their incomes were cut. Joe eventually realized he would never be able to retire because he had accumulated, well, basically nothing. This must have been terribly difficult for him.

Joe had to fess up to his spouse and family that he may have been “rich dad” for a decade or so, but things were going to have to change radically. Otherwise, he would become “poor dad.”

Joe’s wife had become quite comfortable with her life of luxury, so together they sought professional advice from his accountant and a qualified financial planner. Together they built a plan to get out of debt and accumulate some real capital. This was the only way they could ever enjoy retirement. Perhaps it would be more modest than they’d once envisioned, but that was OK.

To borrow Joe’s words, “I decided to stop the world. I wanted to get off!” He described it as a never-ending treadmill: work hard; make a lot of money; pay off bills; buy more cool and expensive stuff; repeat, repeat, repeat. So they built a plan and refocused. Joe and his wife worked together and are quite happy today.

Tom took a different road. He, too, realized his lifestyle was unsustainable. Family and professionals convened in an effort to help Tom see reality. They encouraged him to change his behavior.

Tom discussed his mounting debts and reduction in income very rationally, but he was unable to change his behavior.

As I looked at these two men, I noticed differences. Joe lived in a large city. Tom lived in the small town where he grew up. Joe was the proverbial little fish in a big pond; Tom was the big fish in a small pond. Everyone in town knew Tom as the kid who grew up and obviously really made something of himself.

What the public did not see was this. Tom’s business had a line of credit with the bank and was a good business. Unfortunately Tom maxed out his company’s line of credit and used the money for personal spending. The particular business is capital intensive and his company began to suffer. Now he had to make huge payments to the bank for fear his company would shut down.

Eventually the banks were breathing down his neck. Tom had no leverage and gave the bank whatever they needed to keep the line of credit.

Sad to say, his friends told me he became very depressed. They called him the poster child for depression spending. He had several credit cards and bought designer clothes and new toys to make himself feel good. His children said their dad had a spending addiction.

About a year ago, Tom filed for personal bankruptcy. Of course, that notification hit the local paper in the little town he lived in. Six months later, Tom had a heart attack and died in his sleep. He was not yet 65, and appeared to be in good physical health.

For many, debt is not the real problem, but rather a symptom of a much larger problem: an addiction to a self-image and a way of life. Until you address the real problem, you cannot solve the symptom—debt.

While I am not a psychiatrist, I can pick out common traits from among those who walked the walk—retired friends who have accumulated wealth and enjoy retirement on their own terms. Perhaps it is not as lavish as they once hoped, but they enjoy the absolute freedom of being debt- and stress-free. Here are some tips I have learned along the way.

- Start with a financial checkup. I have written many times about the epiphany many of us experienced when we first sat down with a financial advisor to look at our fuzzy retirement goals. It can be just the dose of reality needed to change our behavior.

- Set real, measurable financial goals. As we get closer to retirement, it is no longer some vague event that we hope will happen in a decade or so. Set firm, measurable short- and long-term financial goals.

- Build a workable plan. Achieving those milestones along the way is exhilarating—almost like a preview of what being debt-free is all about. If you just keep doing what you are doing and stick to your plan, you will make it.

- Both spouses have to be totally committed. This was another major difference I saw between Joe and Tom. Joe’s wife was a country girl whose real values in life are family and friends. Tom did not have that kind of support. He had remarried a younger woman who thought she was marrying a big shot. I guess she just married him “for better” because, when it became evident their lifestyle was an illusion, she left him.

- Realize you are not alone. As a member of Lending Club, every day I see hundreds of loan applications from people with great incomes who want to consolidate and get out of debt. It sounds funny borrowing money to get out of debt, but they want to consolidate and reduce their interest rates, which is part of the process. Many of these people are doctors and lawyers making huge amounts of money. Not only do they need to make the payments to reduce their debt; they also have to curtail their spending at the same time, something Tom was emotionally unable to do.Since 2008, when the interest rates on CDs and fixed income securities dropped to the point of not keeping up with true inflation, even folks who have managed to accumulate some wealth have had to make some tough choices when it comes to priorities. We have many friends who have owned a lot of luxury cars who are quite proud to drive up in their new Toyota and discuss how much they saved along the way.

- There is no shame in adjusting your lifestyle to the current environment. Simply put, you have to do what you have to do! While it may have been nice to feel rich during the boom times, adjusting your lifestyle and spending patterns to avoid being poor is not shameful; quite the contrary, it is prudent. Many couples tell us how they worked together and the process made their marriage even stronger. Shame? No way! Pride is much more accurate.

Once your goal is true, stress-free financial independence, it is worth giving up a lot of stuff. Unfortunately for Tom, he was such an addict he could never make the transition. Joe and his wife are happy, surrounded by loving family, and enjoy seeing their next generation grow and mature.

Being debt-free is a major step. You are halfway home. The next step is accumulating wealth. Instead of making payments to creditors, now you can start making those payments to yourself and prepare for the future.

There are many ways to avoid Tom’s fate if you get started right away. We’ve prepared a free special report that will help you take a critical look at your personal budget and categorize it to make it easier to cut out unnecessary expenses. It also provides some insight into ways to get started on improving the income side of your ledger. Click here to access this free report and get started on your path to more savings and income today.

Fibonacci Retracements Analysis 07.02.2014 (EUR/USD, USD/CHF)

Article By RoboForex.com

Analysis for February 7th, 2014

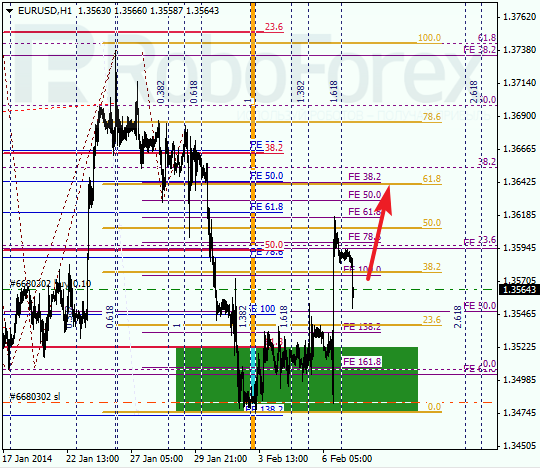

EUR USD, “Euro vs US Dollar”

Euro rebounded from level of 61.8% and started growing up. During local correction, I opened buy order with stop at local minimum. Possibly, market may reach new maximum until the end of this trading week.

At H1 chart we can see, that price reached level of 50% and started new correction. In the future, pair is expected to start new ascending movement towards level of 61.8%. If later market breaks it, pair will continue growing up.

