By www.CentralBankNews.info Hungary’s central bank cut its base rate for the 13th time in a row, this time by 20 basis points, as the central bank lived up to its word that it would change the pace of its easing in coming months.

The National Bank of Hungary, which has cut rates by 195 basis points this year, did not release any further statements.

To stimulate economic growth, Hungary’s central bank embarked on an easing cycle in August last year, cutting rates each month by 25 basis points for a total reduction of 320 basis points.

But last month the bank said it would change the pace or extent of policy easing in light of the significant cuts already executed. The volatile condition in financial markets is also calling fora more cautious approach in policy, the bank said.

Economists had expected the central bank to cut rates again, but by a smaller amount as in the past as Hungary, like other emerging markets, are faced with an outflow of capital as investors prepare for a tapering of asset purchases by the U.S. Federal Reserve.

Last month the bank also said that the rate cuts would help inflation return towards the bank’s target of 3.0 percent. Hungary’s inflation rate eased to 1.8 percent in July from 1.9 percent in June.

In the second quarter of this year, Hungary’s economy expanded by 0.1 percent from the first quarter for annual growth of 0.5 percent, up from a contraction in the previous five quarters.

Asian Stocks Mixed On Firm Yen

Asian stocks closed mixed on Tuesday, with stocks dragged down by the yen firming on the ongoing heated tension in Syria, after the US hinted a possible need for military action against the country’s government over the alleged use of chemical weapons in their attacks. The Chinese mainland Shanghai composite closed higher with the help of the industry data released and the Shanghai free-trade zone news.

Equities in Asia followed Monday’s gains on Wall Street as stocks were seen trading higher, which were followed by losses after the US Secretary of State hinted a possible military intervention against the Syrian government over the alleged chemical weapons attack.

Asian Stocks – Japan Down On Strong Yen

Japan’s benchmark Nikkei 225 declined 0.69% to 13,542.37 points but picked up gains for a while. The Nikkei 225 index weighed on the firm yen which edged 0.38% higher at ¥98.12 at the time of writing.

The Strong yen hurts the nation’s exporters and reduces the overseas income of Japanese companies. Tokyo Electric Power rose the highest during the session, gaining 12.3%, rebounding from previous losses. While shares from the infamous Fukuschina Daiichi nuclear power plant declined 27% over the past six sessions.

Real estate developer Tokyo Tatemono dropped the lowest as it closed with 43% lower. While Toyota Motor declined 0.8%, Isuzu Motors retreated 2%, while tire manufacturers Yokohama Rubber lost 3.6% on the firm yen.

Tokyo’s broader Topix index dropped 0.51% to 1,134.17.

Asian Stocks – Abe’s Tax Comments

The Prime Minister Shinzo Abe discussed about the proposed tax rise on Monday, with a plan to increase sales tax from 5% to 8% from April next year. Abe suggested the government should consider reducing corporate taxes and raise the consumption tax.

During Abe’s visit to Africa and the Middle East, Abe said his main goals were to recover the economic growth and overcoming deflation.

In the trading session in China, stocks were seen mixed with the Hong Kong’s Hang Seng rebounding 0.59% to 21,874.77 points, while the mainland Shanghai advanced 0.34% to 2103.57 point, assisted by the news regarding a planned free-trade zone.

Earlier today, the world’s second biggest economy released some better-than-expected macroeconomic figures, as the Chinese National Bureau of Statistics posted industrial profits and firms in China edged up 11.6% in July from previous record of 6.3% in June.

Interested in trading Asian Stocks Online?

Visit www.hymarkets.com and start trading with the award-winning broker today with only $50 and receive a 20% bonus on your deposits until September.

The post Asian Stocks Mixed On Firm Yen appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog

Gold Futures Rebounds On Weak US Dollar

Gold futures rose slightly higher, rebounding from Monday minor loss, while the US dollar was weakened by the recent economic data as investors raise concerns over speculations that the US Federal Reserve may begin to taper its bond-buying program earlier than expected.

