By www.CentralBankNews.info The Bank of Japan (BOJ) maintained its target for asset purchases and the monetary base and largely repeated its economic assessment from May, saying the “Japan’s economy has been picking up” and the economy is expected to return to a path of moderate recovery.

The BOJ, which launched its new phase of monetary easing in April, repeated that it aims to increase the monetary base by an annual pace of about 60-70 trillion yen and it will buy Japanese government bonds so the outstanding amount rises by an annual pace of 50 trillion yen along with purchases of exchange-traded-funds, real estate investment trusts, commercial paper and corporate bonds.

The central bank also confirmed that it would continue with its “quantitative and qualitative monetary easing” as long as it is necessary to reach its target of 2.0 percent inflation, looking at both upside and downside risks to economic activity and prices, and make adjustments as appropriate.

The BOJ’s new and aggressive easing is aimed at boosting years of tepid economic growth and overcoming some 15 years of deflation.

Japan’s government on Monday revised upwards its estimate for first quarter growth, showing Gross Domestic Product rising 0.6 percent from the fourth quarter from an earlier estimate of 0.4 percent as domestic demand was revised up to a rise of 0.6 percent from 0.5 percent.

But deflation continues to grip Japan, with consumer prices down another 0.7 percent in April, the 11th month in a row with a drop in the headline inflation rate.

The BOJ acknowledged that consumer prices remain negative due to the reversal of the previous year’s movement in energy-related and durable consumer goods. However, it added that “some indicators suggest a rise in inflation expectations.”

“The year-on-year rate of change in the CPI is likely to gradually turn positive,” the BOJ said, based on improving exports as overseas manufacturing is picking up and the effect of better domestic demand from the monetary easing and other economic measures.

However, the BOJ also underlined that there is still a “high degree of uncertainty concerning Japan’s economy, including the prospects for the European debt problem and the growth momentum of the U.S. economy as well as the emerging and commodity-exporting economies.”

In April, the BOJ forecast that inflation, excluding the effect of planned consumption tax hikes, would rise to 1.4 percent in fiscal 2014 and then 1.9 percent in fiscal 2015. In the current fiscal year, inflation is forecast at 0.7 percent.

www.CentralBankNews.info

Three Technology Breakthroughs You May Have Missed…

An old pal cornered your editor over the weekend. He asked:

‘Don’t you feel annoyed that all this news has come out about tech firms letting government spies in through the back door, just as you launch your new technology service?‘

We had a simple answer, ‘No‘. Why? Governments spy all the time.

They’ve done it for thousands of years. You could argue that one of the most famous examples of government spying and treacherous behaviour appears in the Bible. You’ve heard of Jesus Christ, Judas Iscariot and the Romans, right?

We agree that it’s annoying from a liberty perspective. But not from a technology investing perspective.

From that point of view, regardless of what immoral and maniacal governments and politicians get up to, one thing is clear – you’re living at a time that could deliver one of the biggest technological advances in history.

That’s something to embrace, not fear…

You’ve doubtless heard of codes and ciphers. These go hand in hand with spying and have existed almost since humans began to write.

So, while we may abhor governments spying on people, we have to just acknowledge it and move on.

After all, if our ancestors had given up on technology advancements due to spying by the Pharaoh’s, the French Kings, or European Emperors, we would still be rolling around in our own filth.

But fortunately, our ancestors didn’t give up. They pushed on and got on with trying to improve their lives – despite the best efforts of governments to hold them back.

And getting on with things is exactly what the world’s top scientists, researchers, innovators and inventers have done over the past week…

While You Weren’t Watching – a Cure for MS?

While everyone else seemed to focus on the US government and its corporate patsies, or the latest feuding in the Aussie federal government, you probably didn’t notice three key scientific breakthroughs:

5 June, The Independent – ‘Scientists are claiming a breakthrough in the treatment of multiple sclerosis after an experimental therapy given to a small group of patients had dramatic results.

‘The therapy involved extracting white blood cells from the patients which were mixed with proteins and re-infused producing a 50-75 per cent reduction in the body’s immune response.