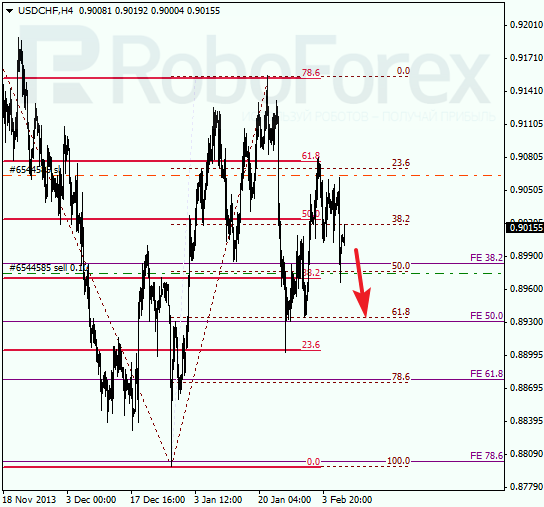

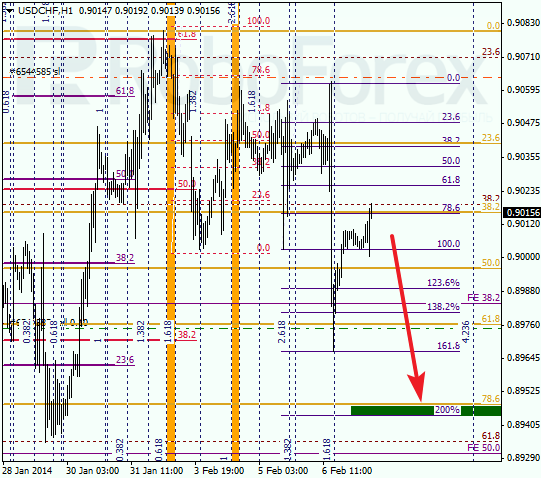

USD CHF, “US Dollar vs Swiss Franc”

Franc also fell down a bit, and I decided to move stop on my sell order closer to local maximum. During the next several days, market may continue falling down.

At H1 chart, pair rebounded from level of 78.6% twice and started falling down. After completing local correction, price is expected to move towards its intermediate target at level of 0.8950. If pair breaks it, market may continue moving downwards even faster.

RoboForex Analytical Department

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Forex Technical Analysis 07.02.2014 (EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, GOLD)

Article By RoboForex.com

Analysis for February 7th, 2014

EUR USD, “Euro vs US Dollar”

Euro broke its consolidation channel upwards and right now continues growing up. We think, today price may reach level of 1.3650, form new correction towards 1.3600, and then move upwards again to reach level of 1.3660.

GBP USD, “Great Britain Pound vs US Dollar”

Pound also broke its consolidation channel upwards. We think, today price may form ascending structure towards level of 1.6385, fall down to reach 1.6344, and then and then continue growing up towards target at 1.6400.

USD CHF, “US Dollar vs Swiss Franc”

Franc broke its consolidation downwards and right now is falling down with target at 0.8940. We think, today pair reach this target and then return to level of 0.9000. Later, in our opinion, instrument may continue moving downwards to reach level of 0.8300.

USD JPY, “US Dollar vs Japanese Yen”

Yen broke its consolidation channel upwards and right now is growing up. We think, today price may reach level of 103.50 and then fall down towards level of 102.00. Later, in our opinion, instrument may start forming new ascending structure to reach level of 104.00.

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is still consolidating. We think, today price may fall down to reach level of 0.8908 and then grow up towards level of 0.9000. Later, in our opinion, instrument may start moving downwards to reach target at 0.8820.

XAU USD, “Gold vs US Dollar”

Gold is also consolidating. We think, today price may continue forming descending correction and reach level of 1240. Later, in our opinion, instrument may return to level of 1250 and then move downwards again to reach level of 1230.

RoboForex Analytical Department

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

GBPUSD: Continues To Hold Above The 1.6259 Level, Eyes More Upside.

GBPUSD: While GBP continues to hold above its horizontal at the 1.6259 level, further upside risk is envisaged. This leaves the pair threatening further upside towards the 1.6398 level as the next upside. Further out, resistance resides at the 1.6440 level, its Feb 03 2014 high where a breach will aim at the 1.6500 level. On the other hand, the risk to this analysis will be a return below the 1.6259 level. Support lies at the 1.6217 level, its Dec 17 2013 low. A cut through here will aim at the 1.6150 level. Further down, a breach will shift attention to the 1.6100 level and subsequently the 1.6050 level. On the whole, GBP continues to face bear threats though recovering.

Article by www.fxtechstrategy.com

Two Market Bubbles Finally Burst, Crush Shareholders

Why use lots of words when pictures will suffice?

That’s my thinking each Friday when I select a handful of graphics to put important economic and investing news into perspective for you.

This week, I’m serving up some pretty pictures and quick-hit observations on the most obvious bubble in the world – and why not one, but two data sets suggest that it’s (almost) time to back up the truck on stocks.

If You Heard a Popping Sound…

It’s because the 3-D printing bubble just burst.

After leading WSD Insiders to triple-digit profits (twice) in 3D Systems (DDD) – before anyone ever heard of the technology, mind you – I began warning about an imminent collapse in the space.

And it hit yesterday.

3D Systems, the biggest company in the sector, warned about future profits – sending the entire sector reeling. Get out while you can!

In other bubble-related news, social media darling, Twitter (TWTR), turned out to be a landmine. It tanked 20% on Thursday after reporting weaker-than-expected user growth.

Both serve as all-too-poignant reminders that we should always buy into out-of-this world fundamentals, not hype.

Only Three More Points to Go

On Tuesday, I put you on high alert for the release of this week’s American Association of Individual Investors’ (AAII) bullish sentiment reading. It’s out – and it’s down!

It fell another 4.3 points this week to hit 27.9%.

To think that only six weeks ago, bullish sentiment stood at a lofty 55.06%…

We’re now only 2.9 points away from the scary mathematical certainty I mentioned on Tuesday.

Remember, every time AAII bullish sentiment has dipped below 25% during this bull market, the S&P 500 Index went on to rally over the next six months.

Gas up the truck and get ready to back it up!

Seasonality Matters

Seasonal trading patterns also point to a contrarian buying opportunity right now.

As you can see, February is the second-worst month for the Dow. However, it’s essentially a flat month, which is followed by two of the most consistently profitable months of the year.

Chew on that before you panic and rush for the exits. You could be exiting right before the next leg higher. And I’d much rather you be counting profits, instead of nursing regret, a couple months from now.

That’s it for today. Before you go, though, let us know what you think of this weekly column – or any of our recent work at Wall Street Daily – by going here.

