By www.CentralBankNews.info Nigeria’s central bank held its monetary policy rate (MPR) steady at 12.0 percent, as expected, with its policy committee rejecting a proposal to cut rates due to slower growth and core inflation because “it could send the wrong signals of a premature termination of an appropriate tight monetary stance” and “signal the preference for a higher inflation rate.

The Central Bank of Nigeria (CBN), which started tightening policy in September 2010 and last raised rates by 275 basis points in October 2011, said rising inflationary pressures in February indicated “factors that could constitute a threat to inflation in the medium term.”

The bank’s monetary policy committee voted by 9:3 to hold rates steady and rejected a proposal to raise rates as there were no major inflationary concerns at this time.

Nigeria’s inflation rate ticked up to 9.5 percent in inflation from 9.0 percent in January, largely reflecting the base effect of the first and second round impact of the removal of fuel subsidy in January 2012 and thus sending a clear signal that there was still a risk of inflation in the near-to-medium term.

The central bank targets inflation of 10 percent but is working to get inflation toward 6 percent.

Taking note of an approximate 5 percent rise in the 2013 federal government budget, which is based on an oil benchmark price of $79, “potentially slows down the pace of fiscal consolidation.”

Nigeria’s Gross Domestic Product rose by an annual rate of 6.99 percent in the fourth quarter, up from 6.48 percent in the third quarter.

For 2012 Nigeria’s real GDP growth eased to 6.58 percent from 7.43 percent in 2011, mainly due to a 0.91 percent contraction in the oil sector. The main driver of growth was thus the non-oil sector, with agriculture contributing with 1.37 percent, wholesale and retail trade with 2.19 percent and services with 2.10 percent, the central bank said.

Growth projections for this year are “relatively robust,” the bank said, noting there are risks of “increased levels of corruption and impunity in the country, insecurity particularly in the northern part of the country, as well as mixed signals from power and petroleum sector reforms.”

The central bank said growth in the domestic capital market, where bond yields have been declining steadily and equity prices were trending upwards, was due to the impact of “huge capital inflows” and quantitative easing, especially in the U.S. and the EU “is already creating a potential new round of asset bubbles globally.”

The principal risk to stability from these inflows can only be addressed through fiscal consolidation and structural reform and without these the economy will not be able to attract the long term capital inflow that can help insulate the economy from the risks of external shocks and capital flow reversals, the central bank said.

The Cyprus Crisis and What It Means For Investors

I’ll give the European Union credit: at least they are creative at finding new ways to upset the world’s capital markets.

Instead of demanding just the usual austerity measures of higher taxes and lower spending—and a potential haircut on speculative creditors such as hedge funds—the EU bailout negotiators insisted over the weekend on extracting a pound of flesh from the customers of Cypriot banks. Savers would see as much as 10% of their checking and savings accounts expropriated to help cover the cost of the bailout, and the levy would apply even to accounts insured by the Cypriot equivalent of the FDIC.

Ouch.

Needless to say, the news didn’t go over well in Cyprus; it led to a small-scale bank run as depositors rushed to get to their cash. It also didn’t go over particularly well in Russia. Cyprus is notorious as a haven for Russian funds of…ahem…questionable origins. Roughly a quarter of all Cypriot bank deposits are owned by Russians.

As I’m writing this, it looked likely that Cyprus’ parliament would shoot down the bailout agreement hammered out between the government and the European Union on the grounds that it wasn’t fair to small local savers who assumed their deposits were protected by government guarantee. (Imagine any democrat or republican approving something like that here; it would be political suicide.) The government is also reluctant to “soak the Russians” out of fear that it will destroy confidence so badly as to end Cyprus’ existence as an offshore financial center. And I can’t say I blame them for not wanting to anger the Russian mafia dons or Russian President Vladimir Putin. That’s not good for your health.

So what happens now?

Good question. My best guess is that the deal is slightly tweaked to allow the Cypriot government to save face but that the bailout goes through and the depositors get hit. Politically, German Chancellor Angela Merkel and French President Francois Hollande cannot ask their taxpayers to come to the rescue of dirty Russian money, nor should they.

If the bailout flops, the options quickly get messy. I don’t see the EU backing down this time and watering down the deal, nor do I see the European Central Bank continuing to provide emergency liquidity. This means that without the bailout, the Cypriot banking system will collapse, and given that the banking system is eight times larger than the economy, there is no way that Cyprus will be able to make its depositors whole. Barring some sort of last-minute emergency loan from Russia (which would presumably come with some pretty wicked strings attached), Cyprus either accepts the EU bailout and goes about its business or it drops the euro, issues a new currency, and then falls into hyperinflationary oblivion.