The December delivery for the yellow metals were up 0.55% and trading at $1,400.80 per ounce at the time of writing, as it closed Monday’s trading session with $1,393.10 per ounce.

The US central bank’s $85 billion monthly bond-buying program weakened the US dollar by dragging the interest rate down, making the yellow metal an attractive hedge fund.

Gold Futures – Weak US dollar

The weaker-than-expected new homes sales data released last week along with the weak core durable goods orders dragged the greenback lower against major of its counterparts on Monday. Towards the end of the Asian trading session on Tuesday, the US dollar remained down against the Japanese yen, Australian dollar and the euro.

Analysts expected a 0.6% rise in July’s core durable goods orders, which dropped at the same rate, reports from the Census Bureau confirmed. The New orders for manufactured durable goods dropped 7.3%, falling from three monthly gains.

The U.S. Commerce Department reported the drop in the new homes sales for July as the highest level in over three years. Realtors closed new home contract rates at a low 13.4%, bringing down the total number of purchased new units to 394,000.

Gold Futures – Fed Doubts

The ongoing speculation over the tapering of the Federal Reserve’s (Fed) bond-buying program have stirred unsteadiness in the market and worries among investors in the recent months, as investors continue to focus on the Fed’s next meeting on September 17-18 for more clues.

Despite the recent better-than-expected economic data spurring predictions that the US central bank could begin to taper its stimulus program as early as September, investors are hoping the tapering of the bond-buying program would be pushed back to December with the release of the weak housing data.

Minutes from the FOMC August gathering, showed that policymakers from the Federal Open Market Committee (FOMC) were at ease with the tapering of the $85 billion monthly bond-buying program later this year, however the minutes did not indicate when exactly they intend to begin.

The second estimate for the second-quarter US gross domestic product is expected to be released on Thursday with predictions to show a rise of 2.3%.

Interested in trading Metals Online?

Visit www.hymarkets.com and start trading today from only $50!

The post Gold Futures Rebounds On Weak US Dollar appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog

Central Bank News Link List – Aug 27, 2013: Basci says Turkey won’t raise interest rates to defend lira

By www.CentralBankNews.info Here’s today’s Central Bank News’ link list, click through if you missed the previous link list. The list comprises news about central banks that is not covered by Central Bank News. The list is updated during the day with the latest developments so readers don’t miss any important news.

- Basci says Turkey won’t raise interest rates to defend lira (Bloomberg)

- Thai central bank says can handle outflows, will act on baht if needed (Reuters)

- Malaysia central bank says interest rates still supporting growth (Reuters)

- Europe’s single bank rule book falls apart as north races ahead (Bloomberg)

- Weidmann repeats warning against ECB bond buying (WSJ)

- China’s vice finance minister says no need for economic stimulus (Reuters)

- John Cochrane: The danger of an all-powerful Federal Reserve (WSJ)

- New Iran central bank chief starts work with inflation as target (Reuters)

- www.CentralBankNews.info

Why The 30/20 Tax Rule May Rise Again

The debt binge of the past 30 years certainly expanded the waistlines of the banks. The banks grew fatter each year as consumers and corporates gorged on debt.

But will the future be the same as the past? Probably not, according to a major study by the Australian Centre for Financial Studies titled Funding Australia’s Future.

Cash is oxygen to banks. Without it they cannot function. The study highlighted two potential choke points for banks:

1) Restrictions on the ability to source funds from overseas and

2) The increase in compulsory superannuation contributions from 9 to 12 percent.

Starved of oxygen, the banks may not be able to fill the traditional lending role in society.

Follow the money trail and superannuation is the new cash cow.

With all this money flowing into superannuation, is there a danger of government ‘sequestering’ some of the funds to ‘nation building’ projects i.e. infrastructure spending and financing government debt?