‘In multiple sclerosis the immune system attacks the myelin sheath that surrounds the nerve fibres causing symptoms ranging from numbness to paralysis.‘

5 June, Science Daily, – ‘Researchers at the University of Copenhagen, in collaboration with Seattle Biomedical Research Institute, the University of Oxford, NIMR Tanzania and Retrogenix LTD, have identified how malaria parasites growing inside red blood cells stick to the sides of blood vessels in severe cases of malaria. The discovery may advance the development of vaccines or drugs to combat severe malaria by stopping the parasites attaching to blood vessels.‘

7 June, Latinos Post – ‘Humanity may not be able to beam someone to and from a planet’s surface like in Star Trek, but according to a new report in Nature Physics, we’ve just found out how to perform quantum teleportation reliably – which is something that, dramatically, the crew of the Enterprise never seems to be capable of.

‘Researchers working at the Niels Bohr Institute at the University of Copenhagen have successfully teleported information between two clouds of gas atoms using a laser. ‘

We noticed them. That’s the type of thing your editor and our technology analyst (Sam Volkering) look out for every day. And just as importantly, finding ways to profit from them.

Those are just three breakthroughs. There are many tens, hundreds if not thousands of revolutionary breakthroughs happening every day.

Most of them stay within the confines of the science world because the mainstream press is too busy focusing on things that most people knew anyway – that the government is spying on you.

That’s a shame, because there is so much opportunity out there…

Twenty Thousand Years of Progress in One Century

As we say, you could just give up on the future and assume things will get worse. We’ve no intention of doing that. Or you could take a positive outlook and believe that things will get better.

That’s how our ancestors dealt with adversity. You can look at the folks who used new technology to flee persecution in Europe and build a life in the New World.

Or you can look at the Pamphleteers in the 17th, 18th and 19th centuries who used the printing presses to get their message out. Not to mention the scientists and innovators who heralded the Industrial Revolution.

And now the human race is at another inflection point. One that could result in more technological advances and more wealth than all previous advancements combined. As futurist Ray Kurzweil notes:

‘Because of the explosive nature of exponential growth, the 21st Century will be equivalent to twenty thousand years of progress at today’s rate of progress; about one thousand times greater than the 20th Century.‘

In other words, if you thought the rate of technological change over the past 40 years was impressive, it’s nothing compared to the rate of change you, your children and your grandchildren will experience over the next 87 years.

It will be truly revolutionary.

This is why we believe it’s so important for you to not stick your head in the sand and keep all your money in cash. Because if you want any chance to profit from this new revolution, you can only do so by taking part in it.

Cheers,

Kris

Join me on Google+

PS. We’ll reveal more details on our new technology investing service, Revolutionary Tech Investor throughout this week. Keep an eye open for what could be the biggest opportunity Aussie investors have ever seen…

From the Port Phillip Publishing Library

Special Report: Buy These Four Yen Dive Stocks Now

Daily Reckoning: The Debate on Gold Infiltrates the Mainstream

Money Morning: Four Great Australian Technological Achievements

Pursuit of Happiness: Improving Your Life Through New Technology

Australian Small-Cap Investigator:

How to Make Big Money from Small-Cap Stocks

There’s More to Technology Than Facebook and Spying

Judging by the traffic I encountered along the Maroondah Hwy yesterday just before lunchtime, I’d go so far to say about half of Melbourne had been on Mount Buller all weekend.

I had been simply enjoying a relaxing long weekend away with family in the surrounding countryside. On the way home we’d managed to find ourselves in an endless procession of cars, trucks and caravans. The amount of people in a real hurry to get home was quite astounding.

Overtaking lanes became drag strips. And to be honest I’ve never seen a 4WD filled with gear and children, towing a boat, do 160kph, until yesterday.

I couldn’t figure out at 11:30am why people we’re so desperate to get home. It had crossed my mind that perhaps the next instalment of The Voice was high on the list, maybe even in a desperate attempt to see what was happening in world markets.

But it was a long weekend; the rush was probably just due to the fact people tend to drive like idiots on long weekends.

But idiocy on the roads aside, it’s fortunate that we get to celebrate the birthday of a Queen who really has nothing to do with our country. Her family did send convicts over to our shores a couple hundred years ago, and since then things have been looking up for Australia.

What that also means is a day off for the Aussie markets. No doom, no gloom, no talk of recession or bad data flowing from the institutions that create data.

