November 3, 2018 – By CountingPips.com – Get our weekly COT Reports by Email

US Dollar Index speculator positions continued higher this week

Large currency speculators continued to boost their bullish bets in favor of US Dollar Index futures once again this week while cutting back on their bullish Mexican peso positions, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 39,523 contracts in the data reported through Tuesday October 30th. This was a weekly advance of 1,495 contracts from the previous week which had a total of 38,028 net contracts.

The speculative Dollar Index position has now risen for five straight weeks and is on an amazing run with gains in twenty-six out of the last twenty-eight weeks. The current standing remains at the highest level since May 2nd of 2017 when the net position totaled 40,020 contracts.

Individual Currencies Data this week:

In the other major currency contracts data, we saw just one substantial change (+ or – 10,000 contracts) in the speculators category this week.

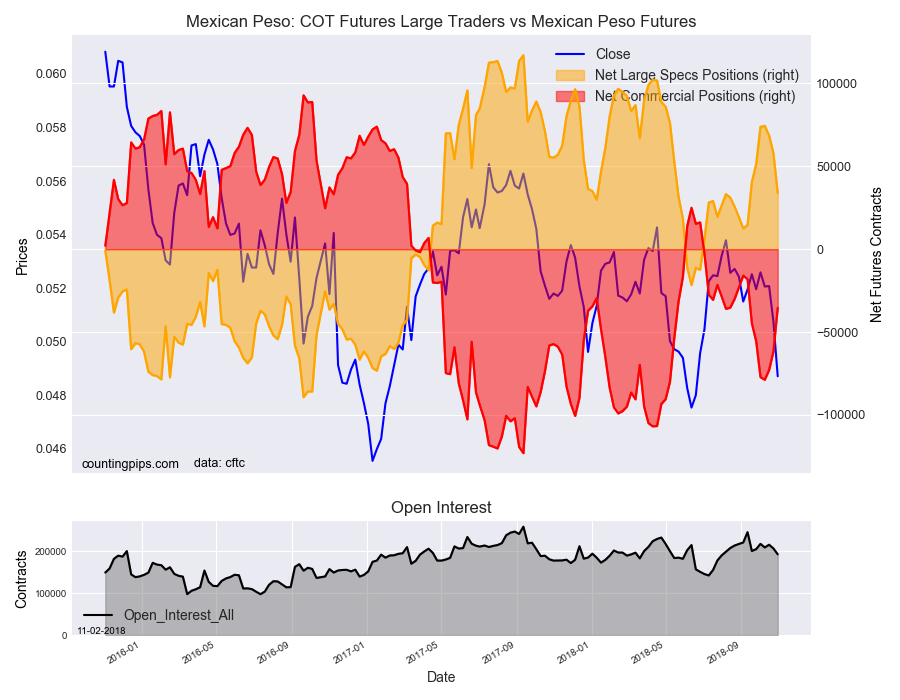

The Mexican peso contract fell sharply by over -20,000 contracts this week and has fallen lower for three straight weeks. Despite these recent shortfalls, the peso has fared better than many of the other major currencies as the MXN has remained in an overall bullish position for eighteen weeks in a row. The current standing is above the +30,000 contract level for a seventh straight week.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Overall, the major currencies that improved this week were the US Dollar Index (1,495 weekly change in contracts), the Japanese yen (1,184 contracts) and the Swiss franc (2,583 contracts).