Cash strapped governments in South and Central America have past form on seizing control of their citizens savings, but surely Australia is more democratic than that? This is true. But there is more than one way to skin the cat.

30/20 is not a new form of cricket. It was a rule that was in force in Australia from 1961 to 1984. To quote from www.cmac.gov.au

‘Under the 30/20 rule life insurance companies and superannuation schemes received tax concessions if they held at least 30% of their assets in public securities with at least 20% of their total assets in securities issued by the Commonwealth.‘

With a widening gap between tax revenues and escalating expenditure (welfare and health entitlements), government debt levels are destined to climb. Could we see the re-introduction of a 30/20 type rule i.e. tax incentives for funds to underwrite government debt at lower than market rates and/or ‘nation building’ projects?

Remember, the most dangerous place to stand is between a politician and a pile of money – mining tax, carbon tax, tobacco tax (need I go on?). Do not discount the possibility of future governments becoming creative in what they want to do with your retirement capital.

The prospect of institutions and governments using super money as their plaything is certain to drive more people to establish self managed super funds. The trap here is the perception of personal control due to the title ‘self managed’.

The reality is the government, via legislation and the ATO, actually controls what you can do with your ‘self managed’ fund. A self-managed fund will not necessarily afford you protection from any cash grab by Canberra.

No need to be concerned at this stage. Just be aware the ‘authorities’ are looking where the future pockets of oxygen are going to be and how they can access them.

Vern Gowdie+

Editor, Gowdie Family Wealth

From the Archives…

Why Risky Stocks are Best in Risky Markets

23-08-2013 – Kris Sayce

Why Al Gore Won’t Like Big Data

22-08-2013 – Kris Sayce

Debt and the the Patient Investor

21-08-2013 – Vern Gowdie

How to Apply Reynold’s Law to Your Retirement Savings

20-08-2013 – Nick Hubble

Holding Cash is an Investment Strategy Too

19-08-2013 – Vern Gowdie

What Resource Investors Could Learn from the Tech Bust…

‘The most precious asset of the commodities business is the character weakness of this generation of central bankers. Forget talk of tapering, conditionality or data dependence; they’ll run from deflation at the first shot of the next crisis.‘ – Financial Times

That quote perfectly sums up our market view.

It’s good to see that what we’ve said for the past ten months has now made it to the mainstream.

The article is right. Does anyone really believe the men in charge of the central banks will do anything that would mean the next financial crisis happens on their watch?

Of course not. Why would they? They know they’re only in the role for five or maybe ten years max. It’s no time to be a hero and do what’s right when there’s a future high-paying private sector job on the line. They’re not likely to get on the board of a big bank if they’ve just caused the biggest financial collapse in history.

So, forget the idea of asset prices falling and deflation taking hold. This rally has plenty more to run. In fact, according to one controversial analysis, it could have another 50 years to run…

Remember that this week we’re showing you both sides of the coin.

In the lead article (this bit) you’ll hear arguments for the bullish case – reasons why we believe stocks are set to enjoy a multi-year rally.

In the second article (below) all through this week you’ll hear from 26-year financial planning veteran, and newest member of the Money Morning team, Vern Gowdie. Vern’s view is that investors should remain cautious as the Great Contraction takes hold.

In today’s article, Vern warns that if federal budget deficits continue, watch out. The government could begin to cast its eye over your retirement savings.

But that’s for later. First, let’s get back to this multi-year…scratch that, multi-decade rally…

A Blip on the Road to a Resource Boom

You’ve probably heard that the resources boom is over.

You’ve probably heard that because, heck, we’re pretty sure we’ve told you that once or twice in recent months.

We’re not the only ones to give you that message. The death of the commodity boom or resources boom is all over the mainstream press.

And even though we’ve recommended buying beaten-down resource stocks since the market bottomed in late-June, we’ve been careful to point out that we’re not predicting the birth of a new resources boom.