And while most are away on a long weekend or simply just watching another game of footy on a Monday the rest of the world continues to go on, business as usual.

Well, I say business as usual, but in all reality it was a remarkably boring day around the world. The best thing to come out of the US was the final episode of Game of Thrones. Sadly that could have also been the reason Time Warner [NYSE:TWX] (which owns HBO, who screen Game of Thrones) was down a touch over 1.8%.

But there was some data from the major economies of the world. Albeit soft data from both the US and China. It meant a pretty lack lustre day for markets. In the US the Dow was down about 0.06% the S&P 500 down 0.03%.

You see what we mean? Pretty boring. Although, even on a boring day you can expect the Japanese market to spark some fireworks. The Nikkei225 gains almost 5%…to make back some of the 15% it had lost in recent weeks.

A Space Ripe With Opportunity

Interestingly enough though the good ol’ NASDAQ managed to post a gain of 0.13%. And that’s off the back of Apple [NASDAQ:AAPL] sliding a fraction due to a really lame attempt at a music streaming service to rival Spotify and Pandora.

Thanks to further evidence that Apple’s lost its way, Pandora [NYSE:P] happened to jump 2.45%. The basket case that Apple is quickly becoming is starting to open up opportunities in other parts of the NASDAQ arena.

What this tells us is that now is a great time to be buying technology stocks. It tells me that some of the big tech companies are starting to lose their way. That presents a great opportunity for the small tech stocks that are trying to take their place.

Every tech cloud has a silver lining.

It’s a strange world if you believe all the news reports at the moment. Ongoing issues with the global monetary system, the (what seems to be) everlasting conflict in the Middle East, the US spying on the world with their PRISM system…there’s a lot to get down about.

But chin up; as Kris mentions today, the world of technology will bring joy to the gloom. And it’s not the big players that you hear about all the time like Apple, Google and Microsoft. These tech giants won the race that’s already over.

It’s the tech stocks you haven’t heard about yet where the real opportunities lie.

And believe me, the opportunities are exciting.

You see, the opportunities are in the companies that push the boundaries of the ‘impossible’ that create unbelievable breakthroughs.

Do you think that just two years ago you’d be capable of 3D printing spare parts for home appliances? Or even just this time last year, did you think you’d be able to ask your TV what it recommends you should watch? How about the ability for paraplegics to walk using the power of their mind? It’s all due to mind blowing technology.

Those are pretty diverse technological achievements. The point is, new technology and innovation has an important impact on almost every aspect of your life. Unless you want to live like a hermit, there’s no getting away from it. And nor should you try to get away from it…embrace it.

The trick is to identify which technology trends will happen first. Even then, there are a lot of companies to choose from. So you need to really understand what their technology does, what it means, and how will it change the world.

That takes a lot of effort. But that’s what I’m here for. In short, what you need to know for now is that it’s a good time to be alive, and a great time to be an investor.

Sam Volkering

Technology Analyst

Join me on Google+

From the Archives…

Bernankenstein’s Financial Monster

7-06-2013 – Vern Gowdie

Six Revolutionary Technology Trends for the Next 20 Years

6-06-2013 – Sam Volkering

The Incredible World of Graphene

5-06-2013 – Dr Alex Cowie

After the Correction: Gold Stocks Set for the Biggest Gains

4-06-2013 – Dr Alex Cowie

The Single Best Way to Build Wealth: Invest in Business…

3-06-2013 – Kris Sayce

GBPUSD is facing trend line support

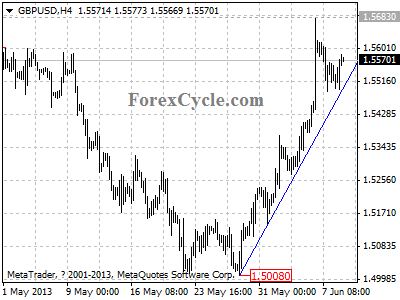

GBPUSD is facing the support of the upward trend line on 4-hour chart. As long as the trend line support holds, the fall from 1.5683 could be treated as consolidation of the uptrend from 1.5008, and one more rise to 1.5800 area is still possible after consolidation. On the downside, a clear break below the trend line support will suggest that the uptrend from 1.5008 had completed at 1.5683 already, then the following downward movement could bring price back to 1.5300 – 1.5400 area.