Ahead of the tape,

Louis Basenese

The post Two Market Bubbles Finally Burst, Crush Shareholders appeared first on Wall Street Daily.

Article By WallStreetDaily.com

Original Article: Two Market Bubbles Finally Burst, Crush Shareholders

Ram Selvaraju: A Pair of Companies Ride the Sea Change in Cancer Therapeutics

Source: George S. Mack of The Life Sciences Report (2/4/14)

A new generation of oncology treatments is moving through clinical trials toward the market. These proposed products are revolutionary in both their approaches to disease and their expected efficacy. Raghuram “Ram” Selvaraju, armed with his background as a drug developer, has followed dozens of highly innovative small- and mid-cap biotech companies, many of which he originally spotted as micro caps. In his second of three interviews with The Life Sciences Report, the head of equity healthcare research at Aegis Capital Corp. highlights two names with huge growth prospects.

The Life Sciences Report: Ram, let me start with a technical sector question, one that I am sure is on every investor’s mind. I’m noting that the New York Stock Exchange’s AMEX Biotechnology Index (BTK) is up more than 110% in the past two years (to Jan. 23). The NASDAQ Biotechnology Index (NBI) is up 127% in that same period. Have we seen the bulk of the move in the biotech sector? Or is it possible that, because we had such a long dry spell before this bull market began in late 2011, we could have a lot more upside left?

Ram Selvaraju: That’s a difficult question to answer quantitatively, because as much as I would like to think I have a crystal ball, I don’t. However, I can say that, based on the indicators that I look at—a combination of macroindicators as well as sector-specific indicators—the current situation is effectively 60–70% the former, meaning we have seen the bulk of the run-up in the biotech sector, and 30–40% the latter, meaning we did have a very substantial dry spell. We had a situation for nearly two years (2008–2009) where the initial public offering (IPO) window was completely shut. Consequently, we had a period of two to three years (2010–2012) during which only the most well-capitalized, well-funded, politically connected and diversified companies managed to go public.

If you look at historical valuations, the biotechnology sector has been defined purely by price:earnings multiples, or even price:sales multiples. You’ll see that the biotech sector, as compared to where it’s traded historically, doesn’t look particularly overvalued. I think that, while the bulk of the run-up is behind us, we could see another 20–30% appreciation across the board over the course of this year.

In addition, I believe the IPO window is going to remain open for biotech companies. But investors are going to continue to be discriminating. They are going to continue to select companies with diversified pipelines, companies that are at or near commercialization stage, companies that have capital-efficient approaches to drug development and companies targeting large margins that focus on a specialty sales model, where they can get revenue without having to spend a massive amount on selling, general and administrative expenses.

TLSR: You are primarily a small-cap analyst. But you follow some interesting mid-cap companies that you’ve tracked from their small-cap days. Do you like to recommend that investors ultimately trade mid caps in for new small caps, or do you recommend they stay with companies they have grown up with, where they understand the value drivers?

RS: When you have a high-quality company and you have a chance to get in on the ground floor, the important thing to remember is, don’t sell out too early. If it’s a great company, and you sell out before the company has the chance to grow up into the next Celgene Corp. (CELG:NASDAQ), you leave a lot of money on the table.

To the investor who’s discerning, who’s had good success with a particular name, and who has good visibility into what the future of the company is, I say hold on. That’s been my advice to investors putting their money into Acorda Therapeutics Inc. (ACOR:NASDAQ), and they’ve done extremely well. I started covering Acorda when it was $2/share. It’s $31/share today. It was also my advice to investors who put their money into Medivation Inc. (MDVN:NASDAQ). When I started coverage, Medivation was, on a split-adjusted basis, a $2.25 stock. It is an $85/share stock today.

I advise investors to take their gains at the appropriate time because, as you know, nothing lasts forever. In the biotech industry particularly, where companies fall in and out of favor, it is important to remember that when you see a healthy gain in a company’s stock price and you don’t see a long-term future for that company—or you see a future where that company could have its position supplanted by new-generation or next-generation technology—you should take profits. But, when you see an opportunity like the one that investors had with Celgene, you’d better recognize it and hope that you are fortunate enough to ride the train all the way to the top.

TLSR: Investors should look at the competitive landscape at all times and see what could supplant these existing therapies—is that what you’re saying?

RS: Essentially, investors must question the nature of the opportunity. They not only have to look at the competitive landscape, but they also have to look at the company’s drugs and understand what they are. Are they best in class? Do they have a sustainable competitive advantage? If the answer is yes, the drugs are likely to remain so for a significant period of time.

Also, you have to ask if a company is worth holding on to as it matures into a commercial entity, with multiple products on the market and a diversified revenue stream. Can it attain a level of sustainable profitability?

TLSR: Based on what you’ve just said, I’m guessing that you recommend growth investors keep a mix of mid-cap and small-cap stocks.

RS: Yes. I see no problem with an investor investing in a company when it’s still a micro-cap stock, and continuing to hold that stock even when it’s appreciated dramatically. I have lots of friends in the hedge fund industry who’ve owned a stock since it was a micro cap and now it represents 20%, 30%, maybe even 40% of their overall portfolio. But they don’t scale back because they believe the company has significant upside to come. They don’t believe that replacing their position with a position in another company is going to yield them the same growth with the same low-risk profile, multiple sources of revenue and sustainable profitability.

TLSR: The last time we spoke, in early December, you discussed the evolution of oncologic diagnostics, which has become an exciting industry in its new genomic configuration. It’s not humdrum diagnostics, as we once thought. Today, I’d like to hear you address new directions in oncologic therapeutics. What trends do you see in cancer therapeutics that could excite investors?

RS: We are at the cusp of a real sea change in oncology. New cancer therapies being brought to the forefront have the potential to offer substantially greater efficacy than anything we’ve seen in the past. We are seeing things emerge in cancer therapy that lead us to hope that, in all honesty, over the course of the next five to seven years, we could aspire to a cure for cancer. And if a cancer does return, and it’s more aggressive or metastatic than before, we could have new weapons to address those things.

There are four interesting areas that I’m following closely. I’m looking at the advent of targeted therapies, the advent of antibody-drug conjugates, the advent of cancer immunotherapy and—something that is new and really all that oncology researchers talk about these days—the advent of checkpoint inhibitors.

TLSR: Ram, briefly address the checkpoint inhibitors. It’s an interesting area because we know that tumor cells can mask themselves or hide from the immune system.

RS: We’ve already seen the advent of cancer immunotherapy, which is very important because oncology researchers have figured out, after years and years of research, that tumor cells have evolved ways to trick the immune system into thinking they are not even there. There are checkpoint pathway substances produced by tumor cells that act as brakes on the immune system, like the parking brake on a car. These substances allow tumor cells to fool immune cells into thinking that they shouldn’t be active. If immune cells are about to go on a rampage, killing all the cancer cells in their path, the cancer cells produce these substances to prevent the activation. A lot of research has gone into the development of molecules—mostly antibodies at this juncture—aimed at dealing with these checkpoint pathways.