What does this mean for the Eurozone?

The fear was that seizing bank deposits would set a terrible precedent and lead to bank runs in Spain, Italy and other indebted countries and plunge us back into crisis mode. Once bank depositors are seen as a viable target, you create a slippery slope.

But judging by the market’s reaction, this is a non-event. European stocks took a small hit on the news, though it caused nothing like the turmoil over Greece, Spain and Italy last year. Bond yields in these problem countries spiked up but hardly to levels that would cause alarm.

There are a couple reasons why the bank run didn’t happen…or at least hasn’t happened yet. To start, Spain and Italy already effectively had bank runs last year. Funds have been leaking out of both since the onset of the crisis, and their respective banking systems have been kept solvent by the ECB. But more basically, it’s an open secret that Cyprus is a haven for dirty money (wink wink), and investors see clear differences between their own banking systems and that of Cyprus.

There is also the “Draghi Put,” or the belief that ECB President Mario Draghi will live up to his word to do “whatever it takes” to keep the euro intact. This, more than anything, has been what has stabilized the Eurozone over the past nine months.

And finally, don’t underestimate the effects of “crisis fatigue.” After three years of crisis, these sorts of headlines simply don’t have the ability to move the market like they used to.

Things could still get very ugly very fast in Europe if the feared contagion finally does happen. But for now, it looks as though this too shall pass.

Cyprus may choose to leave the Eurozone before this is over or may well become a Russian client state; anything is possible at this point. But I don’t see any of these outcomes changing the direction of events. The Eurozone will undergo deeper integration. With or without Cyprus, the rest of the Eurozone will sink or swim together.

This makes things a little awkward for non-Eurozone EU members like the UK, Sweden and Demark. But even as the cumbersome, confusing mess it is, the Eurozone will muddle through.

How are we to invest in this environment? I would recommend using any sell-offs to accumulate shares of some of Europe’s finest companies. One in particular I like at current prices is Spanish telecom giant Telefonica (NYSE:$TEF). Telefonica is quietly paying down its debts, and I expect the company to reinstate its dividend within the next 1-2 years. In the meantime, it’s an excellent way to get exposure to the growing markets of Latin America, where it gets more than half its revenues.

SUBSCRIBE to Sizemore Insights via e-mail today.

Disclosures: Sizemore Capital is long TEF.

The post The Cyprus Crisis and What It Means For Investors appeared first on Sizemore Insights.

“Safe Haven Demand” for Gold Seen Amid Fresh Cyprus Chaos, But #1 ETF Shrinks Again

London Gold Market Report

from Adrian Ash

Tues 19 Mar, 09:35 EST

The GOLD PRICE continued to hold above $1600 per ounce in Asian and early London trade on Tuesday, easing back from Monday’s 3-week high as world stock markets struggled again amid fresh uncertainty and rumor over Euro-member Cyprus’ banking crisis.

Silver below $29 per ounce held flat alongside other commodities, while major-government bond prices rose.

Ahead of the US Federal Reserve’s 2-day policy meeting, 10-year Treasury yields edged down to 1.94% per year.

Consumer price inflation was reported at 2.0% on Friday.

“[The Eurozone’s] long-running problems…are not going to be resolved quickly,” said New Zealand’s finance minister Bill English in an interview this morning.

“I think over the next five to seven years, you’re going to see these occasional outbreaks of [Eurozone] anxiety in quite unexpected ways.”

Following Monday’s jump in the gold price, “Whether this will be enough to push prices sustainably higher remains to be seen,” notes the latest Precious Metals Update from German refining group Heraeus.

“In the past, such measures fuelled investors’ uncertainty and gave a boost to bullion demand.”

Monday saw turnover in US gold futures contracts jump 28% from the previous week’s average, but the outstanding number of open contracts was barely changed by session’s end.

The giant SPDR Gold Shares – briefly the world’s biggest exchange-traded trust fund when Dollar gold prices peaked in late-summer 2011 – saw yet another outflow from its holdings, down for the 32nd time this year to a 20-month low beneath 1,220 tonnes.

By value the SPDR Gold ETF slipped beneath $63 billion for the first time since July 2011.

Silver ETF holdings, in contrast, rose to a new all-time record at 19,738 tonnes according to Bloomberg data.

Silver prices again touched $29 per ounce in Asian and early London trade today, before slipping back unchanged from last week’s finish.

“We now see the gold market building a solid base at [$1600 per ounce],” says a London bullion-bank trader in a private note, with “the fundamentals for gold as a ‘safe-haven’ coming back in force.”