Keeping Stakes Small: How Some Companies Are Navigating the Gold M&A Market: Keith Phillips

Source: Brian Sylvester of The Gold Report (6/10/13)

Bigger isn’t always better, as recent acquisitions by Agnico-Eagle Mines Ltd., Coeur d’Alene Mines Corp. and New Gold Inc. suggest. These companies are choosing to make multiple smaller deals as they keep the M&A thesis alive. In this interview with The Gold Report, Keith Phillips, head of Cowen and Company’s Metals & Mining Investment Banking Group, tells investors what they can learn from those deals, the biggest problems facing the gold equities market and how they can take advantage of what he calls the strongest debt-financing markets in history.

The Gold Report: Coeur d’Alene Mines Corp. (CDM:TSX; CDE:NYSE) recently acquired Orko SilverCorp. for cash and shares. What should investors pay attention to in that deal?

Keith Phillips: The deal involved La Preciosa, a silver asset controlled by Orko, in an attractive jurisdiction in Mexico. From an investment banking perspective, seeing two different, quality companies competing for a junior mining asset in an environment where people thought the merger and acquisition (M&A) business was dead was encouraging. First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE) made an initial bid for Orko, and Coeur d’Alene was the successful bidder.

TGR: Are high-quality silver assets more likely to be targets than similarly valued gold assets in this market?

KP: There are many targets in gold but very few buyers currently. Silver is a smaller business with fewer quality targets but a relatively large number of healthy buyers. Coeur d’Alene is obviously healthy, having gone for Orko; Hecla Mining Co. (HL:NYSE) bought Aurizon Mines Ltd. to diversify into gold but also to stay in precious metals in North America. Pan American Silver Corp. (PAA:TSX; PAAS:NASDAQ), Fresnillo Plc (FRES:LSE), Silver Standard Resources Inc. (SSO:TSX; SSRI:NASDAQ), First Majestic and many others are well positioned to be consolidators of silver assets.

TGR: What are your thoughts on the strategy of Agnico-Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), which has been on a shopping spree this year? Agnico has taken significant positions in ATAC Resources Ltd. (ATC:TSX.V), Sulliden Gold Corp. (SUE:TSX; SDDDF:OTCQX; SUE:BVL), Kootenay Silver Inc. (KTN:TSX.V)and Probe Mines Limited (PRB:TSX.V) and also bought Urastar Gold Corp. and its Mexican assets for a total of CA$10 million.

KP: Many of Agnico’s friendly competitors are being cautious from an M&A perspective, and I think Agnico sees an opportunity to be more aggressive and to position itself in desirable assets. I’m impressed that it continues to be opportunistic, and I think Agnico will be rewarded for staying on track.

TGR: What are some common themes in those deals?

KP: Agnico is looking broadly. The company is focused on high-quality assets it thinks it can build in regions where it is comfortable operating. The Urastar deal was a synergistic one. Urastar’s core assets were near Agnico’s La India project in Sonora, Mexico, so it was a natural for them. ATAC is the high-grade gold play in the Yukon.

TGR: The share prices for those juniors remain stagnant, but is that the measure of success for those deals?

KP: You can measure success from the perspective of Agnico or from the perspective of the company that Agnico is investing in. We won’t know the value of these positions for Agnico for some time. For the companies that received the capital, I would differentiate them from others that had to finance in a more conventional sense, in a very difficult equity market. These companies have been able to raise capital without negatively impacting the share price.

TGR: Canada’s National Bank Financial put out a note in late May that suggested that Agnico is the trendsetter of “bite-sized deals” and that we could see more of the same from other players, includingNew Gold Inc. (NGD:TSX; NGD:NYSE.MKT), Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE), Alamos Gold Inc. (AGI:TSX), Eldorado Gold Corp. (ELD:TSX; EGO:NYSE), Goldcorp Inc. (G:TSX; GG:NYSE) andB2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX). Do you think that thesis has legs?

KP: I wouldn’t rule it out. I’ve spent time with many of the companies on that list and know that some are uncomfortable having a small minority stake in the company because of the financial-statement implications. Agnico isn’t unique; Coeur d’Alene has done something similar, which is to take several small stakes. Agnico has been more aggressive this year, but I’m not sure many others will follow its strategy.