One checkpoint target that has been widely featured at various oncology-focused clinical and scientific conferences is an antigen called PD-1, which is produced by cancer cells and effectively turns off immune cell activation. Several companies are developing antibodies against PD-1, including Merck & Co. Inc. (MRK:NYSE), with MK-3475 in non-small cell lung cancer (NSCLC) and other cancers, and Bristol-Myers Squibb Co. (BMY:NYSE) with nivolumab, also in NSCLC. Roche Holding AG (RHHBY:OTCQX)is also developing a checkpoint inhibitor, MPDL3280A, in NSCLC.

The idea is that administration of these antibodies can reactivate immune cells by taking the brake off, which then allows the car to roll forward. You’re able to get a robust activation signal against the cancer cells.

TLSR: Can we talk about some companies? Cancer stem cell therapy is a very hot idea right now. Can you start with that?

RS: You may have seen that Stemline Therapeutics Inc. (STML:NASDAQ) stock has appreciated substantially during January. This represents a reawakening to the fact that this company is the only cancer stem cell-focused company that actually has an abbreviated path to market approval with its lead drug SL-401 (recombinant human interleukin-3 coupled to a truncated diphtheria toxin payload that inhibits protein synthesis). You and I talked about this last July.

This drug is focused on a niche hematological malignancy called blastic plasmacytoid dendritic cell neoplasm (BPDCN), which affects a very small number of people and, as such, essentially qualifies as an ultraorphan disease. Therefore, SL-401 potentially qualifies for breakthrough therapy designation. An abbreviated pathway to approval could position the drug to be priced at a very premium level, meaning hundreds of thousands of dollars per year, just like other drugs currently available for other ultraorphan diseases.

In addition, Stemline Therapeutics, in late September of last year, disclosed that it had demonstrated the activity of SL-401 preclinically in chronic myelogenous leukemia (CML). This is the disease that Novartis AG’s (NVS:NYSE) Gleevec (imatinib mesylate), a receptor tyrosine kinase inhibitor, was originally developed to treat. Gleevec is currently a $4 billion ($4B)/year franchise scheduled to go off patent in 2015, but its substantial size as a commercial franchise clearly demonstrates what an important market opportunity CML is.

Because Stemline appears to have a drug that is active in CML and, more important, works as a single agent as well as synergistically with Gleevec—and a drug that demonstrates activity against CML cells that are resistant to currently available tyrosine kinase inhibitors—we think there’s substantially greater upside to the stock than investors imagine. The stock’s recent rebound is primarily due to investors reawakening to the fact that the company is well financed for the next two years and could, in fact, have a drug on the market next year for the niche ultraorphan BPDCN market.

We have a $70 price target on Stemline, which is the highest on the Street. We believe investors are undervaluing the company’s unique positioning and not giving it sufficient credit for what could potentially be a game-changing therapy in CML.

TLSR: You believe investors are undervaluing this stock because they are focused on the BPDCN indication, which only represents 2,000 patients each year, and don’t understand the potential for CML?

RS: I don’t believe any value is being ascribed to Stemline’s SL-401 in CML. Stemline doesn’t have an active clinical development program in CML as of yet, but we expect it to start one before the end of this year. The preclinical CML data were presented by a researcher from the MD Anderson Cancer Center at a very small conference in Portugal last year. No buysider (money manager or money manager analyst) that I know of attended that conference. The company did not get the attention it would have at the American Society of Clinical Oncology (ASCO) meeting, where everybody shows up and potential therapies become common knowledge in the biotech investment community.

TLSR: Even with its 56% increase in share value during January, I’m noting Stemline still only has a market cap of $400 million ($400M).

RS: Yes. But prior to this recent run-up, Stemline was the cheapest publicly traded cancer stem cell company in the market. We believe it ought to be the most highly valued of this group. ComparingOncoMed Pharmaceuticals Inc. (OMED:NASDAQ), Verastem Inc. (VSTM:NASDAQ) and Stemline Therapeutics, we think Stemline should have the highest valuation because it’s the closest to commercialization, and could come to market first with a drug commanding ultraorphan-level premium pricing.

TLSR: Ram, I find it interesting that SL-401 is thought to increase in efficacy with subsequent administrations. This is quite the opposite of what we see in most oncology therapeutics.

RS: That is absolutely correct. We’ve seen this before, in a related drug called Ontak (denileukin diftitox;Eisai Inc. [ESALF:OTCPK]), which was originally brought to market by Ligand Pharmaceuticals Inc. (LGND:NASDAQ). Ontak, like SL-401, demonstrated the ability to increase in efficacy as more cycles were administered. In addition the safety profile—its tolerability—improved as more cycles were administered. Because it’s an immunotherapy, the immune system of the cancer patient was essentially becoming more acute, more trained.

TLSR: Ram, in your notes you’ve made a point of describing SL-401 as a targeted therapy. Tell me about that.

RS: SL-401 is effectively delivering a toxic payload, in this case diphtheria toxin, specifically to the cancer cells. SL-401 contains the receptor-binding domain of interleukin-3 (IL-3), which homes to tumor cells andcancer stem cells that specifically express the interleukin-3 receptor (IL-3R) at high density on their cell surfaces. The cells internalize the diphtheria toxin, which kills the cells off.

SL-401 also activates the immune system against the cancer cells. In particular, if you administer this therapy in multiple cycles, it tolerizes the immune system to its presence just as Ontak did. The more cycles you administer, the lower the frequency of adverse events, including injection site reactions, as well as the higher the likelihood of getting a positive response on the cancer front. This is the best of both worlds.

TLSR: You talked about Medivation as a company you have followed from micro cap to mid cap. It has a product on the market, Xtandi (enzalutamide), which was approved for prostate cancer in August 2012. From what you’ve said today, you still like this company, right?

RS: Yes. I continue to like the company because it still has substantial upside from its current $6B market cap. You get the alpha (upside) without the beta (volatility or risk). We recently raised our price target from $100 to $125, and remain the most bullish on the Street regarding the company. Our research has consistently been ahead of the curve on this name, demonstrating our industry-leading knowledge base in the prostate cancer area.

Medivation is a risk-mitigated opportunity for investors. Although there is no such thing as a riskless investment, we think the risk profile of this company relative to its upside is very attractive. Xtandi is a leading drug for the treatment of prostate cancer, and it may also have applicability in breast cancer. I’ll invoke the following metric: If you look at the market sizes of these two cancer types, they are gigantic. Gigantic. There are millions and millions of people who suffer from prostate cancer and breast cancer. These are two of the largest markets you could have in oncology, and Medivation could potentially target both of them with the same drug.