“For as long as there is a lack of clarity,” agrees today’s note from Commerzbank, “and especially if the situation should escalate, gold should continue to remain in high demand as a safe haven.”

Cyprus last night declared an emergency 3-day Bank Holiday, giving parliament time to argue and vote on the proposed “bail-in” which would cut bank deposits below €100,000 by 6.75% and by 9.9% above that level.

Nicosia’s finance ministry has now proposed a “zero levy” on savers with less than €20,000, according to the BBC.

After the Kremlin in Moscow said it may call in a €2.5 billion loan to Cyprus in retaliation for the tax hitting Russian savers, energy giant Gazprom this morning denied Greek press reports that it has offered to pay all of Cyprus’s €16bn rescue in return for oil and gas exploration rights.

“Cyprus is shaking…the people are bleeding,” says editorial comment in German tabloid newspaper Bild.

Publicly criticizing the levy on German TV on Saturday, German finance minister Wolfgang Schaeuble had in fact “demanded a 40% depositor tax” according an un-named Cypriot official quoted by Bloomberg.

“The blackmail…peaked at 3.00am on Saturday,” according to local reports, when Germany’s Jorg Asmussen apparently phoned European Central Bank president Mario Draghi, and told him to prepare the ECB for the collapse of two Cypriot banks.

Looking ahead meantime to Wednesday’s updated Budget from the UK’s coalition government, “There is little room to move on fiscal policy,” says FX strategist Simon Derrick at BNY Mellon.

“[So] monetary policy remains the principal tool for providing additional support to the economy.”

“With the economy flatlining,” agrees analysis from HSBC bank – also quoted by CNBC – “the mood music certainly suggests some sort of change [to the monetary policy framework] is on the cards.”

Japan’s central-bank governor Shirakawa last night ended his term and was replaced by so-called “radical inflationist” Kuroda.

The Bank of Japan has already set itself a 2.0% target for annual inflation.

The Japanese Yen has lost almost one-fifth of its value against the Dollar since the new Abe administration took over in November.

Indian gold prices meantime rose Tuesday as the Rupee fell hard – and the Mumbai stock market dropped 1.5% – following an interest-rate cut and news that the ruling coalition government has lost the support of a key member party.

“With the federal elections next year,” Reuters quotes Bank of Baroda economist Rupa Rege Nitsure, “political stability is key for all economic reforms” planned in the world’s No.1 gold consumer nation, now struggling with a large balance of trade deficit.

“[The exit of the Dravida Munnetra Kazhagam party] will surely delay them.”

Gold price chart, no delay | Buy gold online

Adrian Ash is head of research at BullionVault, the secure, low-cost gold and silver market for private investors online, where you can buy gold and silver in Zurich, Switzerland for just 0.5% commission.

(c) BullionVault 2013

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

Final Deal on Cyprus Rescue Package Still Pending and the U.S. Dollar Suspended its Growth

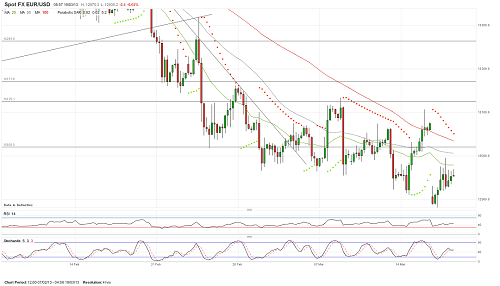

EURUSD

The bulls failed to close the gap, with which the EURUSD pair was opened yesterday. But the bears could not manage to move below 1.2881. There, the euro made an attempt to recover, which was limited by the 1.2996 level, while pullbacks were facing the demand on the approach to 1.2920. Thus, the pair spent the day in a narrow range. It remains under pressure, and testing of the support at 1.2880 still looks likely. Only the pair growth and ability to consolidate above 1.3125 would indicate the end of the downward trend.

GBPUSD

Against the background of the situation in Cyprus, the British pound has become more attractive in comparison with the euro, allowing the GBPUSD afloat above 1.5074 so far. This time, the pound is to overcome the resistance in the 1.5200-1.5220 proximity and fixe above it. Possible reduction in the GBPUSD will contribute to it, and then the GBPUSD may increase to 1.5300. The loss of the current support would cause the reduction to 1.5000.

USDCHF

The USDCHF was trading in a range yesterday. There, the support is at 0.9415 and the resistance — near 0.9480. None of these levels has not been passed, though the dollar continues to trade on a positive note, which enabled it to recover after the drop to 0.9378. If the bulls manage to overcome 0.9480, the pair will test the strong resistance at 0.9555 once again. The loss of 0.9378 would weaken the bullish momentum and cause the decrease to 0.9308.