We simply see the resource sector returning to ‘more normal’ conditions. By that we mean that not every resource stock will go up. Instead, given recent history, investors will be fussy about which stocks to back.

That’s good news for small-cap mining stocks with a potentially quality resource.

However, there is a school of thought – a small school of thought – that believes the recent resource stock rout is just a blip on a multi-decade boom. If true, it could be a spectacular change of fortune for resource stocks.

But what’s the source of the belief in a new commodity boom? Well, it’s all thanks to a man the Soviet Union murdered in 1938…

Is it ‘Ludicrous’ to Say the Resource Boom is Over?

We’re talking about Nikolai Kondratiev, the Russian economist who developed a theory based on 45-60 year economic cycles. He’s a mostly forgotten character in history. But Stalin didn’t like Kondratiev’s free market tendency and so executed him.

But there are a handful of advocates who follow his theories and put them into practice today. One of those is investment analyst Dennis Gartman. He told the Financial Times:

‘It’s ludicrous to talk about an end to a supercycle that only started a decade ago. [Bank divestitures and mining firm losses] are just the sort of stories that accumulate at the end of a downward move.‘

In other words, Gartman is saying that if this really is a supercycle, it’s far too early to pronounce it dead.

Of course, as you may remember, we’ve profiled another analyst who follows Kondratiev’s theories – Phillip J Anderson. Anderson says the resources boom isn’t even half over. And it’s not just the resource sector that Anderson analyses using Kondratiev’s cycle theory.

Anderson has also shown that a similar ‘supercycle’ is about to play out somewhere else – the US and Australian housing markets. In fact, Anderson says Australian housing is at the start of a 14-year boom.

If he’s right, it would mean the Aussie housing sector has missed out on the bust that was inflicted on most other economies. While it’s difficult for your editor as a housing market bear to accept that, we have to acknowledge the possibility.

Resources to Follow the Tech Boom Model

Think about something else too. In 2001 most folks thought the technology boom had ended following the dotcom boom and bust. In reality, the dotcom bust was a cleansing exercise. The market purged malinvestments that investors should never have made. Companies went bust and investors lost money.

Sound familiar?

That’s what has happened in the resource sector over the past two years. But the technology boom didn’t end in 2001. It recovered. It boomed again with the rest of the market leading up to 2007, and following the 2008 crash technology stocks are booming again.

In fact, many tech stocks are now at an all-time high – 12 years after the dotcom bust. If good quality resource stocks can give investors even half the gains that tech stocks have given investors, then far from being the end of the resource boom, we could well be at the beginning of a multi-decade boom.

Cheers,

Kris+

From the Port Phillip Publishing Library

Special Report: Panic of 2013

Daily Reckoning: Superannuation Overtakes Bank Deposits

Money Morning: Why I’m Certain Stocks Are Going Higher

Pursuit of Happiness: War: The Reason to Own Gold

Australian Small-Cap Investigator:

How to Make Big Money from Small-Cap Stocks

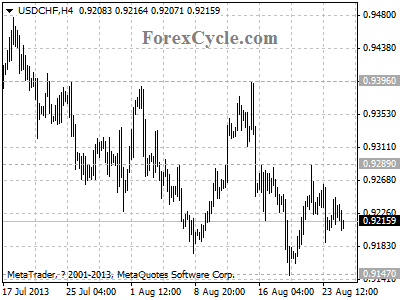

USDCHF moved sideways in a range between 0.9147 and 0.9289

Being contained by 0.9130 (Jun 13 low) support, USDCHF rebounded from 0.9147, and moved sideways in a range between 0.9147 and 0.9289. Initial resistance is at 0.9289, as long as this level holds, the price action in the range could be treated as consolidation of the downtrend from 0.9396, another fall to re-test 0.9130 could be seen. On the upside, a break above 0.9289 resistance will indicate that lengthier consolidation of the longer term downtrend from 0.9751 is underway, then further rise to 0.9350 area is possible.