TLSR: That’s very compelling. How about the near-term valuation?

RS: I know you’re familiar with Pharmacyclics Inc. (PCYC:NASDAQ). In mid-November, Pharmacyclics got its drug, Imbruvica (ibrutinib), a Bruton’s tyrosine kinase inhibitor, approved for certain niche hematological malignancies. In our view, the total market potential for Imbruvica is a fraction of the market potential for Medivation’s drug Xtandi. Imbruvica is also partnered with Janssen Pharmaceutica, a division of Johnson & Johnson (JNJ:NYSE). So it’s not as though Pharmacyclics owns 100% of Imbruvica. But Pharmacyclics enjoys a market cap right now of roughly $10B.

In my view, Medivation, partnered with Astellas Pharma Inc. (ALPMF:OTCPK) on Xtandi, should be trading at par with Pharmacyclics. If you compare the two companies in terms of commercial phase and relative maturity, Medivation has the edge. Its drug was approved more than a year before Pharmacyclics’ drug, and it has an established sales and marketing force in the U.S. It should report positive earnings per share for the first time in Q4/13. It is likely to be sustainably profitable over the course of this year and beyond. Medivation should trade at par with Pharmacyclics just on the basis of relative valuation.

Medivation is as attractive an acquisition candidate as Pharmacyclics, if not more attractive, because of the size of the markets Medivation targets. We believe that there is probably 60–70% upside in Medivation, even from these levels. We consider our $125 price target to be inherently conservative.

TLSR: It’s interesting to see this product being studied in so many prostate and breast cancer indications, including triple-negative breast cancer, which by itself could be a tremendous market. Are there data to support the hypothesis that this could be important as a triple-negative breast cancer therapy?

RS: The androgen receptor, the target for Medivation’s Xtandi, is overexpressed in 70% of breast cancers, not just triple-negative breast cancer. The company is targeting triple-negative breast cancer first because that’s the shortest path to approval from the U.S. Food and Drug Administration (FDA). Nothing else works in triple-negative breast cancer.

In my view, there is potential in triple-neg, similar to what we saw in chemo-refractory, hormone-resistant prostate cancer—the worst of the worst. Xtandi has also demonstrated activity in chemo-naïve prostate cancer, and the company has trials running in hormone-sensitive prostate cancer. Medivation is starting with the worst-of-the-worst breast cancer patients, who are not treatable with any of the existing therapies. The company will then move into earlier-stage populations that are estrogen receptor- and progesterone receptor-positive as well, since the androgen receptor is expressed on 70% of all breast cancer types, regardless of what the other receptor expression is.

TLSR: Ram, you’re always generous with your amazing bank of knowledge. Thank you.

RS: Absolutely. Thank you so much.

Raghuram “Ram” Selvaraju’s professional career started at the Geneva-based biotech firm Serono in 2000, where he discovered the first novel protein candidate developed entirely within the company. He subsequently became the youngest recipient of the company’s Inventorship Award for Exceptional Innovation and Creativity. Selvaraju started in the securities industry with Rodman & Renshaw as a biotechnology equity research analyst. He was the top-ranked (#1) biotech analyst in The Wall Street Journal’s “Best on the Street” survey (2006) and went on to become head of healthcare equity research at Hapoalim Securities, the New York-based broker/dealer subsidiary of Bank Hapoalim B. M., Israel’s largest financial services group. While at Hapoalim, Selvaraju was regularly featured in The Wall Street Journal, Barron’s, BioWorld Today, and Reuters/AP. He was also a regular guest on the Bloomberg TV program “Taking Stock,” appeared with Bloomberg TV’s on-air correspondents Betty Liu and Gigi Stone and was a guest on CNBC’s “Street Signs with Herb Greenberg.” He is currently an analyst with Aegis Capital Corp.

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) George S. Mack conducted this interview for The Life Sciences Report and provides services to The Life Sciences Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Life Sciences Report: None. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Ram Selvaraju: I own or my family owns shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Streetwise – The Life Sciences Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part..

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Life Sciences Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8204

Fax: (707) 981-8998

Email: [email protected]

Do Away with the Pill-A-Day Biotech Model: Steve Brozak

Source: George S. Mack of The Life Sciences Report (2/6/14)

http://www.thelifesciencesreport.com/pub/na/do-away-with-the-pill-a-day-biotech-model-steve-brozak

The U.S. healthcare system is untenable, says Steve Brozak, president of WBB Securities. The solution-oriented Brozak is on the hunt for biotech and medical device companies that fit a new paradigm, in which budgets are restrained and companies generate curative therapies for unmet needs. In this interview with The Life Sciences Report, Brozak takes aim at a broken system and lists ten problem-solving companies that can adapt to the changes he believes must take place for healthcare to be profitable and productive. A bonus: These companies can also add vigor to investment portfolios.

The Life Sciences Report: When we spoke in April 2013, you said small-cap biotechs had not followed the large-cap indices upward. I believe we can safely say that small biotechs are catching up or have caught up. Where are we now in the small-cap biotech market valuation cycle?

Steve Brozak: Yes. More small companies are realizing and being recognized for their underlying value. I’d like to make a couple of observations. We’ve seen upward mobility in the initial public offering process for many companies that, frankly, have not been as well researched as they should have been. There has not been a visible path to product commercialization, as there should have been. I see the upward movement in biotech stocks as a commoditization trend. It’s like when people said that gold was going to go to $5,000/oz. Investors have been buying into the biotech space as if it were the new commodity, so there’s a bit more excitement than I’d like to see. That said, and although some companies we have covered have been taken over, there are still remarkable values within the biotech sphere.

TLSR: What about the indices? Certainly, we know that upward-moving indices help all stocks. Are the indices ready for a rest, or is there more upside to the broader biotech markets?

SB: For the broader biotech market, I would answer no. I don’t believe the broader biotech markets are going to continue upward in an all-encompassing sense. Frankly, I’ve been very surprised by some transactions. To paraphrase a former Federal Reserve chair, have we seen “irrational exuberance?” No, but we have seen overenthusiasm in some cases.

TLSR: Steve, you always have a specific theme backing up your investment ideas. You are currently looking quite harshly at the healthcare system—particularly in the U.S., where you see a very flawed economic business and medical model. Bring me up to speed on your thinking here. What grand-scale malfunction do you see in the healthcare system?