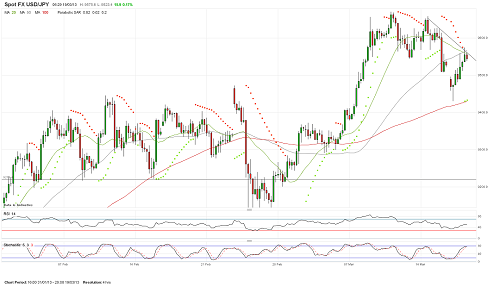

USDJPY

Yesterday, the USDJPY opened the gap and dropped to 94.07, but the downward movement was not developed again, thus the pair returned to 95.60. During the Asian session on Tuesday, the growth continued and the dollar increased to 95.75. Here on the 4 hour chart the 20-day converge together with the 50-day one, which gives hope for the sufficiently strong resistance formation so that the Japanese currency could try to develop its downward correction. The pair’s growth above would deprive the bears of hopes for it.

Major global banks narrow capital shortfall to 3.7 bln euros

By www.CentralBankNews.info The world’s major banks have bolstered their capital base by 8.2 billion euros during the first half of last year and now only have a shortfall of 3.7 billion euros under the new Basel III 4.5 percent minimum capital requirement, global banking supervisors said.

In its latest assessment of how global banks would do under the new global banking rules that are being phased in, the average common equity Tier 1 (CET1) for so-called Group 1 banks – international banks with Tier 1 equity in excess of 3 billion euros – fell to 8.5 percent from 10.8 percent at the end of 2011, reflecting regulatory changes.

For the 7.0 percent minimum capital ratios, which includes surcharges for the systemically-important banks, the aggregate equity shortfall plunged by 45.8 percent to 208.2 billion euros, the Basel Committee on Banking Supervision (BCBS) said.

To put the capital shortfall into perspective, the BCBS said the sum of after tax profits for all the Group 1 banks between July 1, 2011 and June 30, 2012 was 379.6 billion euros.

For smaller, internationally-active banks, the so-called Group 2, the capital shortfall is estimated at 4.8 billion euros under the 4.5 percent minimum capital requirement and 16 billion for the 7 percent capital requirement.

The ambitious Basel III banking rules were agreed by global leaders in 2010 in an effort to strengthen the global financial system following the 2008 global financial crises. The rules raise capital charges on banks around three times and impose much stricter supervision, especially on major, globally-active banks.

The rules are being phased through January 2019 to make sure that banks can still lend and stimulate economic growth while strengthening their capital positions so they can better withstand a crises.

In order to evaluate how the new capital rules affect banks, the Basel Commission – which comprises regulatory authorities from almost 30 jurisdictions – has carried out two prior surveys, assuming that banks fully implement the Basel III rules.

The latest survey, which is based on data from June 30, 2012, includes 210 banks, of which 101 banks belonged to Group 1 and 109 from Group 2.

Click for full details of the Basel Committee’s latest survey.

www.CentralBankNews.info

Central Bank News Link List – Mar 19, 2013: Cyprus overshadows bank union, ECB prepares as watchdog

By www.CentralBankNews.info Here’s today’s Central Bank News link list, click through if you missed the previous link list. The list comprises news about central banks that is not covered by Central Bank News. The list is updated during the day with the latest developments so readers don’t miss any important news.

- Cyprus overshadows banking union as ECB prepares for watchdog role (Reuters)

- PBOC adviser: Inflation to slow, no hurry to tighten policy (dow jones)

- Kuroda gets BOJ monetary-policy-fixer as Amamiya returns (Bloomberg)

- Nigerian central bank set to keep key rate at record high (Bloomberg)

- New Zealand’s dollar overvalued says English; currency falls (Bloomberg)

- RBA leaves door open to rate cut (dow jones)

- IMF: Switzerland should consider temporary negative interest rates (dow jones)

- Uruguayan economy expanded between 3% and 3.5% last year – central bank (mercopress)

- www.CentralBankNews.info

India cuts rate, but says has limited room to cut further

By www.CentralBankNews.info India’s central bank cut its policy rate by 25 basis points to 7.50 percent, as expected, but said it had limited to room to cut rates further given the inflationary pressures and the risks from the current account deficit.

The Reserve Bank of India (RBI), which cut its rate by 25 basis points in January following cuts of 50 points in 2012, said headline inflation is expected to be range-bound around current levels in the coming 2013/14 fiscal year but there are “adverse implications for inflation expectations” from elevated food prices and increases in minimum support prices (MSP) that is driving a wedge between wholesale and retail price inflation.