TGR: The National Bank Financial note added that it saw potential for assets in the Americas, notably Canada, the United States, Mexico, Chile, Brazil and Peru, and also in Australia. Which jurisdictions do you favor?

KP: Each jurisdiction is unique. They are all evolving, but very few are moving in a favorable direction. The mining industry is an easy revenue target, and I can’t think of many jurisdictions that are getting better for mining. We have seen permitting difficulties within Canada, in British Columbia, and there has been some pressure within Quebec on taxes and on the mining business. There’s been pressure on taxes in Nevada, considered by many to be the best jurisdiction in the United States, and pressure on taxes in strong mining regions like Australia and Chile. The pressure tends to be from governments to either raise more money through taxes or to stop development all together for community reasons.

TGR: Will analysts have to raise their discount rates in some of these once relatively stable jurisdictions?

KP: I suspect analysts will be cautious in adjusting their models until the reality has changed. I wouldn’t expect meaningful changes to discount rates in places like Nevada. Having said that, in a place like British Columbia, some projects will get built and some won’t, and it will all be based on the merit of each project and its impact on the environment. That’s the reality. Similarly, some projects in California are getting built against all odds.

TGR: Are you following any specific companies there?

KP: Golden Queen Mining Co., Ltd. (GQM:TSX) is advancing a project that is fully permitted. Pan American Silver is now drilling in California. The state is seeing modest activity; it is very much company and asset specific, but in industrialized parts of California mining is viewed as an industry to support.

TGR: What would a discount rate be on, say, Ontario; Nevada; Sonora, Mexico; Ghana; and Peru?

KP: I think everybody would use the same discount rate within Canada and Nevada and the better parts of Mexico. My guess is people would use a relatively low discount rate for Ghana, and, presumably, Peru would be higher.

TGR: National Bank Financial also shortlisted what it calls “high-quality acquisition candidates,” which included Romarco Minerals Inc. (R:TSX), Balmoral Resources Ltd. (BAR:TSX.V; BAMLF:OTCQX), Belo Sun Mining Corp. (BSX:TSX.V), Minera IRL Ltd. (IRL:TSX; MIRL:LSE; MIRL:BVL), Newstrike Capital Inc. (NES:TSX.V), Rainy River Resources Ltd. (RR:TSX.V) and Torex Gold Resources Inc. (TXG:TSX). Would you agree with those names?

KP: I don’t disagree with that list, but I could write one that is literally 10 times longer in five minutes, and it would be considered attractive by some group of potential buyers. The list of companies that have attractive projects that are available is long; the problem is very, very few buyers exist currently.

TGR: Do you see that changing in the gold space within the next 18 months to two years?

KP: Inevitably, the bigger companies currently focused on internal operating challenges, like Barrick Gold Corp. (ABX:TSX; ABX:NYSE) or Kinross Gold Corp. (KGC:NYSE), will come back. Nobody has a portfolio that can keep it going indefinitely; every gold company needs to review new opportunities.

TGR: So the M&A thesis in the gold space isn’t dead—it’s just a long thesis?

KP: That’s right. The most critical issue is this abundance of available assets and dearth of buyers. If you have a nice asset like Rainy River Resources in Ontario, the real list of buyers is somewhere between 5 and 20 names. And those names are looking at dozens and dozens on the same list of acquisition opportunities, and out of the 20, at least half are not interested in transacting right now. [Editor’s note:On 5/31/2013 New Gold Inc. announced a $310 million cash and stock deal to buy Rainy River.]

TGR: What about China? Are some of the big Chinese mining companies venturing into the small-cap space?

KP: The Chinese are always on the buy list. As a group they have not been aggressive in precious metals in North America, but we all continue to call them and try to get them interested. I know the Chinese bought Corriente Resources Inc. in Ecuador. It’s a good time to be a buyer, whether you are a North American company or an international company.

TGR: Are you noticing any other trends in this and the M&A space?

KP: The good news is the things that drive M&A activity are CEO confidence and capital markets and financing. CEO confidence on the M&A side is very low right now. But the financing market, especially debt-financing and private equity markets, is open and ready for business.