SB: It’s epitomized by the recent government shutdown. We literally went to the brink and shut the entirety of our system down based on polarization in how we want to move forward with healthcare. Most Americans are familiar with a system that has provided a level of care never seen in the history of medicine. The problem now is that this system has gone too far in terms of how it approaches expenditures. We simply can’t afford it, and we don’t have a system of checks and balances that works on healthcare expenditures.

When I say we can’t afford it, I mean we can’t afford a system that basically doesn’t restore the health of an individual. We can’t afford a system that provides the proverbial pill-a-day model. That model isn’t satisfactory for the growth of the healthcare system, and it’s certainly not satisfactory considering how sick our population is.

TLSR: You’re saying that it’s untenable for payers to continue to pay for the pill-a-day blockbuster products that ultimately support and grow the large pharmas. Is that it?

SB: Yes. Patients are divorced from the actual sticker prices of their drugs. They are responsible for a co-payment, and they don’t suffer the sticker shock of how much these products actually cost. A moderately priced drug for hypertension that has not yet gone generic can run $1,000/month. In the same way, an interventional procedure can be in the high five figures. Who can afford to pay that?

TLSR: What is your solution?

SB: The first part is coming to grips with who has ultimately been the payer. It’s always been the U.S. government. People have been happy to praise Medicare, which is the ultimate payer. Even corporate plans offer tax benefits to companies, and therefore the government has been paying for everyone’s employee health insurance indirectly. Some people say the capital markets will understand this. No. No, they won’t, because there is no transparency. Pricing is an example of this lack of transparency. The insurance industry and Centers for Medicare and Medicaid Services are considered the penultimate price setters. The reality is, the companies responsible for development and marketing of new drugs often base prices on their perceived value. We can’t keep that kind of model forever.

The solution involves—if you’ll allow me a baseball metaphor—getting on base, getting singles. Have you read the Michael Lewis book, Moneyball: The Art of Winning an Unfair Game, or seen the movie based on it? It’s about Billy Beane and his work as general manager with the Oakland Athletics baseball team. The person who began that work and who was in charge before Beane took over—and who is now with the New York Mets—is Sandy Alderson, an attorney and former Marine Corps officer who basically came into the game without prejudices in terms of how to value players. Alderson said baseball was valuing the wrong things.

In the same way, if you speak with physicians or others in the healthcare field, they are looking at the wrong metrics. There’s a wonderful passage in the movie when the scouts say a certain player doesn’t resemble the athletic mold because he has a paunch. That means that Babe Ruth basically wouldn’t have made it in today’s baseball because he had a paunch?

For better or worse, we’re at a critical juncture. We need to look at strategies that no longer strive for the blockbuster product, such as a drug or device with the primary goal of revenue. We now need to focus on restorative medicine, and more important, on understanding the root causes of diseases, so we can address health issues prior to their becoming unacceptably burdensome to medical and financial well-being. In baseball parlance, I don’t want to hit home runs every time I go out. I want to get on base, as in the Alderson-Beane model. I want to provide the best value for the money in terms of the best clinical outcomes.

TLSR: Steve, I’m assuming the stocks you currently recommend somehow fit the model you would like to see created here in the U.S. and globally. Go ahead and tell me how they fit that paradigm.

SB: Here’s how they fit. The law of large numbers is going to preclude growth in pill-a-day returns. The law of large numbers is about growing revenue and earnings. If you’re a pharma, you can double $50 million ($50M) in revenue in a year or two, but you can’t double $5 billion ($5B) very easily. Investors look for growth of multiples—growth of revenue and earnings—but this cannot be sustained in the major pharma group of companies because they are so large already.

An exception to the pill-a-day model would be antibiotics, which are prescribed for a finite consumption period, not generally for chronic therapy. We now realize antibiotics are more important than we previously imagined, especially during flu season. Clinicians are accustomed to viewing viral attacks as non-antibiotic diseases, but the reality is—and published research in the “Journal of Infectious Diseases” is telling us this—bacterial infections can often occur simultaneously, when your system is weakened by a virus. Antibiotics will play an even greater role in modern medicine as new, multidrug-resistant strains of bacteria evolve. The lack of promising new antibiotic programs is also going to come to the forefront. The industry will have to do something about that.

In the long run, regenerative medicine is going to address medical objectives in a new way. Cell therapies will enable a self-contained healthcare mechanism in which patients achieve disease-modifying therapy or restoration of health, versus just regulation of disease. I believe governments, and I believe taxpayers, and I believe individuals, will pay higher prices for outcomes like this. The restoration of a person’s health is what we’re looking for, and that’s an overarching theme.

TLSR: Let’s talk about some companies.

SB: I’ll start on the regenerative medicine side. Athersys Inc. (ATHX:NASDAQ) is a company we’ve talked about before and, in full disclosure, we at WBB Securities acted as a financial adviser on Athersys’ last transaction.

Athersys looks to provide a resolution of inflammatory conditions. The company’s value has gone up but, frankly, we believe it is still undervalued. I would also mention, with regard to Athersys and many companies in the regenerative medicine space, that the Japanese government has realized that stem cell/regenerative medicine programs are almost nonexistent in that country, with only a handful of studies ongoing, versus hundreds of studies taking place in the U.S. and Europe. As a result, Japan’s parliament passed legislation allowing companies to receive conditional approval for products even if efficacy hasn’t been fully demonstrated yet, as long as the products are safe. That represents a much quicker pathway to approval in the Japanese market. Japan’s Ministry of Health, Labour and Welfare will now develop and implement regulations to get this process moving.

TLSR: All a company needs is phase 2 data to get a regenerative medicine/cell therapy product conditionally approved in Japan. What does that mean to you?

SB: That means there is the potential for breakthrough technologies that was not heretofore possible. Now individual clinicians can try different things. True science and discovery are at an important moment in time. It’s not possible, normally, to go from a handful to hundreds of studies in a short period of time, but it looks like that is what will happen in Japan. Athersys announced, on Jan. 9, that it had been granted three new patents in Japan that cover indications like stroke, graft-versus-host disease and inflammatory bowel diseases such as ulcerative colitis.

TLSR: In Q2/14, we’re going to get the first data from Athersys’ 128-patient phase 2 trial using MultiStem (multipotent adult progenitor cells) in ulcerative colitis. This program is partnered with Pfizer Inc. (PFE:NYSE). We’re going to get endpoints for all subjects through eight weeks following initial treatment. Then, later in Q2, the company plans to provide data through 16 weeks. I have two questions with regard to this. First, could the phase 2 data being derived for the U.S. Food and Drug Administration (FDA) be accepted by the Japanese regulators? Second, if the data are good, will investors consider this pivotal data and bid up this stock? By the way, Athersys is up 60% in the last four weeks and up 210% in the last 52 weeks.

