By JW Jones – Traders Video Playbook

“The selfish they’re all standing in line

Faithing and hoping to buy themselves time

Me, I figure as each breath goes by

I only own my mind.”

~ Pearl Jam, I Am Mine ~

Long time readers know that I have been and remain bullish on gold and gold stocks in the longer-term. However, the reasons why I believe gold and silver will perform well in the longer-term are a bit different than what many economists and pundits are expecting.

I am a contrarian by nature. I generally try to do the opposite of the crowd in every situation I find myself regardless of whether I am in a movie theater or trading options. Before getting into the gold and gold miners analysis, I thought I would explain my position publicly to readers. I do not consider myself an expert economist, but I try to read those who many consider to be experts looking for similarities in their viewpoints and expectations.

The herd mentality exists in financial markets and a similar behavior exists among economists. Most economists in the mainstream media today tend to be Keynesians or neo-classical economists. Both viewpoints are generally accepted as the correct interpretation of economic and monetary policies by academia.

However, the academic world can actually reduce open thought through ridicule and persecution. In the world of academia the herd is right, until someone proves that they are wrong using logic based reasoning.

Very similar to political ideologies, economic ideologies are deeply rooted. Paul Krugman is a great example of Keynesian economist. Like it or not, the majority of economists believe his views are correct regardless of whether they are based on fact, history, or dare I say “common sense.”

This leads me to the reason why precious metals and commodities in general may be approaching a major bottom and the potential for a monster rally. The reasoning stems from the fact that across the world central bankers generally share the same views as Paul Krugman. They believe that the modern finance system does not need gold and that fiat currency is the answer even though history argues in their face across multiple millennia.

Most economists and financial pundits believe that sovereign debt is going to bring down the economy and they may be correct. Many believe that the debt will unleash a massive deflationary spiral that will consume fiat valuations, specifically on risk assets and debt obligations.

I do not necessarily disagree that this is a likely outcome, but what concerns me is the number of people that believe this is true. This is the herd’s idea and as I have said many times before the herd is rarely right. This time may be different, although it rarely is. For inquiring minds I offer a rather different potentiality.

What if the debt crisis causes a totally different outcome that very few economists envision? What if they follow Dr. Krugman’s ideas and create massive amounts of debt to stimulate the economy while printing vast quantities of fiat money to prop up failing financial institutions? Clearly increasing debt levels and debasing the currency do not imply a long term positive scenario.

Central banks do not have a strong track record when it comes to reducing liquidity or increasing liquidity at the appropriate times. Thus these actions are likely to facilitate some sort of crisis in the future whether it is a result of runaway deflation or inflation.

I believe that should a deflationary crisis caused by massive debt levels and diminishing economic strength present itself, central bankers around the world will behave exactly the same way. They will act simultaneously and through dovish monetary policy central bankers will flood the world with massive sums of freshly printed fiat currency with the intent to print away issues with a liquidity induced risk-on orgy.

Should that be their ultimate choice, risk assets will rally sharply higher initially. Paper assets like stocks will produce huge gains in a short period of time while supposedly safe assets such as Treasuries would likely arrive at negative interest rates across the yield curve in nominal terms. The next phase is the scary part and why I am bullish long term of precious metals specifically.

The devaluation of fiat currencies simultaneously around the world will result in a monster economic crash when the masses realize that the majority of the major worldwide currencies are becoming worth less and less. The resulting crash would be caused by the opposite force of runaway inflation while the herd mentality that anticipates a deflationary debt spiral espoused by most experts and pundits would be proven materially false.

Under those circumstances, precious metals will be the true safe haven. Gold and silver will prove to be a true store of wealth that they have been for centuries. So many so-called experts fail to recognize that gold and silver are currencies. Yes they have industrial uses, but gold and silver represent the last unequivocal bastion of wealth preservation against the constant debasement procured by central bankers and their minions.

Under the scenario whereby central bankers flood financial markets with cheap, freshly printed fiat currency one would expect other essential commodities such as oil to also perform well. Furthermore agricultural based commodities would also flourish under those economic conditions. Investors would be in much better fiscal condition owning things that they could hold in their hands versus stocks or bonds.

I posit this potentiality not to say that this is exactly what is going to happen, but to challenge readers to open their minds. The crowd is usually wrong. The central bankers and most economists generally share the same viewpoints and their behavior is literally a giant group-think.

Is it possible that they are a herd which ultimately will be proven wrong? Will the herd mentality of economists and central bankers cause a massive currency crisis as they attempt to stem the tide of a deflationary debt crisis?

The two possible outcomes go hand in hand. I do not know what is going to happen, but neither outcome in the longer-term is especially optimistic. Should either scenario come to pass, the human condition will likely be threatened by a decrease in the standard of living across multiple developed countries and ultimately the threat of revolution and military action on a scale not seen in several decades could eventuate.