Debt-financing markets are the strongest they’ve been in the history of time—literally. If you are an acquirer, you have an opportunity to use debt to finance a company—operating companies, not project companies. Some folks are reluctant to use debt in the mining business, but I think you can use it prudently and attractively to deliver the real cost of capital.

TGR: Thanks for your insights.

Phillips was a speaker at the Society for Mining, Metallurgy and Exploration “Current Trends in Mining Finance—An Executive’s Guide” conference.

Keith Phillips is a managing director and head of Cowen and Company’s Metals & Mining Investment Banking Group. Phillips joined Cowen from Dahlman Rose, where he was head of the Metals & Mining Investment Banking and responsible for the company’s Metals & Mining investment banking effort globally. Previously, he was with J.P. Morgan, where he headed the investment bank’s Metals & Mining practice. He previously ran the Metals & Mining investment banking groups at Bear Stearns & Co. and Merrill Lynch. Phillips has worked with over 100 Metals & Mining companies during his 26-year Wall Street career, including established global leaders such as Rio Tinto, Vale, Barrick Gold and Peabody Energy, successful growth companies such as Goldcorp, Yamana Gold and PanAmerican Silver, as well as exploration and development stage companies such as Silver Standard, NOVAGOLD, Seabridge Gold, Guyana Goldfields and Gold Canyon Resources. Phillips received his Master of Business Administration from the University of Chicago and a Bachelor of Commerce from Laurentian University in Canada.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Brian Sylvester conducted this interview for The Gold Report and provides services to The Gold Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Sulliden Gold Corp., Probe Mines Ltd., Goldcorp Inc., B2Gold Corp., and Balmoral Resources Ltd. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Keith Phillips: I or my family own shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: My company acted as a financial advisor to Urastar Gold Corp in connection with its acquisition by Agnico-Eagle Mines Limited that was announced on March 25, 2013. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Streetwise – The Gold Report is Copyright © 2013 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Belarus cuts rate 150 bps as inflation continues to fall

By www.CentralBankNews.info The central bank of Belarus cut its benchmark refinancing rate by a further 150 basis points to 23.5 percent due to a continued fall in the inflation rate and inflationary expectations.

The National Bank of the Republic of Belarus has now cut rates by 650 basis points this year after cutting rates by 1500 points in 2012 in response to lower inflation.

“The decision was taken with regard to the current tendency for further deceleration of inflation and a decline in inflation expectations,” the central bank said, adding the situation on the domestic foreign exchange market remains favorable for a stable exchange rate for the Belarusian ruble.

Real interest rates remain high, contributing to the inflow of households’ deposits to banks and any “further change in the refinancing rate will depend on the macroeconomic situation in the country, as well as the dynamics of prices and inflation expectations,” the bank said in a statement from June 7. The new rate takes effect June 10.

Belarus’ inflation rate fell to 20.7 percent in April from 22.2 percent in March as it continues to trend downward from a high of almost 110 percent in January 2012. The country, a former Soviet republic, devalued its ruble by about half during a balance of payments crises in May 2011, sparking inflation.

The central bank responded by raising interest rates from 10.5 percent in January 2011 to a high of 45 percent in December 2011. But in February last year the central bank started cutting rates.

This year the central bank expects its refinancing rate to fall to 13-15 percent by the end of the year due to falling inflation.

Ukraine cuts rate 50 bps to 7% to spur economic growth

By www.CentralBankNews.info Ukraine’s central bank cut its benchmark discount rate by 50 basis points to 7.0 percent to boost lending and spur economic activity while inflation remains close to zero.

The National Bank of Ukraine, which last cut its rate in March 2012, said the new rate would be effective from today, June 10, following a board meeting on June 6.

Ukraine has suffered from deflation in the last 12 months with the headline inflation rate at minus 0.4 percent in May compared with minus 0.8 percent in April.

In 2012 inflation averaged 0.6 percent. In 2013 and 2014 the central bank targets consumer price inflation in a range of 4.0 to 6.0 percent and between 3.-0 and 5.0 percent in 2015.