While exports the trade deficit narrowed in February due to higher exports and lower non-oil imports, the RBI said the current account deficit in the first 11 months of the current fiscal year widened from last year.

“Although capital inflows, mainly in the form of portfolio investment and debt flows, provided adequate financing, the growing vulnerability of the external sector to abrupt shifts in sentiment remains a key concern,” the RBI said, adding:

“Accordingly, even as the policy stance emphasises addressing the growth risks, the headroom for further monetary easing remains quite limited.”

The RBI welcomed the government’s commitment to fiscal consolidation, noting that the deficit to GDP ratio for 2012/13 fiscal year, which ends in March, was contained around the budgeted level of 5.2 percent and expected to decline to 4.8 percent next year and 3.0 percent in 2016/17.

Expansion of India’s Gross Domestic Product in the third quarter of 2012/13 of 4.5 percent was the weakest in the last 15 quarters, with the RBI saying it was worrisome that the services sector – the mainstay of growth – had decelerated to its slowest pace in a decade.

And there are several risks to the global outlook, including the impact of fiscal cuts in the United States and risks to determined policy actions in advanced economies with a significant risk of spillovers to emerging economies. While global inflationary pressures are likely to be subdued, some emerging markets could face elevated energy prices.

India’s economic growth for 2012/13 is expected at 5 percent, the slowest growth in a decade, and below the RBI’s forecast of 5.5 percent.

The key to reinvigorating growth, the RBI said, was to accelerate investment and “the government has a critical rose to play in this regard by remaining committed to fiscal consolidation, easing the supply bottlenecks and improving governance surrounding project implementation.”

India’s inflation rate as measured by wholesale prices, the main inflation gauge, rose slightly to an annual rate of 6.84 percent in February from January’s 6.62 percent, above the RBI’s comfort level of 5 percent.

“However, the unrelenting rise in food inflation is keeping headline wholesale price inflation above the threshold level and consumer price inflation in double digits,” the bank said, adding that there are latent pressures from administered prices and this is complicating the task of managing inflation and “underscores the imperative of addressing supply side constraints.”

“The foremost challenge for returning the economy to a high growth trajectory is to revive investment. A competitive interest rate is necessary for this, but not sufficient. Sufficiency conditions include bridging the supply constraints, staying the course on fiscal consolidation, both in terms of quantity and quality, and improving governance,” the RBI added.

The Shocking Truth About Insider Selling

Riddle me this, Batman…

In the last week, the Dow hit an all-time high. Yet corporate insiders are selling shares of their own stock at the fastest pace in over a decade.

As of late February, the ratio of the number of shares that insiders sell in a given week to the number they buy almost hit 10 to 1, according to Vickers Weekly Insider Report.

That must be a sign that a turn in the market is imminent, right? Or, at the very least, that company executives don’t feel optimistic about the economic outlook.

After all, corporate insiders always know best.

Or do they?

Since Tuesday is as good a day as any to bust a Wall Street myth wide open, let’s put this one to the test.

Newsflash: Insiders Don’t Possess Superhuman Investing Skills

The rationale for following an insider’s lead couldn’t be more straightforward: No one knows a company better than a corporate insider.

So, if insiders are buying, then they must be optimistic about the company’s outlook. And if they’re selling, well… not so much.

Unfortunately, though, the data doesn’t back up such simple logic…

As Jim Stack of Investech demonstrates with his annotated chart of the Dow, insider selling has been a terrible indicator of when this bull market is going to end.

More specifically, since 2009, every time insider selling ramps up, the mainstream financial headlines predictably urge caution. But the stock market ends up charging higher and higher.

Insiders: The Most Unreliable Stock Market Indicator?

Lest you think the chart above is some rare anomaly related to the current bull market – and that insiders are otherwise capable of predicting market turns – consider a more comprehensive history of insider buying and selling, courtesy of Stack…

- In late 1982, as the Dow approached a level it couldn’t top in 17 previous years, insider selling hit its highest level in a decade. Did stocks fall shortly thereafter? Nope. They kept rallying for another five years.

- One week before the infamous 1987 market crash, insider buying – not selling – reached a record high level. So they were completely caught off guard, too.

- In 1991, as stocks rallied out of the 1990 recession, insider selling spiked – indicating that the market would eventually plummet. But the bull market lasted another eight years, without a single 10% correction along the way.

- In May 1999, insider buying hit an eight-year high right before the peak of the dot-com bubble. Again, insiders proved terrible at predicting a market turn.

Add it all up, and as Scott Wren, Senior Equity Strategist at Wells Fargo Advisors, says, “[Insiders] react to fear and greed and are just as uncertain as to what is going to happen in the future [as every other investor].”