Clearly I have simplified the issues at hand presently for ease of reading, but the ultimate endgame will likely be one or a combination of both a debt crisis and a currency crisis. They will likely occur in close proximity to one other in terms of time, but the precise outcome will likely be different than what is commonly expected.

Regardless of which scenario occurs, precious metals will eventually be sought for their protection against the constant devaluation of fiat currencies by central banks around the world. For this reason, I remain a long term precious metals bull. With that said, why don’t we take a look at the recent price action in gold, silver, and gold mining stocks shown below.

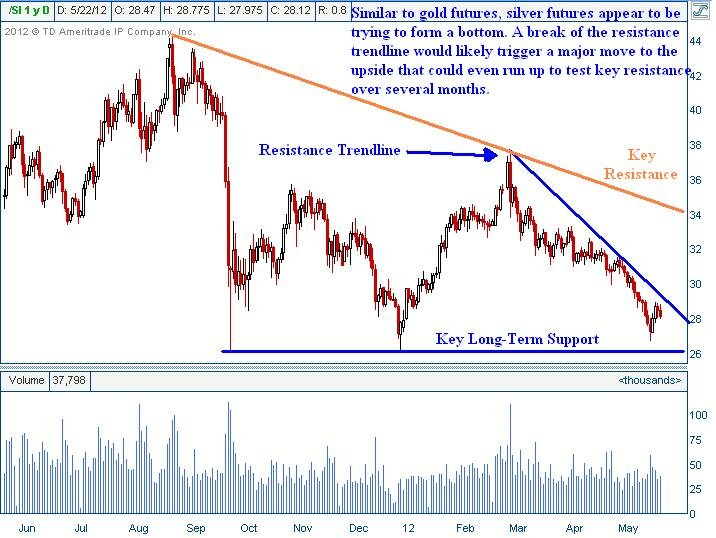

A lot of writers have stated that gold has bottomed. I am not totally convinced, however I do believe that gold is in a bottoming process. For me to get completely in my gold bull suit I would need to see price action exceed the key resistance trend line shown below.

Gold Futures Contract Daily Chart

As can be seen above, until we see price push through resistance I will remain cautious. I would also point out that the last two times gold found bottoms near current prices the bottom forming process took several weeks to complete.

I do not expect for gold to form a V shaped reversal. In fact, lower prices in the short term would help drive the bullish case for the longer term. Bottoms take weeks to form and can be very dangerous trading environments where active traders get chopped around.

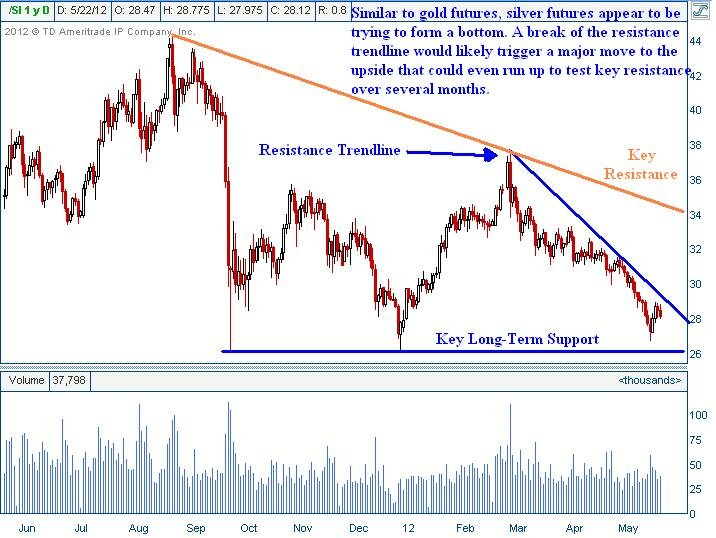

Silver is very similar to gold in that it appears to have formed the beginning of a possible bottom. Bottoms are generally not formed in one day. During the recent selloff, silver showed relative strength against gold. It is important to acknowledge that silver has yet to test the key lows that should offer support.

Because of this divergence in these two precious metals, I continue to believe that gold may see more downside again before a much stronger rally begins to take hold. Similar to gold, the descending trend line offers a great resistance level where traders can flip from being short-term bearish to longer-term bullish if the resistance line is penetrated. If we see silver carve out multiple daily closes above the resistance trend line paired with strong volume, I would anticipate that a bottom has formed and silver prices will have an upward bias. The daily chart of silver is shown below.