Ukraine’s economy expanded by 0.6 percent in the first quarter from the fourth, reversing an 0.8 percent quarterly decline, for an annual contraction of 1.1 percent, less than the 2.5 percent annual fall in the fourth quarter and the 1.3 percent drop in the third quarter of 2012.

In 2012 Ukraine’s Gross Domestic Product grew by 0.2 percent and the International Monetary Fund estimates it will stagnate this year.

Turkey: A Reminder that Emerging Markets are Not Always Warm and Fuzzy

When you hear a mention of Turkey, it conjures up certain mental images. The Aya Sofya in Istanbul…ships passing through the Bosphorus…mustachioed men selling doner kebabs out of pushcarts.

And, unfortunately, military coups d’état and baton-wielding riot police.

Turkey has become a little softer around the edges over the past decade as economic growth and political reform have made the country more Western in many respects. And investors had begun to notice.

In May of this year, Turkey was upgraded to “investment grade” by Moody’s, the ratings agency, and up until recently the country was enjoying “China-like” growth rates in the high single digits. Investors had begun to lose interest in the high-profile “BRICs” countries and had started looking elsewhere for growth, and Turkey seemed a fine destination.

From January of 2012 to the recent high in May of this year, the Turkish stock market was up by more than 80%. And this is even more noteworthy when you consider that the European Union—Turkey’s most important trading partner—has been mired in recession and crisis for most of that time.

And then it all came crashing to a halt. From its May 22 high, the Turkish market is down nearly 20% and the iShares MSCI Turkey ETF ($TUR)—the primary vehicle for most American investors to get access to the Turkish market—is down further.

What happened? A series of riots broke out across the country demanding that a popular park be spared from development, and the prime minister—who, though controversial, has up until now been broadly popular—reacted the way you might have expected a Turkish general of old to react: with crushing force.

Fearing political instability and a return to Turkey’s chaotic past, investors dumped their shares and fled the Turkish markets.

So what now? After the bloodletting, are Turkish stocks attractive again?

I would like to say yes. Even after their spectacular gains of recent years, Turkish stocks are among the cheapest in the world, trading at just 10 times earnings. You would have to go to neighboring Greece or to places not known for being friendly to investors—think Argentina or Russia—to find cheaper.

Yet you don’t want to try to catch a falling knife. If the hot money has decided that the Turkish “story” is over, then it will take them time to unwind their positions and move on, which will mean more downside pressure in the near term.

I, for one, still like the Turkish growth story, and I expect that 6 months from now these riots will be a distant memory. But I sold my shares of TUR and I do not intend to buy them back until the dust settles.

Action to take: Put TUR on your watch list. This is a great long-term growth play. But wait until prices have stabilized to buy. Alternatively, you can take a play out of John Templeton’s playbook and place GTC limit orders at prices far below today’s market price. That way, if the market gets pushed temporarily lower due to panic selling, you can snag shares on the cheap.

This article first appeared on TraderPlanet.

SUBSCRIBE to Sizemore Insights via e-mail today.

Central Bank News Link List – Jun 10, 2013: Turkey’s Erdogan vows to “choke” financial speculators

By www.CentralBankNews.info Here’s today’s Central Bank News’ link list, click through if you missed the previous link list. The list comprises news about central banks that is not covered by Central Bank News. The list is updated during the day with the latest developments so readers don’t miss any important news.

- Turkey’s Erdogan vows to “choke” financial speculators (Reuters)

- German top court likely to say “yes, but’ to ECB policy (Bloomberg)

- Uruguay to change monetary policy strategy to fight inflation (Reuters)

- Exit strategies, spillovers vex G20 finance officials (Reuters)

- Poland may intervene again to curb zloty volatility-central bank governor (WSJ)

- Monsoon to matter in India’s monetary policies: Subbarao (FirstPost)

- BOK to freeze key rate in June following May’s cut: poll (Yonhap)

- Fresh SDA rate cuts expected this week (Business World)

- China tipped to cut rates to revive sagging economy (ibtimes)

- Chile annual inflation slows to 0.9 pct, rate cuts eyed (Reuters)

- China central bank ready to unveil deposit insurance (Xinhua)

- BOT unfazed by capital outflows, says official (The Nation)

- Colombia central bank may alter dollar-buying: monetary official (Reuters)

- ECB says bond-buying program is unlimited (Reuters)

- Burma to revamp central bank with new law (The Irrawaddy)

- Exit strategies, spillovers vex G20 finance officials (Reuters)

- www.CentralBankNews.info

Precious Metals Bounce, But Rally Seen “Over” as US Fed Tapering Talk Hits Emerging Markets

London Gold Market Report

from Adrian Ash

BullionVault

Mon 10 June, 08:25 EST

The GOLD PRICE rallied from a 1-week low at $1376 per ounce Monday morning in London, edging back up to $1383 as world stock markets rose.