Provided by ForexCycle.com

Central Bank News Link List – Aug 26, 2013: ECB not set to keep rates low for years: Bundesbank chief Weidmann

By www.CentralBankNews.info Here’s today’s Central Bank News’ link list, click through if you missed the previous link list. The list comprises news about central banks that is not covered by Central Bank News. The list is updated during the day with the latest developments so readers don’t miss any important news.

- ECB not set to keep rates low for years: Bundesbank chief Jens Weidmann (AFP)

- Fed officials rebuff coordination calls as QE taper looms (Bloomberg)

- Russia slashes economic growth forecasts, second time this year (Reuters)

- Brazil Copom seen raising Selic 50 bps to 9.0% (MNI)

- Colombia cen bank gov: Likely see increased mkt volatiilty (MNI)

- Hungary’s central bank suggests more FX mortgage concessions (Reuters)

- Hungarian central bank seen trimming rates slightly (Reuters)

- Bank of England governor to hold firm on record low interest rates (The Guardian)

- Pakistan changes schedule: MPS now on September 13 (Business Recorder)

- Taiwan central bank may hike interest rate toward end of year (The China Post)

- BI introduces new measures to boost declining rupiah (Jakarta Post)

- Mexico rate in line for now with inflation target, Carstens says (Bloomberg)

- Swedish FSA gets financial stability powers (WSJ)

- Iran’s new central bank head: Interest rates should be proportional to inflation (Trend AZ)

- www.CentralBankNews.info

Small (Capex) Is Beautiful in Silver and Gold, Says Salman’s Ash Guglani

Source: Kevin Michael Grace of The Gold Report (8/26/13)

Multibillion-dollar capital expenditures for precious metals projects have gone the way of the dinosaur, says Ash Guglani, research analyst at Salman Partners. In this interview with The Gold Report, Guglani delivers a report card for eight gold and silver companies, with the highest grades going to those that have kept down costs and have kept capital requirements modest.

TGR: The traditional market advice is sell in May and go away. This period of market restraint typically lasts until November. Why should investors in precious metals come back then?

Ash Guglani: What we’re seeing now is companies adapting to a new environment. The big theme this past quarter was cost containment. Many companies have followed through on that and reported good operating numbers. Going into the fall, investors will have the opportunity to pick companies that have shown improvement.

TGR: We’ve had a recovery in bullion, with silver over $23/ounce ($23/oz) and gold over $1,350/oz. Do you expect silver and gold equities to increase to match the increases in bullion?

AG: Yes. We’re seeing it now. The main thing is that we need some sort of price stability so that companies can adapt to this new price-point environment. If you go through the quarterly earnings, a lot of companies are cutting headcounts, capital expenditures (capexes) and exploration budgets. They are focusing on operating efficiency. I’m finding that miners are very quick to react.

TGR: I’ve been looking at your coverage list and see Pretium Resources Inc. (PVG:TSX; PVG:NYSE). Its Brucejack project in British Columbia has been an investors’ darling for years. The company put out a feasibility study in June, and you visited the site that month. In your opinion, is the promise justified?

AG: Pretium’s flagship asset is its high-grade Brucejack project. In the Brucejack feasibility study, the capex was $663.5 million ($663.5M). For that amount of money it would produce 7.1 million ounces of gold over a 22-year mine life. This bodes well for the project. There are not a lot of high-grade discoveries like this out there right now. The feasibility study showed the numbers are very strong. In our visit, Pretium outlined a little bit more of what it is doing with underground development. The bulk sampling remains the major catalyst for the story and we’re hoping to see that by the end of 2013.

TGR: Why is the bulk sample so important?

AG: When you get a high-grade asset like Brucejack, there’s always the question of what kind of grades we are actually going to see consistently. The main reason for the bulk sample is to verify the strength of the economics of this project.