SB: You’ve hit on a remarkably good question. In theory, it’s possible that the Japanese regulators will accept the data, but ultimately it is data from Japanese trials that are accepted in Japan. To accept the U.S. data from the Athersys phase 2 trial would require a coordinated plan with the Japanese regulators. I don’t want to go overboard and say a good phase 2 here in the U.S. would guarantee market acceptance in Japan, because that’s not the way it’s going to work. However, good data here cannot do anything but improve Athersys’ potential for partnering, and improve everything across the board for later approval in Japan—and, by definition, in the rest of the world.

TLSR: Go ahead with another regenerative medicine name.

SB: Let’s discuss Cytori Therapeutics Inc. (CYTX:NASDAQ).

TLSR: Cytori seems like an inefficient model because its platform is an autologous technology, where each individual patient’s cells must be harvested and processed, whereas Athersys’ platform is allogeneic, using single-donor cells expanded ex vivo into millions of doses. Does Cytori fit your efficiency model for the new paradigm?

SB: Producing Cytori’s adipose-derived stem and regenerative cells (ADRCs; adherent stromal cells), is actually an efficient model because it is simple. The costs of goods sold (COGS) are minimal by comparison to therapies that do not work as well. Remember, it’s not just an immediate economic or cost-saving benefit we’re looking for—it is about obtaining a good result, with the potential for restoration of health.

The U.S. government—specifically the Biomedical Advanced Research and Development Authority (BARDA)—has backed this company, allowing it to demonstrate that it can repeat in animals what it has already done in people. The company can qualify for up to $56M in nondilutive development funding once it achieves BARDA milestones. What BARDA is looking to do is seed the field so new things can grow. The government would like to see tactical regenerative medicine demonstrated by clinicians—in Cytori’s case, for treatment of radiation burns. Frankly, burns—whether from radiation or other sources—will be treated the same way. That’s where there is exciting potential for Cytori’s therapy. The ADRCs are produced by the company’s Celution System, which is being vended now. Once the system is out there, clinicians will be free to use it in other capacities.

TLSR: Did you have another regenerative medicine name?

SB: NeoStem Inc. (NBS:NASDAQ) has two business models. It does its own manufacturing and outsources work through its Progenitor Cell Therapy (PCT) subsidiary, which it acquired in January 2011. PCT has collaborated with more than 100 companies or clients, one of which was Dendreon Corp. (DNDN:NASDAQ). PCT was the original collaborative outsource manufacturer of Dendreon’s autologous cellular immunotherapy, Provenge (sipuleucel-T), the first cell therapy approved as a cancer therapeutic. PCT has a very cost-effective process, and we might have seen a different outcome in terms of COGS for Dendreon if it had stayed with PCT. NeoStem is replete with potential partners and technology.

NeoStem’s other business model is the development and marketing of its own product. Through its Amorcyte subsidiary, NeoStem is positioned to take advantage of a global need for regenerative medicine by preserving heart function after heart attacks. In mid-December 2013, the company announced completion of enrollment in its phase 2 PreSERVE AMI trial with AMR-001 (autologous bone marrow-derived CD34+/CXCR4+ enriched cells), to preserve heart function following a severe myocardial infarction. The initial data has been positive beyond expectations. I would say that, statistically, the good results should continue. We are looking forward to hearing data at the end of the summer.

TLSR: That’s three regenerative medicine names. Any others?

SB: No—I’m moving into the antibiotics space. I’ve mentioned the connection to influenza, and we have had a vicious flu season. Cempra Inc. (CEMP:NASDAQ) is in clinical trials with solithromycin (CEM-101), which I think is the most important antibiotic to come along in a while. It will hit the market within a short period of time.

Solithromycin has proven itself repeatedly. It’s in phase 3 studies for oral and intravenous use for community-acquired bacterial pneumonia. Solithromycin is being tested as a step-down therapeutic, which means the same drug can be used in an oral or intravenous form. It is a money-saver for the healthcare system. A patient could come to the emergency room with a dangerous infection, be treated intravenously, and then be released once the infection is under control with the oral dose, rather than being admitted for several days to receive periodic intravenous medication. Cempra also is the beneficiary of BARDA funding. I like Cempra’s technology very much, and the company has more than one antibiotic in development. It has a phase 2 candidate, Taksta (fusidic acid), in acute and chronic methicillin-resistant staphylococcus aureus (MRSA) infections and prosthetic joint infections.

Cempra is not only fully committed to developing antibiotics, it also has the ability to do it by itself. It is a strong company and has been able to attract partners from around the world. I believe that Cempra is primed to deliver. For full disclosure, we did act as a financial advisor on one of its transactions.

TLSR: Is there another antibiotic company in your quiver?

SB: Tetraphase Pharmaceuticals Inc. (TTPH:NASDAQ). Again, you’re looking at a company that has an understanding of antibiotics and generations of experience. It has eravacycline (TP-434) in phase 3 studies for adult community-acquired complicated intra-abdominal infections. This is a broad-spectrum antibiotic that also can be used as a step-down therapy. Tetraphase is getting ready to start a phase 3 study with this product in complicated urinary tract infections.

TLSR: One of your themes is targeted therapeutics. Please address that.

SB: Some companies are developing technologies that elicit a specific response in patients who display a narrowly defined set of characteristics. Celldex Therapeutics (CLDX:NASDAQ) is studying rindopepimut (a fully human antibody conjugated to chemo agent monomethyl auristatin E) in glioblastoma multiforme (GBM) patients who are expressing epidermal growth factor receptor variant III (EGFRv3). Rindopepimut is specifically targeted to EGFRv3, which is overexpressed in 30% of GBM patients. This is specific targeting, and this antibody has demonstrated significant increases in overall survival in phase 2 studies. We expect phase 3 results in 2015.

TLSR: You still like Celldex even though it is up more than 370% in the last 24 months?

SB: Yes, I still like Celldex, and I’m still recommending it.

TLSR: Go ahead with another idea.

SB: Omeros Corp. (OMER:NASDAQ) has a therapy platform that targets inflammation, whether it be ophthalmic or in joints, specifically in arthroscopic surgery. The idea is to reduce inflammation, thereby reducing postoperative pain and providing for much better outcomes.

TLSR: The lead candidates at Omeros are combinations of drugs that have been on the market for ages. Would you imagine that the ophthalmologists and orthopedists who use these products currently on an off-label basis would shift over to the Omeros proprietary combinations once they are approved?

SB: Anecdotally, what I’ve seen is no consistency in the current standard of care. This bothers the FDA to no end. I think it would be easy for Omeros to single-handedly take the market.

TLSR: Another name?