Silver fell within 20¢ of mid-May’s 30-month low, before rallying to $21.80 per ounce.

Commodity prices fell after weaker-than-expected Chinese industrial data. US Treasury bonds also slipped in price once again, nudging interest rates on 10-year debt up to 2.17%.

The gold price “conclusively broke back down through $1400 and stayed there” following Friday’s release of US Non-Farm Payrolls data for May, says the latest daily note from brokers Marex Spectron.

But “the market is well ahead of itself in thinking the Fed will soon pare back on their stimulus,” reckons Danske Bank’s head of fixed-income trading Soeren Moerch, pointing to the slight uptick in the US jobless rate shown in Friday’s official data.

Now at 7.6%, the unemployment rate is well above the 6.5% level previously named by US Federal Reserve chairman Ben Bernanke as key to any review of target interest rates.

“The latest employment news,” says one gold price analyst, “supports our view that the [US Federal Reserve’s] asset purchase programme will not start to ‘taper’ until the latter part of this year.”

But Fed officials “are likely to signal at their June policy meeting that they’re on track to begin pulling back their $85-billion-a-month bond-buying program,” writes the Wall Street Journal’s Jon Hilsenrath – dubbed “Fed wire” for his apparent connections to the US central bank.

“The recent recovery [in the gold price] is over,” Bloomberg today quotes Richard Adcock, technical strategist at London bullion market-maker UBS.

“The next leg of the bear trend is to be seen down to the long-term 50% retracement point at $1303, which we would set as our objective.”

Other analysts point to a trading range with either $1360 or $1375 at the bottom, with a move above $1420 needed “in order to escape the downward trend” according to German refining group Heraeus in a note.

Even before Friday’s jobs data, “News out of India had already weighed on gold,” says Heraeus.

Last week’s import duty rise from 6% to 8% for gold going into India – the world’s No.1 gold-buying nation – in will cut foreign-currency outflows and so help reduce the country’s current account deficit, spokesmen for the Finance Ministry said at the weekend.

“The prospect of lower inflation and [lower] gold imports [is] good news for the Rupee,” agrees Singapore fund manager Samir Arora of Helios Capital.

The Indian Rupee today fell to new all-time lows at worse than 58 per Dollar.

“I think this is panic in the market which is unwarranted,” economic affairs secretary Arvind Mayaram told journalists Monday, pointing to concerns that tighter US policy would hurt investment flows to India.

“[The Fed] have now more than clarified that this [tapering of QE] is not imminent. Neither is it something which will happen quickly.”

“What’s happening today is not India-specific,” says J.P.Morgan’s chief India economist, Sajjid Chinoy, quoted by the Financial Times.

“Emerging markets are bleeding [money] across the board.”

Speculative traders in US futures and options meantime grew their overall bullishness on gold in the week-ending last Tuesday, latest data from regulator the CFTC show – the first such rise in two months.

The so-called “net long” of bullish minus bearish bets held by non-industry players rose by 13% to the equivalent of 204 tonnes – only the 7th week-on-week rise out of 23 weeks so far in 2013.

Compared to New Year, however, the total net long remained below one-third the size. It was less than one-fifth the record levels of summer 2011.

“Silver [positioning] followed the recovery in gold,” says the weekly analysis from Standard Bank in London.

“Unlike for gold, it was an addition to speculative longs that drove the overall improvement…avoiding a push into negative territory which had seemed imminent.”

Gold price chart, no delay | Buy gold online

Adrian Ash is head of research at BullionVault, the secure, low-cost gold and silver market for private investors online, where you can buy gold and silver in Zurich, Switzerland for just 0.5% commission.

(c) BullionVault 2013

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.