TGR: How is Pretium’s cash position?

AG: At the end of June it had $33M in cash. The company is in a position now where it doesn’t need a lot of cash at this moment. The feasibility is done and most of the exploration work is finished. Pretium has excavated most of the bulk sample now. Cash-wise, the company is okay for now, but at some point, if it decides to go ahead and develop Brucejack, it will need more cash. But given what we’ve seen with this project, I don’t expect it will have any problem getting the capital it needs.

TGR: British Columbia is not known as the easiest place to open a mine in Canada. What suggests to you that Pretium will succeed where others (for environmental and First Nations reasons) have failed?

AG: I don’t foresee any environmental problems because Brucejack Lake is not a fish habitat. I believe the company is talking to three different First Nations groups in that area, and the talks have been going well. The company hopes to have agreements in place by the end of the year. Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT), which is nearby, also reports positive talks with First Nations. I don’t see any real permitting issues here; the area has been permitted before. The Tahltan tribe worked with Barrick Gold Corp. (ABX:TSX; ABX:NYSE) during the Eskay Creek days.

TGR: You rate Pretium a Buy. What’s your target price?

AG: $17.50.

TGR: Turning to Mexico, you rate Almaden Minerals Ltd. (AMM:TSX; AAU:NYSE) a Speculative Buy. This is a company that has about $24M in working capital and owns its drills. Does that put it in pretty good shape?

AG: Definitely. Almaden has a history of raising money in challenging times. It was able to raise another $5.5M in July. It has a strong cash position, and, as you said, it owns its own drills, so the drilling cost per meter is a lot cheaper than its peers. Almaden is in a great position.

TGR: Almaden has pursued a policy of drill, drill, drill at the Ixtaca gold-silver zone of its Tuligtic property. How close is this to bearing fruit?

AG: Almaden has drilled about 80,000 meters so far and has done a great job at filling in the blanks. It is a project generator, so I’m pretty sure Almaden’s management is out there generating interest in this story. It will be interesting to see what people think. Ixtaca is a decent gold story with a nice silver byproduct credit.

TGR: The Poliquin family, which runs Almaden, finds properties, develops them and then sells them. Do any companies come to mind as possible acquirers?

AG: Recently we’ve seen Alamos Gold Inc. (AGI:TSX) make a bid for Esperanza Resources Corp. (EPZ:TSX.V). Mexico being what it is, there would be a lot of producers there that would be looking at a project with this kind of scope. It’s just that we need a little bit of consolidation to start happening in the market first.

TGR: What is your target price for Almaden?

AG: $3.75.

TGR: What other companies have you rated Speculative Buy?

AG: Red Eagle Mining Corp. (RD:TSX.V) has pushed for near-term production at its Santa Rosa gold project in Colombia. That’s what I like about this story. It’s not a massive deposit, but it is something that could be producing within a couple of years. It is an open-pit scenario, so Red Eagle could look at different alternatives to get Santa Rosa into production. The company is deciding now whether to go underground first. Red Eagle’s market cap is about $12M. I think it has about $10M in cash. It has some great strategic investors, including Liberty Metals & Mining Holdings and Appian Capital Advisory out of London. Both groups have pretty good technical backgrounds. I don’t expect to see a massive capex for Santa Rosa, and that’s another reason I like it.

TGR: What’s your target price for Red Eagle?

AG: $0.55.

TGR: These days, is small beautiful with regard to capex?

AG: Yes, it is. Small is beautiful now. Until we have stabilization in gold and silver prices, the days of looking at multibillion-dollar capexes are over. There are a lot of them out there already, and I don’t think we’re going to see a lot being developed any time soon.

TGR: What other companies do you rate as Buys?

AG: Silver Standard Resources Inc. (SSO:TSX; SSRI:NASDAQ) and Great Panther Silver Ltd. (GPR:TSX; GPL:NYSE.MKT) are both Buys. My target prices are $16.50 for Silver Standard and $1.30 for Great Panther.