Silver Futures Contract Daily Chart

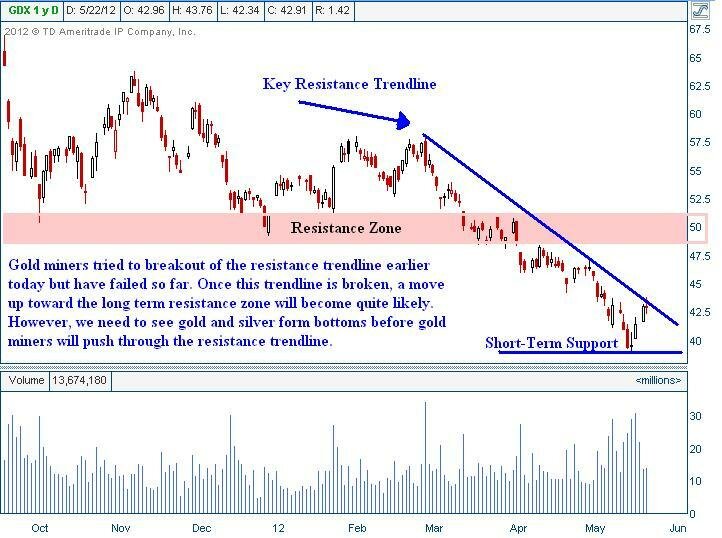

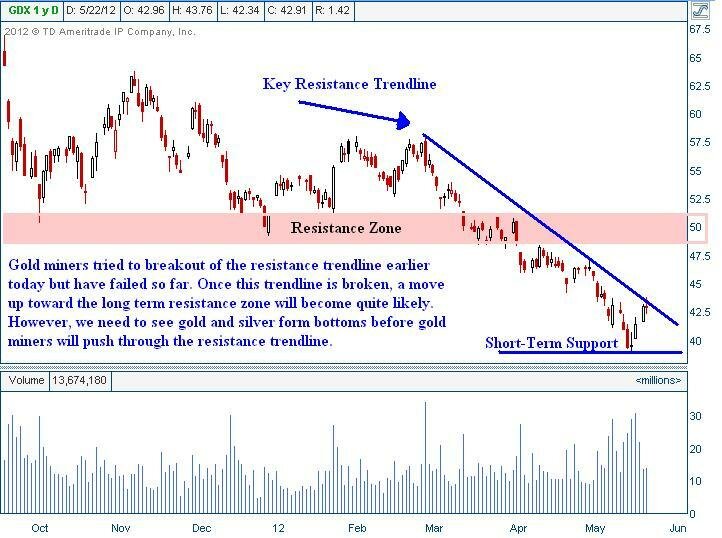

As expected, the gold miners have shown relative strength recently. The miners were just absolutely massacred during the recent selloff in equities and precious metals. However, gold miners similar to precious metals have a major descending trend line which they have already tested today. If the gold miners can push through resistance a large scale rally could play out. The daily chart of gold miners is shown below.

Gold Miners (GDX) Daily Chart

In addition, if readers look at a long term GDX price range that dates back to the 2009 lows the recent pullback is almost precisely a 0.50% Fibonacci Retracement. Similar to gold and silver, I would expect to see the gold miners pull back a bit here before pushing through major resistance. We may be setting up for a possible major bottom in precious metals and gold miners in the near future. Only time will tell.

In closing, remember to keep an open mind with regards to the future. The more often you hear the same message coming from financial pundits and experts, the more cynical you should become. Both potential scenarios will likely not end well. The question is whether the reason for the crash is deflation, inflation, or a combination of both scenarios. Regardless of the outcome, the long-term future for precious metals remains quite bright.

If you enjoyed this article and analysis, you can get our detailed trading analysis videos every Sunday, Monday, Wednesday and Thursday.

Happy Trading and Investing!

By JW Jones –Traders Video Playbook

This material should not be considered investment advice. J.W. Jones is not a registered investment advisor. Under no circumstances should any content from this article, TradersVideoPlaybook.com, or OptionsTradingSignals.com websites be used or interpreted as a recommendation to buy or sell any type of security or commodity contract. This material is not a solicitation for a trading approach to financial markets. Any investment decisions must in all cases be made by the reader or by his or her registered investment advisor. This information is for educational purposes only.

Tradervox (Dublin) -The sterling pound has been the best performer in the last three months increasing by 4.8 percent over the period. However, the current upward trend has changed today after government data showed that the inflation dropped in April more than the market was expecting. The pound fell against the greenback after extending gains for the last three days. Further, the sterling weakened after the International Monetary Fund recommended that Bank of England should resume its quantitative easing program to spur economic growth in the country.

Tradervox (Dublin) -The sterling pound has been the best performer in the last three months increasing by 4.8 percent over the period. However, the current upward trend has changed today after government data showed that the inflation dropped in April more than the market was expecting. The pound fell against the greenback after extending gains for the last three days. Further, the sterling weakened after the International Monetary Fund recommended that Bank of England should resume its quantitative easing program to spur economic growth in the country.