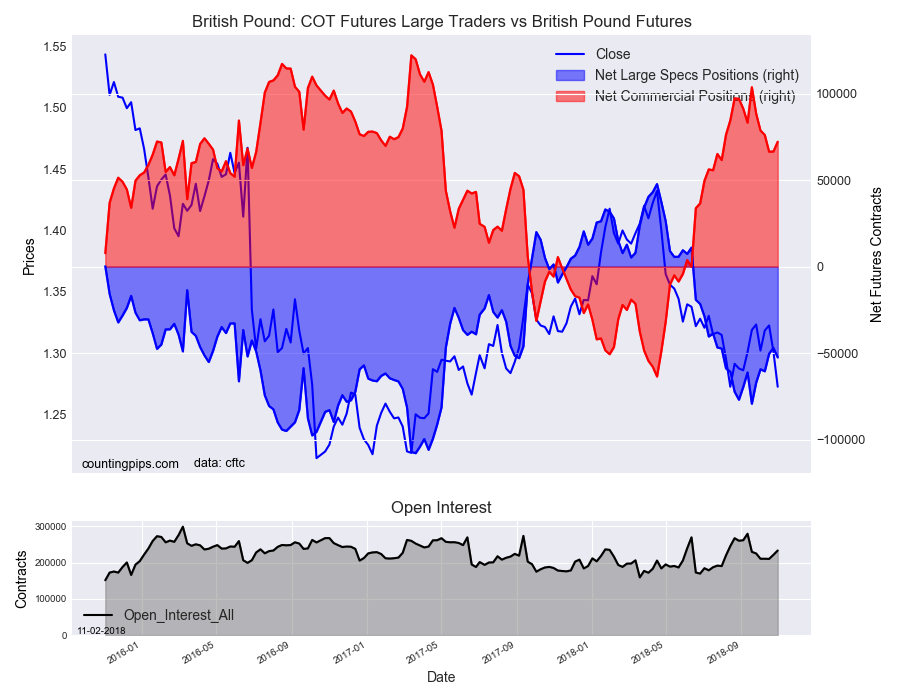

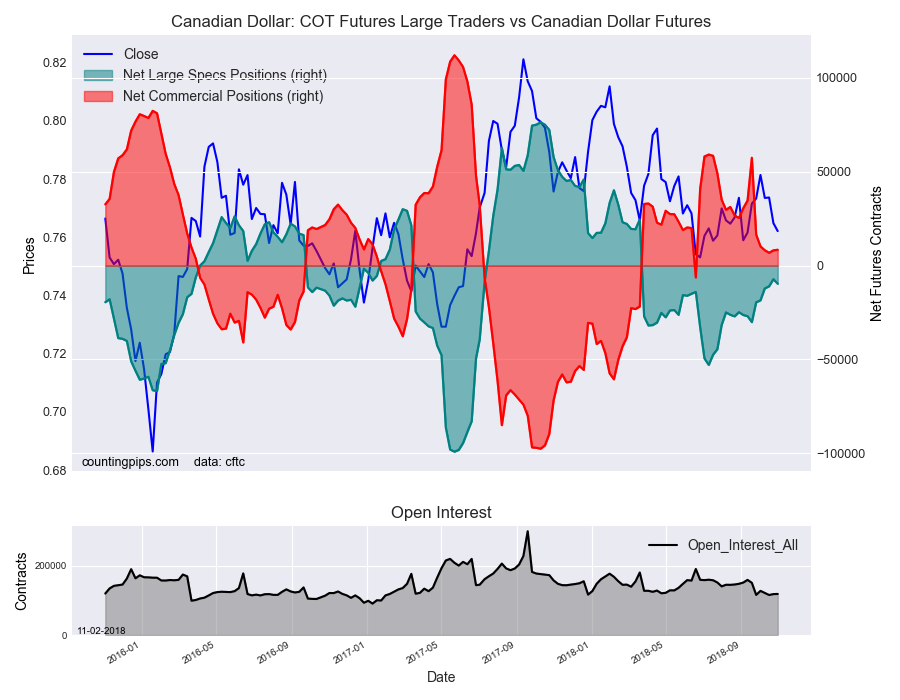

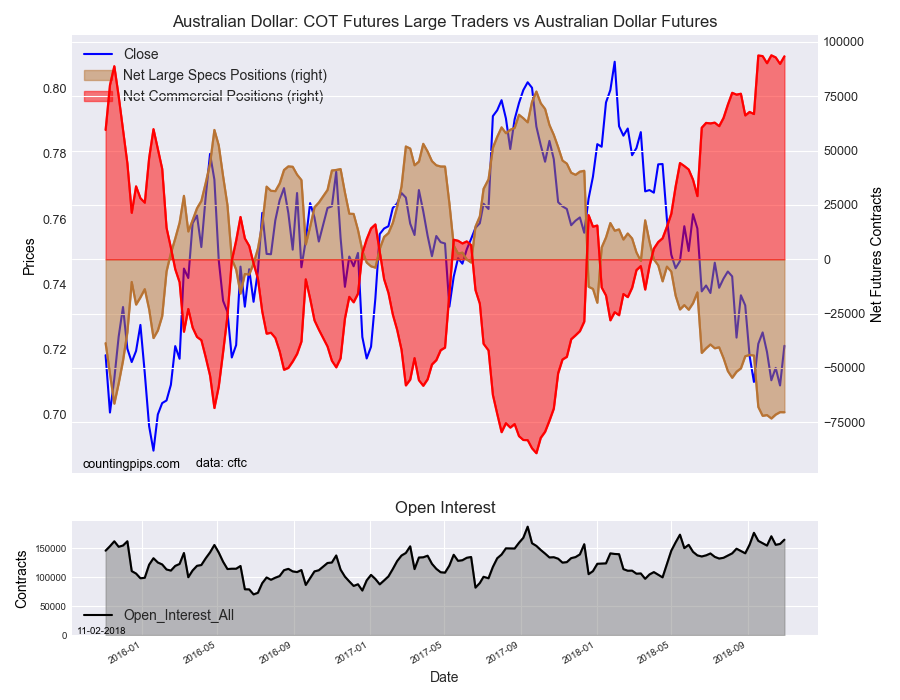

The currencies whose speculative bets declined this week were the euro (-2,358 weekly change in contracts), British pound sterling (-5,485 contracts), Canadian dollar (-2,427 contracts), Australian dollar (-44 contracts), New Zealand dollar (-1,983 contracts) and the Mexican peso (-24,218 contracts).

Other Notables for the week:

Euro positions continued to get battered and bruised this week and fell for the fifth straight week. The current standing remains at the most bearish level since March 14th of 2017 when net positions totaled -41,027 contracts.

New Zealand dollar positions declined againt this week (-1,983 weekly change in contracts) and are right near the record high bearish level of two weeks ago (-35,412 contracts). The NZD remains above the -30,000 contract level for a seventh week in a row.

See the table and individual currency charts below.

Table of Weekly Commercial Traders and Speculators Levels & Changes:

| Currency | Net Commercials | Comms Weekly Chg | Net Speculators | Specs Weekly Chg |

| EuroFx | 14,605 | 2,760 | -32,662 | -2,358 |

| GBP | 72,170 | 5,641 | -52,482 | -5,485 |

| JPY | 107,462 | -5,688 | -91,620 | 1,184 |

| CHF | 34,852 | -756 | -14,522 | 2,583 |

| CAD | 8,472 | 314 | -9,655 | -2,427 |

| AUD | 93,402 | 3,470 | -70,412 | -44 |

| NZD | 39,098 | 1,826 | -35,031 | -1,983 |

| MXN | -35,418 | 26,351 | 33,809 | -24,218 |

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators). Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.

(The charts overlay the forex closing price of each Tuesday when COT trader positions are reported for each corresponding spot currency pair.) See more information and explanation on the weekly COT report from the CFTC website.

Article by CountingPips.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026