TGR: Has Silver Standard met the challenge of the lower silver price?

AG: It just reported a good operational quarter. The theme for all these producers is to take the right steps in containing costs. We need to see that continuing over the next few quarters as we figure out where gold and silver prices are going.

TGR: What do you think of Silver Standard’s projects?

AG: Silver Standard has one operating mine, Pirquitas in Argentina. The company has the big Pitarilla silver-lead-zinc project in Mexico and it has a whole bunch of little projects in its portfolio that it could potentially develop. I think Silver Standard’s main focus right now is increasing efficiency at Pirquitas. I believe it is looking for a partner for Pitarilla.

The beauty of Silver Standard is that it has a pretty sizeable cash position that allows it control over its production profile. The company also has projects that it could divest, if it needed more cash, including a sizeable position in Pretium. I think Silver Standard is actually in a great position right now.

TGR: And Great Panther?

AG: It is a higher cost producer, but it showed some promise this past quarter. The company needs to demonstrate consistent operating efficiency.

TGR: You have a Buy recommendation for Silvercorp Metals Inc. (SVM:TSX; SVM:NYSE), correct?

AG: Yes, and a $4.60 target price. Silvercorp has done a good job at scaling back costs wherever it can and shutting down some of its high-cost mines in the Ying mining district.

TGR: Has Silvercorp triumphed over those who claimed it had exaggerated its resources in China?

AG: I think the company did a good job fighting those allegations and in getting back to what it does best: operating mines in China. So now there is more focus on the actual numbers coming out of the company.

TGR: What other companies are in your coverage universe?

AG: Kimber Resources Inc. (KBR:TSX; KBX:NYSE.MKT) is a Speculative Buy with a price target of $1.25. The company’s Monterde gold-silver project in Mexico is interesting, but it has been the victim of funding. Its cash position limits what it can do. Kimber needs the market to improve so that investors can open up their wallets to get Monterde back on track. The company needs to do a lot more work to delineate its underground resource. But it does have both open-pit and underground mining scenarios.

TGR: Is there one more company you would like to discuss?

AG: Endeavour Silver Corp. (EDR:TSX; EXK:NYSE; EJD:FSE) is a Buy recommendation at $5.50. The company has two mines in Mexico, Guanaceví and Bolañitos, that are profitable and cash-flow positive even with $20/oz silver. Its El Cubo acquisition has hampered the company a little bit, but it has taken the right steps to control grade there, and it will be interesting to see how that plays out.

TGR: What will it take for investors in gold and silver equities to become excited about the market again?

AG: I’ll say again that we need price stability. Also, we need producers continuing to show that they’ve adapted to the new commodity price environment. That’s when investors will begin to see that valuations are ridiculously cheap. That’s when people will start getting excited again.

TGR: Many of these companies have been ridiculously cheap for quite some time, but investors have been waiting for a bottom. Have we gotten to the point where investors can’t resist these bargains any longer?

AG: I think we’re seeing it now.

TGR: Ash, thank you for your time and insights.

Ash Guglani is a research analyst with Salman Partners, covering precious metals companies in the mining sector. He has been with Salman Partners since 2004. Guglani holds a Bachelor of Business Administration degree with a focus in finance from BCIT.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Kevin Michael Grace conducted this interview for The Gold Report and provides services to The Gold Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Pretium Resources Inc., Almaden Minerals Ltd., Red Eagle Mining Corp., Silver Standard Resources Inc. and Great Panther Silver Ltd. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Ash Guglani: I own or my family owns shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Streetwise – The Gold Report is Copyright © 2013 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

Email: [email protected]

So Brazil, About That Currency War…

By The Sizemore Letter

In the international currency war, it would appear that Guido Mantega has turned traitor and gone over to the other side.