SB: Before last November I was basically in a different camp with regard to Sarepta Therapeutics Inc. (SRPT:NASDAQ), saying that the company was overvalued. Sarepta is testing its antisense drug, eteplirsen (AVI-4658) in Duchenne muscular dystrophy (DMD). Sarepta management met with the FDA in November, and there was a very interesting outcome. The agency said, “We need to think about this more in terms of what the potential is going to be.” The stock, obviously, lost a considerable amount of its value.

TLSR: You had Sarepta rated as a Sell, and you were right on target. When others on the Street were going negative on this story after the FDA meeting, you upped your rating to a Buy. The FDA said, on Nov. 12, 2013, that a new drug application (NDA) for eteplirsen would be “premature.” The stock is up quite nicely since you went to a Buy.

SB: Thank you for that. This is one where I happen to like the technology very much, and that’s why we have a Buy recommendation on the stock right now. Everyone was disappointed in the FDA meeting. To quote Sherlock Holmes, Sir Arthur Conan Doyle’s fictional character, “You see, but you do not observe.” What we observed was that Sarepta had every high-level FDA official in the building monitoring what was going on in that meeting. We looked at that as a very strong testament to the fact that the agency wants to work with the company. You see something like that and you say to yourself, “This is different.” We say Sarepta is a good value.

TLSR: You can understand the FDA being cautious, and saying an NDA would be premature. The FDA based its decision, in part, on the failure of competitor Prosensa Holding N.V.’s (RNA:NASDAQ)antisense drug, drisapersen, in a phase 3 trial about six weeks earlier. That trial did not meet its primary efficacy endpoint. Why do you see Sarepta as being undervalued?

SB: Obviously, I want to see this product work and benefit the patients who are suffering significantly. But the idea is that this platform can be used in other indications. Generally, looking at other RNA-based technologies and companies, potential targets would include the universe of neuromuscular disorders. A short list would include indications such as Huntington’s disease and amyotrophic lateral sclerosis (Lou Gehrig’s disease).

TLSR: I know you have an important diagnostic company in your coverage. Tell me about it.

SB: That company is Navidea Biopharmaceuticals Inc. (NAVB:NYSE). In disclosure, we do have equity ownership in Navidea, based on our advisory services to the company.

This is an interesting company, but there’s a disconnect with investors. Navidea’s product, which was approved in mid-March 2013, is a targeted radiopharmaceutical called Lymphoseek (technetium Tc 99m tilmanocept). It is used intraoperatively, so that a surgeon using a handheld gamma detector can map the lymphatic system around solid tumors and detect metastatic cancerous tissue draining from the primary tumor site. So far it has been approved for melanoma and for a much larger indication, breast cancer. Lymphoseek is now gaining traction.

As for the investor disconnect, a lot of people don’t understand the potential here. This is the most important product approval in the last 30 years in the oncology space—and that comes from the FDA, not from me. But it’s a diagnostic, so how can the FDA say that? Because of the outcomes.

Now the surgical oncologist can stage solid tumors like never before. The next disease indication will be head-and-neck cancer; the company has just finished up clinical trials in head-and-neck. After that, Navidea can start to think about sentinel lymph node mapping, which would make every solid tumor a potential treatment target. Because of the product’s specifics, the company can think about targeting prostate, lung and colorectal cancer. Lymphoseek has such a low molecular weight that it can get into the very-hard-to-navigate lymphatic systems in each of these organs. It’s never been possible to do that. Without a targeted diagnostic like Lymphoseek, a surgeon might never know if all tumor tissue is removed during surgery.

The stock price is down based on introductory sales, but the clinicians who are using Lymphoseek are coming back to use it again. It’s one of those situations where investors are saying, “Well, how much revenue can Navidea really get from Lymphoseek?” I look at it and say, “In the U.S. and eventually in Europe, what is 100% market share and growing actually worth?” The fact that this product is designated as a targeted diagnostic makes it really important.

TLSR: Steve, the FDA granted fast track status to Navidea’s Lymphoseek for squamous cell carcinoma of the head and neck back on Dec. 10, 2013. When can we expect approval for that indication?

SB: In speaking with one of the clinicians who was running the trial, he said there isn’t any other diagnostic to use in this indication. Right now, you basically do a resection, meaning that you filet the patient. That’s the way it is now. . .or you use this product. I can’t speak for the agency, but I expect quick approval.

Keep in mind that this is one of those situations where, frankly, the Street has already sold off on the approval and the sales. I believe that, based on approval of sentinel lymph node mapping for head-and-neck cancers, we will see the first of two critical milestones for the Navidea franchise. The head-and-neck approval will allow for greater dissemination of clinician understanding. Concurrently, I believe the second and most critical milestone will be crossing the 50%-usage threshold, after which there can be no going back to the antiquated technology, which Lymphoseek will replace.

TLSR: Steve, you also follow medical device companies. Do you have something in this sector you’d like to talk about?

SB: Yes, Cyberonics Inc. (CYBX:NASDAQ). The stock has gone up considerably, nearly doubling over the past 24 months. I’ve covered this company for about seven years now. Its product has a simple concept. Basically, a wire is attached to the vagus nerve; that wire is then attached to a battery-powered pulse generator, which sends out pulses. This vagus nerve stimulation has potential to treat several different, specific, targeted indications. It is approved for use in preventing and treating epileptic seizures and what was heretofore untreatable depression, and it has the potential to treat chronic heart failure. The technology has provided some unintended but positive outcomes. I see this as the kind of medicine that allows for returns in multiple, targeted indications, and I think that is significant.

TLSR: Steve, I’ve enjoyed this, as always. Thank you.

SB: It’s my pleasure. Thank you.

Stephen G. Brozak is a top-ranked analyst in biotechnology, pharmaceuticals and medical devices according to the Starmine ranking system and The Wall Street Journal. He has worked in the securities industry for more than 25 years, where he held positions in sales, management, investment banking, and research analysis. He is now the Managing Partner and President of WBB Securities, an independent broker/dealer and full-service investment bank. Brozak holds a bachelor’s degree and a master’s degree in business administration from Columbia University. He is a retired lieutenant colonel in the United States Marine Corps and currently is a member of the Secretary of Navy’s Retiree Council, advising on healthcare issues.

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) George S. Mack conducted this interview for The Life Sciences Report and provides services to The Life Sciences Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Life Sciences Report:Athersys Inc., Cytori Therapeutics Inc. NeoStem Inc. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Steve Brozak: I own, or my family owns, shares of the following companies mentioned in this interview: Navidea Biopharmaceuticals Inc. I personally am or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: Athersys Inc., Cempra Inc., Navidea Biopharmaceuticals Inc. and NeoStem Inc. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Streetwise – The Life Sciences Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part..

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Life Sciences Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8204

Fax: (707) 981-8998

Email: [email protected]