Accordingly, we shouldn’t blindly follow their lead.

Lies, Damn Lies and Statistics

If you’re still not convinced that you should ignore the latest bout of insider selling, chew on this:

According to Nejat Seyhun, a professor at the University of Michigan, insiders actually aren’t that bearish after all.

Instead, the headline figures are being heavily skewed by “mega sales” – a large number of shares being sold by a handful of insiders.

Or, as Mark Hulbert of MarketWatch puts it, the headline insider sales numbers don’t “tell the whole story.”

Forget the whole story, Mark. They don’t tell the true story!

It turns out that the overwhelming majority (90%) of shares sold by insiders in February were mega sales. And if we subtract them out, Seyhun says the ratio of insider selling to buying is actually 10% below its average level of the past 12 months – and right in-line with the average level over the last decade.

In other words, even if you want to put your faith in insiders, there’s nothing to worry about based on their latest activity.

Bottom line: Don’t ever take financial headlines at face value. They seldom tell the whole (or true) story. And you definitely shouldn’t rely solely on insiders to govern your investment decisions. They’re just as unreliable.

Ahead of the tape,

Louis Basenese

Article By WallStreetDaily.com

Original Article: The Shocking Truth About Insider Selling

Your Retirement or Your Mortgage?

Back when we launched The Money for Life Letter (an investment service designed to help ordinary Aussies plan for retirement), two news stories hit the press.

The first was about British retirees turning to gambling to pay off their debts.

People across the UK found themselves without a job, but with an enormous mortgage and houses worth less than the loan against them. In a last ditch effort, they turned to the national lottery to try and salvage their finances.

Imagine gambling on the lottery just to pay off your mortgage.

As you can probably guess, it doesn’t work out well most of the time. But even if it did work, people who won the lottery are left with very little after settling their debts with the bank. That makes you realise just how crazy all this property speculation really is. Even winning the lottery might only set you free from the bank’s grasp.

But the second news story was even more frightening…

According to an article in the Guardian, elderly Japanese are turning to petty crime to pay for their daily expenses. Deflation, demographics and low interest rates have taken their toll over twenty years. They left a huge proportion of Japanese society broke. Now retirees shoplift for basic necessities and a cheap thrill.

But it’s when they get caught that things get surreal. The Guardian explains what you might see in a typical Japanese prison:

‘Pills and porridge: prisons in crisis as struggling pensioners turn to crime.‘Charts on their cell doors stipulate special dietary requirements and medication regimes. A handrail runs the length of the corridor, and makeshift wheelchair ramps are kept at the entrance to the communal baths.

‘But the most common condition afflicting these men is loneliness. Some serve their sentences without seeing a single visitor. Their relatives are either dead, live too far away or, unable to cope with the shame of having a criminal in their midst, have ceased all contact.

‘The rise of the superannuated criminal is only partly explained by Japan’s rapidly ageing population. While the number of Japanese aged 60 and over grew by 17% between 2000 and 2006, the number of prisoners in the same age bracket soared by 87%.

‘The prisoners repay their debt by performing six hours a day of light manual labour, two less than Onomichi’s younger prisoners. Every few minutes, one of the men lays down his tools and shuffles to a makeshift pharmacy set up in the corner of the room, where the prison doctor dispenses pills that must be washed down on the spot with tiny cups of water.

‘As many as 80% of the inmates here have high blood pressure or diabetes. There is a portable mattress on hand in case anyone feels faint, along with a wheelchair and, placed discreetly behind a desk, boxes of incontinence pads.’

All this must seem very distant from you and your retirement plans. But the first cracks in Australia’s retirement system are already appearing. And we haven’t even had a crisis yet.

Choosing Between Your Retirement and Your Mortgage

Imagine you tipped the Gold Coast Titans to beat the Canberra Raiders by more than 30 points last week. Your betting account is up several thousand dollars as a result. Being a responsible person, and acknowledging the Titans’ prospects for the rest of the season, you decide to do something more constructive with the money.

If you had to choose between saving for retirement and paying off your mortgage, which would you choose?

It’s an incredibly tough question to answer. There are all sorts of factors. Theoretically, the correct answer has something to do with what you do with your retirement savings.

If you invest in shares that go up 10%, and your mortgage costs you 7%, you would be better off investing. But that’s a very crude analysis. It’s not like you know how well your investment will do. And there are all sorts of tax implications, not to mention your bank’s rules on paying down your mortgage early.

It turns out Australia’s retirement system guardians are already panicking about this issue. Not gambling, but the idea that people will get the decision between their mortgage and retirement savings wrong.

