Article by Investment U

Most investors think that when they buy shares of a company, the only thing they can do is hold onto them in the hopes of generating a profit.

But in a volatile market environment like today, writing – or selling – covered call options are giving many shareholders the chance to generate even higher returns by “renting out” the shares they own to speculative investors in exchange for monthly income.

It sounds crazy, but it’s absolutely true. And today I’d like to show you exactly how it works.

Like Renting Out Real Estate

It may seem complicated at first, but writing a covered call option is like renting out a home with the option to buy.

The way these leases work, tenants agree to pay a certain amount of rent each month to a homeowner for a certain period of time.

At the end of that time period, the renter then has the option to buy the home from the property owner.

When you write a covered call option, you’re basically doing the same thing.

As the “share landlord” in this case, you already own the shares of the stock you’re “renting out.”

The buyer of the option would pay you a premium (or the rent) for the right to become the new owner of your shares if that stock hits, or rises above, a certain price (strike price) by a specified date (expiration date).

The concept is really that simple.

In fact, many investors today get their feet in the options market trading covered call options because, while there is risk involved, most of it comes from owning the stock – not selling the call.

Let’s look at a few examples. Just keep in mind though, one options contract represents 100 shares. So you’ll need at least that many to use this strategy.

Covered Call Scenario #1: Shares Become “in-the-Money”

If you’re really bullish on a stock for the in the short term, writing covered call options is probably not a good strategy.

That’s because if the stock price becomes “in-the-money” – that’s when shares rise above the strike price by the expiration date – your call option will be exercised and you’ll be obligated to sell each option, 100 shares per contract, to the buyer.

The bad news here is if the stock continues to climb higher, you’re going to miss out on any of the extra gains that come after shares hit the strike price.

However, on the bright side, you will still make a profit from the stock price rising. It just won’t be as much as if you simply held onto the shares from the very beginning.

Another plus, you’ll be able to keep the premium that the buyer paid you, which will add to your returns.

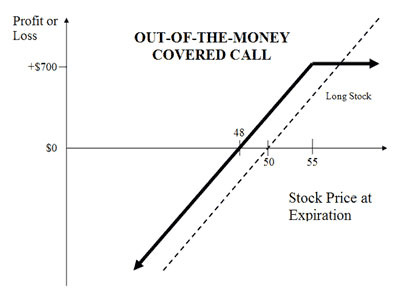

As you can see below, by writing the covered call (the bold line), you’re limiting the upside. As once the stock hits the strike price, the options buyer will likely exercise the option and take your shares. However, you get to keep the premiums and capital gains you collected up to that point.

(Source: www.theoptionsguide.com)

Of course, this is just one example.

Covered Call Scenario #2: Shares Go Down

Remember, when you write a covered call option, you have to own the shares of the company upfront.

That’s why, in this second scenario, two things will happen when the stock price goes down by the time your covered call option expires.

One, you’ll lose money because the value of the stock went down.

But number two, you’ll offset your losses somewhat because you get to keep the premium for selling the option.

Here’s where things can go really well though…

Covered Call Scenario #3: Shares Go Up, But Stay “Out-of-the-Money”

For covered call sellers, this is the ideal scenario.

That’s because the call option you sold will be “out-of-the-money” – that’s when the option expires worthless since the stock never actually hit the strike price – and, therefore, you won’t be obligated to let go of your shares.

An added benefit here is you’ll still make money from the price increase of the stock. In addition, you’ll also make extra money on the premium from selling the option.

It’s really a win-win-win situation.

Studies have even shown that the return on investment from writing covered call options of U.S. stocks typically ranges anywhere from 3% to 9% per month.

In today’s market environment, this basic options strategy may be a useful tool for investors – willing to take on some risk – to bump their returns even higher, without risking everything they have.

Good Investing,

Mike

P.S. As the seller, a general rule of thumb, think about 2% of the stock value as an acceptable premium to offer. You may also want to consider 30 to 45 days in the future as a good expiration date to start out with. Remember, with options, the further out in time you go, the harder it is to predict which direction a stock will head – but you’ll also be able to charge a higher premium because of the time-value of money.

P.P.S. Don’t forget to consult your broker and do your own additional research before writing covered call options. Also, check out The Investment U Bookstore for some great resources to get you started in the options market.

Article by Investment U