If you’re not familiar with Mr. Mantega, he is the colorful—and quotable—finance minister of Brazil and one of the most vocal critics of the easy money policies pursued by the United States, Europe, and Japan. It was Mantega who introduced us to the term “international currency war” in 2010 and—with a touch of bravado—promised that Brazil wouldn’t lose.

What did he mean by that? Mantega was concerned that the soaring price of the Brazilian real (or the plunging price of the dollar, euro and yen, depending on your perspective) due to loose monetary policy in the developed world put Brazilian exporters at a disadvantage and ran the risk of hollowing out the economy by making manufactured imports artificially cheap.

Source: tradingeconomics.com

For perspective, take a look at the embedded chart. I set the start date to 2003, which happens to correspond to the year I went to Brazil for the first time. It almost brings a tear to my eye to think that I could buy a steak dinner for the price of a Big Mac then.

Alas, those days are over. In 2003, a dollar would buy you 3.5 Brazilian reais. But as yield-hungry investors and speculators jumped into the market throughout the 2000s emerging markets boom, the real more than doubled in value in dollar terms. By the beginning of 2011, a dollar would barely buy you 1.5 Brazilian reais (for those unfamiliar with the terminology, “reais” is the plural of the “real,” Brazil’s currency).

As the real continued to strengthen, Mantega did everything in his power to weaken it. In an attempt to deter “hot money” speculators and Western fund managers, he instituted a tax on foreign investment…and then raised it to 6%. He also encouraged the central bank governor to go on an aggressive dollar buying spree.

Generally speaking, it’s a bad idea to bet against a country that is determined to weaken its currency. Strengthening a currency is tough; it requires a fat stash of hard currency reserves and an ability to instill confidence in a fickle, temperamental market. But weakening a currency requires nothing more than a willingness to print money and flood the international currency markets with it.

Brazil won the currency war. The real had been steadily weakening since mid-2011…until the U.S. Fed’s “taper scare” turned the decline into a rout. Now the victory is looking like a Pyrrhic one, and Mantega and his compatriots are more concerned about a destabilizing currency collapse. The foreign transaction tax has been scrapped, and the central bank is actively intervening to prop up the real with a new $60 billion program.

All of this has sent investors running for the door. The iShares MSCI Brazil ETF ($EWZ) is down 21% year to date in a year when the S&P 500 is up 20%. The Brazilian Bovespa, in local currency terms, is down only 14%. Most of the damage came in the May/June “taper” scare, which rattled India, Turkey, and most of the rest of the emerging world as well.

So, what are we to do with this information? Is Brazil cheap enough to warrant a look after the recent rout?

iShares MSCI Brazil (EWZ)

Brazil is reasonably cheap. By Financial Times estimates, the broad market trades for about 15 times earnings and yields 4%. And after the recent slide, the real is sitting near five-year lows. The currency could always go lower, of course. But it would appear that the hot money has largely already fled the coup.

Brazil has also been rattled by the slowdown in China, which has hit all commodity-producing countries hard. Yet the recent data coming out of China suggests that the worst might be behind us. Industrial production and fixed investment both saw improvement in the latest data release.

Finally, we get to market psychology. This is notoriously hard to measure and subject to change at the drop of a hat. But in general, investors haven’t exactly been lining up to buy emerging market stocks. Emerging market mutual funds and ETFs have lost nearly $6 billion in outflows this year, suggesting that investors have given up hope. All else equal, that’s a contrarian bullish sign.

I may be a little early on this trade, but I would recommend accumulating shares of Brazilian and other emerging market stocks at these prices. It’s not time to back up the truck just yet, but I would start with a small position and average in over the course of the next several weeks.

Charles Lewis Sizemore, CFA, is the editor of the Sizemore Investment Letter and the chief investment officer of investments firm Sizemore Capital Management. As of this writing, he had no position in any stock mentioned. Click here to learn about his top 5 global investing trends and get your copy of “The Top 5 Million Dollar Trends of 2013.”