Never mind choosing whether to pay off the mortgage or boost your retirement savings. CPA Australia (an accounting group) has issued a warning that Australian retirees are prone to using their retirement savings to pay off their enormous debts when they retire.

Channel 7 did a story on CPA Australia’s report. Here’s an excerpt of the transcript to give you an idea of how sensationalist their claims are:

Presenter: ‘A peak accounting body has expressed concerns about the future of Australia’s retirement funding system…a warning that the system could collapse if retirees are given too much freedom in how much money they spend.’

Alex Malley, CPA Australia: ‘The consequences are catastrophic for Australia if we don’t get the process of Superannuation right.’

Presenter: ‘Accountants say our taste for bigger and better homes and lavish retirement living has long term consequences.’

Alex Malley, CPA Australia ‘When people retire, they’re going to take that lump of…superannuation and they’re going to extinguish the debt. Which will mean they have no income and they’ll need to go on the pension.’

The solution is supposedly to limit the lump sum payment you can take out on the day you retire. We can’t have you deciding what to do with your money, can we?

It’s remarkable that Australians are still in so much debt when they retire that this is such a big concern. Again, that shows you the costs of abnormally high house prices.

But the accounting body’s argument doesn’t make much sense. They say you should stay invested to secure an income. But if the mortgage chews up that income, it’s not much good. You might be better off using your savings to pay off the loan, if that saves you from paying more interest.

For example, if you’re getting $1500 dollars a month in income from your retirement investments, but your mortgage costs you $1600, then the loss of income from investments is only half the story. You also lose an expense by selling out of your retirement investments and paying off the debt. Owning your home outright has its own non-financial benefits too.

Of course the better option is not to get into that position in the first place. That’s why it pays to plan ahead long before you retire.

Balancing your mortgage and retirement savings is one of the most delicate issues of retirement. There are a bundle of ‘outside the box’ solutions which we’ve featured in The Money for Life Letter.

One of the most controversial involves a way to extinguish a mortgage while still keeping your home. Just so you know, not everyone with a mortgage will be in a position to do this. It’s all got to do with Australia’s very own sub-prime debt crisis. But unlike in America, Australian borrowers fought back and won.

What nobody has realised just yet is that, in Australia, it isn’t just sub-prime type debt that’s caught up in the scandal. Normal mortgages can have the same crucial fault that has allowed borrowers to cancel their debts.

But how do you know if you qualify to cancel your debt?

Well, only those borrowers who bother to make three phone calls and examine some paperwork will ever know whether they really need to pay ‘that bill’ every month. Instead, they might be able to live mortgage free, own their home, and have the income from their retirement investments.

You can find out just how you might be able to cancel your mortgage any day now. Keep an eye out for the video presentation and special report.

Nick Hubble

Editor, The Money for Life Letter

From the Port Phillip Publishing Library

Special Report: Australia’s Energy Stock BLOWOUT

Daily Reckoning: Drama in Europe’s Economy: Savers ‘Suffer for Cyprus’

Money Morning: Get Used to This Stock Market Action, It’s Set to Last…

Pursuit of Happiness: Where Cyprus Got the Idea for its Savings Raid

From the Archives…

Can This Indicator Predict The Dow Jones Next Move?

16-03-2013 – Kris Sayce

Seven Situations to Watch in the Pacific Currency War

15-03-2013 – Dan Denning

Stock Market Warning: Next Week Could be a Blood Bath

14-03-2013 – Murray Dawes

REVEALED: One Opportunity to Escape Your Mortgage

13-03-2013 – Nick Hubble

UK Property: How You Can Buy a House For Less Than 250 Grand

12-03-2013 – Dr. Alex Cowie

Government Theft in Cyprus

Here’s a scenario for you.

You wake up one morning. Over the radio, you hear that the government has said that all the banks are bust. Everyone is going to have to sacrifice 10% of their savings to bail the system out. It’s the only solution.

Now, you’ve only got 20,000 in the bank. You know up to 85,000 is insured under the nation’s deposit protection scheme. So you think you’re covered.

Not so. Turns out the 10% fee is a tax. A ‘wealth’ tax, if you like.

So you lose 2,000 of your savings anyway, even although you thought you were playing by the rules.

Sound unfair? I’m sure the residents of Cyprus would agree with you. Because that’s exactly what happened to them this weekend.

And the ramifications will spread well beyond their little island…

How Cyprus Ending Up Robbing its Savers

The banking system in Cyprus is about eight times the size of the country’s economy.

And, as Hugo Dixon of Reuters points out, due to its exposure to Greece and its ‘own burst property bubble,’ it is bust.

Meanwhile, the European Central Bank was threatening to cut off emergency funding to the banking system if some sort of bailout deal couldn’t be sorted out.

In all, Cyprus needed around €17bn – 100% of GDP – to save the banking system and pay its own bills.

It’s not much money by euro standards. Trouble is, any bailout loan would just have boosted the nation’s debt-to-GDP to ridiculous levels. They’d never have been able to repay it. Eventually, its government debt would have needed to be restructured.

The northern ‘creditor’ countries (Germany and Finland in particular) have already been caught out on that front by Greece. They’re not keen to let it happen again. Not in a German election year.

It doesn’t help that Cyprus is a tax haven. More than half of the savings in the Cypriot banking system come from overseas. And while I’m no expert on the topic, it’s a reasonable assumption that a fair bit of that is there to be laundered.

Bailouts are unpopular at the best of times. Bailing out organised criminals is even less of a vote-winner.

So Germany and Finland said that Cyprus had to find more money from somewhere to reduce the loan needed, from €17bn to €10bn.

Making government bondholders take a ‘haircut’ would have scared every other bond holder in the eurozone. It also wouldn’t have helped much, because banks hold a lot of the debt.

So it had to be the savers. That’s drastic enough – so far depositors have been protected in this crisis.

But even more radically, the tax applies to everyone. So the €100,000 eurozone protection scheme counts for nothing. The argument is it’s a tax. It’s not that the bank has gone bust. So the protection isn’t relevant. But I’d agree with Dixon, who goes so far as to describe it as ‘a type of legalised robbery’.

If you hold less than €100,000, you’ll be charged 6.75%. If you’re over that limit, it’ll be 9.9%.

Now, the deal isn’t done yet. The Cypriot government has postponed a vote on the topic. It looks as though they might try to punish small savers a bit less by changing the split from 6.75% and 9.9%, to 3.5% and 12.5%, suggests the FT.

And they’re also talking about giving people who keep their money in the banks some form of potential future compensation, in the form of bank shares, or future revenues from natural gas production.

But the point is: a precedent has been set. Depositors are fair game, regardless of how often the rest of Europe insists this is a ‘one-off’. And that’s a major worry.

The Lessons from Cyprus

Assuming you don’t have any money in Cyprus, you won’t be directly affected by this. But there are two key lessons to take away.

Firstly, when you deposit money in a bank, you are making a loan to that bank. ‘Savers’ are a much-derided group of people at the moment, more often painted as degenerate selfish ‘hoarders’ than as the vital sources of capital they actually are. And banks often act as if they’re doing you a favour by deigning to look after your money.

But the fact is, you are providing funds for the bank. And just as you would with any other person who asks you to borrow money, you need to consider both the terms on offer (such as the interest rate available), and the borrower’s creditworthiness.

The second point is that governments can do what they like. They will lie point blank. They will make stupid decisions. You cannot expect them to look after your best interests if this conflicts with their own.

What Does This Mean for Investors?

This is frightening for anyone with savings in a fragile economy, and the ‘peripheral’ eurozone countries in particular. As The Economist puts it, ‘People who don’t trust banks, and keep their money under the proverbial mattress, will not be touched by this levy; in the past, such people have been regarded as eccentrics. Not anymore.’ The same goes for gold, the paper adds.

That said, I’m not convinced that the biggest immediate worry is a bank run in Greece or Spain or Italy, say, although it’s worth monitoring. The real worry is that this undermines any sort of trust in the eurozone in the longer run.

It’s one thing to put up with austerity measures. It’s quite another to start having to worry that your savings might just be confiscated. Your average Cypriot is being asked to pay nearly 7% of their savings as the price of staying in the euro.

That might still seem a price worth paying compared to the scale of devaluation they’d see if they quit the euro. But it starts to provide a benchmark for other countries. It can only add to the evidence for anti-euro political parties.

And given that the euro is a political construct, that’s what you really have to watch out for. If a group of voters finally wake up to the fact that this is the fault of the euro, not just the Germans, then the disintegration will have begun.

John Stepek

Contributing Writer, Money Morning

From the Archives…

Can This Indicator Predict The Dow Jones Next Move?

16-03-2013 – Kris Sayce

Seven Situations to Watch in the Pacific Currency War

15-03-2013 – Dan Denning

Stock Market Warning: Next Week Could be a Blood Bath

14-03-2013 – Murray Dawes

REVEALED: One Opportunity to Escape Your Mortgage

13-03-2013 – Nick Hubble

UK Property: How You Can Buy a House For Less Than 250 Grand

12-03-2013 – Dr. Alex Cowie